Pre-Open market analysis

Friday was an outside down day after a credible minor top on the daily chart on Wednesday. Remember, 2 weeks ago, I said that t 5% correction was likely to begin within 3 weeks. It probably began last week. Friday is a sell signal bar for today.

The Emini is down almost 50 points in the Globex session and almost 3% from the high. It is now close enough to make the bears take some profits.

If today has a big gap down and then a reversal up, the correction could end today. It would be near the 1st targets of the daily EMA and the January 6 buy climax low. Many bears would take at least some profits. If enough did, the bull trend could resume.

A Surprise Bear Breakout usually has a 2nd leg down

At the moment, the selloff is a Surprise Bear Breakout. When there is a Bear Surprise, there usually is at least a small 2nd leg sideways to down. Consequently, even if the bulls get a strong reversal up today or tomorrow, there will probably be more traders looking to sell for a 2nd leg down than looking to buy for a resumption of the bull trend.

Getting near minimum targets for bears

Last week is a sell signal bar on the weekly chart. The 2 prior weeks were the biggest 2 bull bars late in a bull trend. That typically makes bulls take some profits. Today will probably gap down, which would trigger the weekly sell signal. The Emini would be about 3% down. That is getting close to my minimum target of 5% .

This is an important week. If the bears begin to get consecutive bear bars on the daily chart, especially big bear bars, traders will conclude that the profit-taking will probably reach about 5% and below 3200.

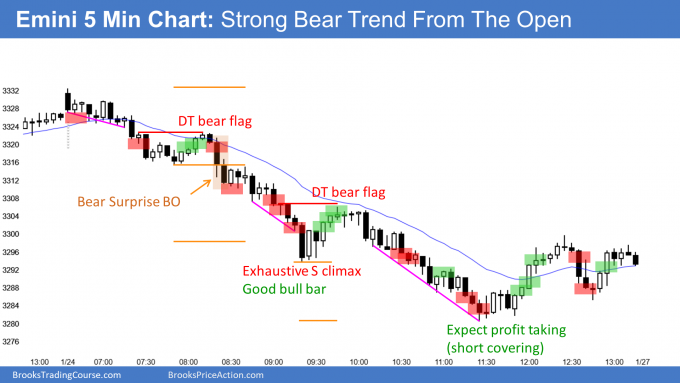

The big ranges over the past 2 days increase the chance of more big ranges this week. Furthermore, big bear days are more likely than big bull days. But because the chart is now oversold, the bears will begin to take some profits today. There will probably be at least a couple hours of sideways to up trading at some point.

Overnight Emini Globex trading

The Emini is down 49 points in the Globex session. It will probably gap down on both the daily and weekly charts. This is a surprisingly big 2 day selloff. I and many traders will look to take some profits on their shorts today.

Also, Friday was a sell climax day. That is another reason for some profit taking. There is a 75% chance of at least 2 hours of sideways to up trading today beginning by the end of the 2nd hour today. It reduces the chance of today being another relentless bear trend day.

This is the last week of January. I mentioned a couple weeks ago that the month might end near its 3246.50 open. That might be a magnet this week. That means that the Emini might trade around it this week and then close the month on Friday close to it.

Yesterday’s setups