Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Pre-Open Market Analysis

The Emini is in the final 7 trading days of the decade and the decade has been very strong. On the yearly chart (not shown) where each bar is one year, you would see that the decade opened near the low and it is now closing near its high. Also, this year would be a big bull bar. This 11 year rally is an unusual event and you will probably never see something as strong as this again on the yearly chart in your trading career.

The bulls are trying to show that they are still strong. They want the year and the decade to close near their highs. Since they have been in control for 10 years (actually, 11), they will probably achieve their goal. The Emini will probably be sideways to up through December.

There is always a chance of profit-taking. The Emini often tries to either duplicate or do the opposite of what it most recently did on any time frame. There was a crash last Christmas that reversed up sharply. This year, the Emini is crashing up. There is therefore a small, but real, chance of a big selloff soon after Christmas, which would be the opposite of last year. But the downside risk is currently small. Traders will buy the next 1 – 3 day pullback.

Christmas week is traditionally the quietest week of the year. There are usually more and longer tight trading ranges on the 5 minute chart than at other times. Furthermore, the ranges can be very tight. While there will be some swings, most of the week will probably be quiet.

Overnight Emini Globex Trading

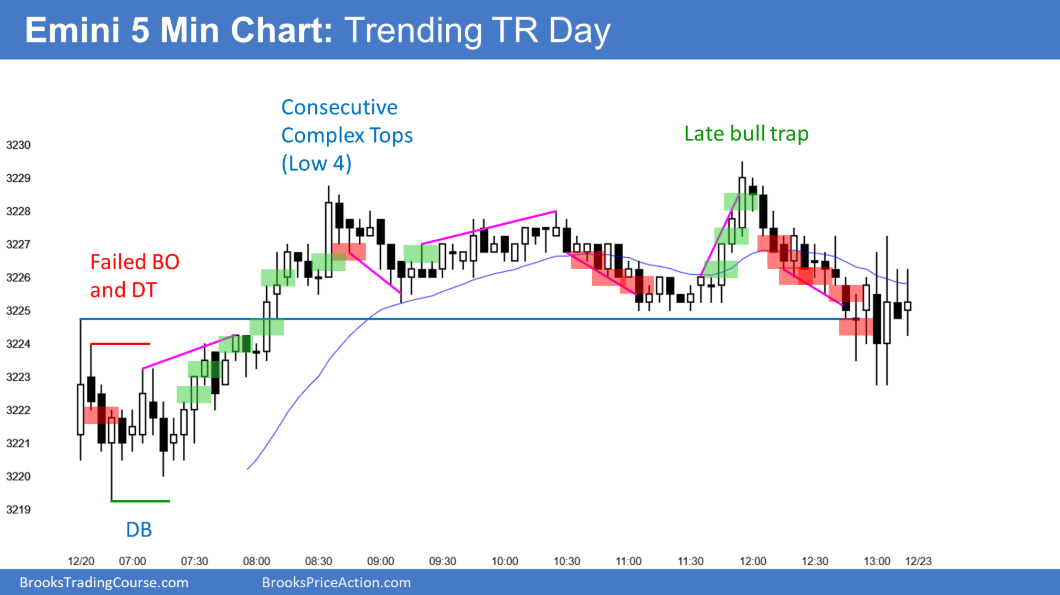

The Emini is up 6 points on the Globex chart. It might gap up today. If so, it would form another gap up on the weekly chart, like it did last week.The bull trend on the daily and weekly charts has been strong. Most days over the past few weeks closed above the open. However, most had a lot of trading range price action. Consequently, day traders expect a bullish bias, but mostly quiet trading.Since the trend is strong on the daily chart and today will probably gap up, there is a slightly increased chance of a big trend day. If there is a trend, up is more likely. However, Christmas week is typically the quietest of the year. If the early bars are small and if there is a trading range open, a trading range will be likely today.Friday’s Setups

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.