Pre-Open market analysis

The Emini rallied strongly early on the Fed interest rate cut, but then sold off. It retraced about half of the 3 day rally. Yesterday was probably just a pullback from Monday’s rally. There will probably be a 2nd leg up.

However, the Emini will probably go sideways for another week or two as long as there is no big increase in the number of coronavirus cases. If there is, the odds of a 30 – 50% correction will go up from the current 30% chance.

I have said before that I do not have confidence in Fed Chair Powell. The reversal down on a big rate cut might in part be due to a lack of confidence in Powell. It is a sign that traders fear that there might be a bigger problem out there than what the Fed is telling us. In addition, they do not trust him to handle it.

The Emini will probably not get back to the all-time high for at least a few months. Traders repriced the market after the coronavirus outbreak.

The pandemic is unlikely to be contained, and there will not be a vaccine for at least a year. Consequently, the Emini will probably not recover its previous price for a long time.

If there is an acceleration of the number of cases, the Emini will fall 30 – 50%. There is currently only a 30% chance of a 30% selloff.

Overnight Emini Globex trading

Despite yesterday’s big selloff, it was probably a bull flag after an even stronger 2 day rally. The Emini is up 58 points in the Globex session and it is testing the start of yesterday’s bear channel. That is always a magnet after a Spike and Channel Bear Trend. The rally usually leads to a trading range.

Also, the Emini has been in a trading range for 3 days. Since the legs up and down have been huge, day traders have been able to swing trade.

It is important to remember that the daily range is about 10 times normal. Day traders should multiply stops and targets by 10 and divide their position size by 10. Trading micro Eminis is a good way to reduce position size. Scalps are now 5 – 10 points instead of 11 – 2 points.

The daily ranges will begin to shrink over the next week. But it will probably be a month or more before they are back to the usual 15 – 20 points.

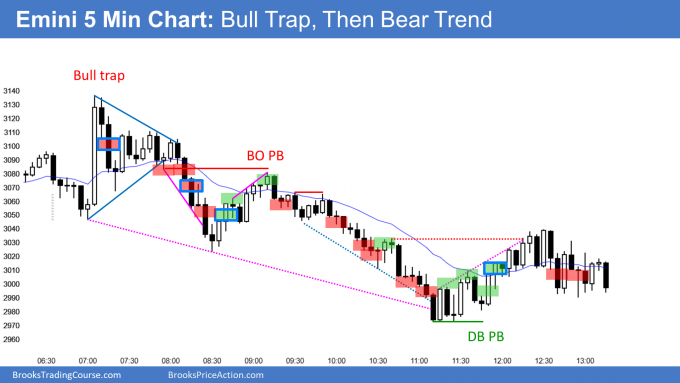

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.