Yesterday was a bull inside day after Monday was a huge outside down day. It is therefore an ioi buy signal bar for today (inside-outside-inside).

But, remember, Thursday and Monday were consecutive outside bars. That is an OO Breakout Mode pattern (outside-outside), which is a more important setup. Monday is therefore both a buy signal bar, and a sell signal bar.

Also, there is a Spike and Channel Bull Trend on the daily chart. Traders should expect a break below the bottom of the channel at some point in January, and then a test down to the start of the channel. That is the November 10 low at around 3500. Monday may be the start of a couple weeks down to 3500. We need to see follow-through selling over the next few days.

With both buy and sell signals, there is confusion. That typically results in some sideways trading. Traders might be waiting for the results of the Georgia elections, which will probably come by the end of the week.

It is important to understand that sometimes when a market triggers a higher time frame buy signal, it immediately reverses down sharply. That happened this week on the yearly, monthly, and weekly charts. However, when that happens, the market often resumes up and triggers the signal again before deciding if the signal will fail or succeed.

This might be happening with the E-mini. Traders should know that there is a 50% chance that the Emini will go back above last year’s high, before there is a 2nd leg down. The odds still favor a move down to 3500 before the Emini goes much above last year’s high, if it does go above last year’s high.

Overnight E-mini Globex trading

The E-mini is down 11 points in the Globex session. Yesterday was an inside day. Today will open in the middle of yesterday’s range. Markets sometimes form consecutive inside days. Traders will therefore watch for reversals today on tests of yesterday’s high and low.

With the E-mini in the middle of a 2-week trading range and with reversals every couple days, there is an increased chance of more trading range trading today. However, because it will probably begin to test down to 3500 this month, there is an increased chance of some bear trend days, like Monday.

That also increases the chance of bears being squeezed, which can lead to a series of strong bull trend days. Most likely, the E-mini will have another quiet day. But, traders should be ready for several bear trend days coming at any time.

Yesterday’s setups

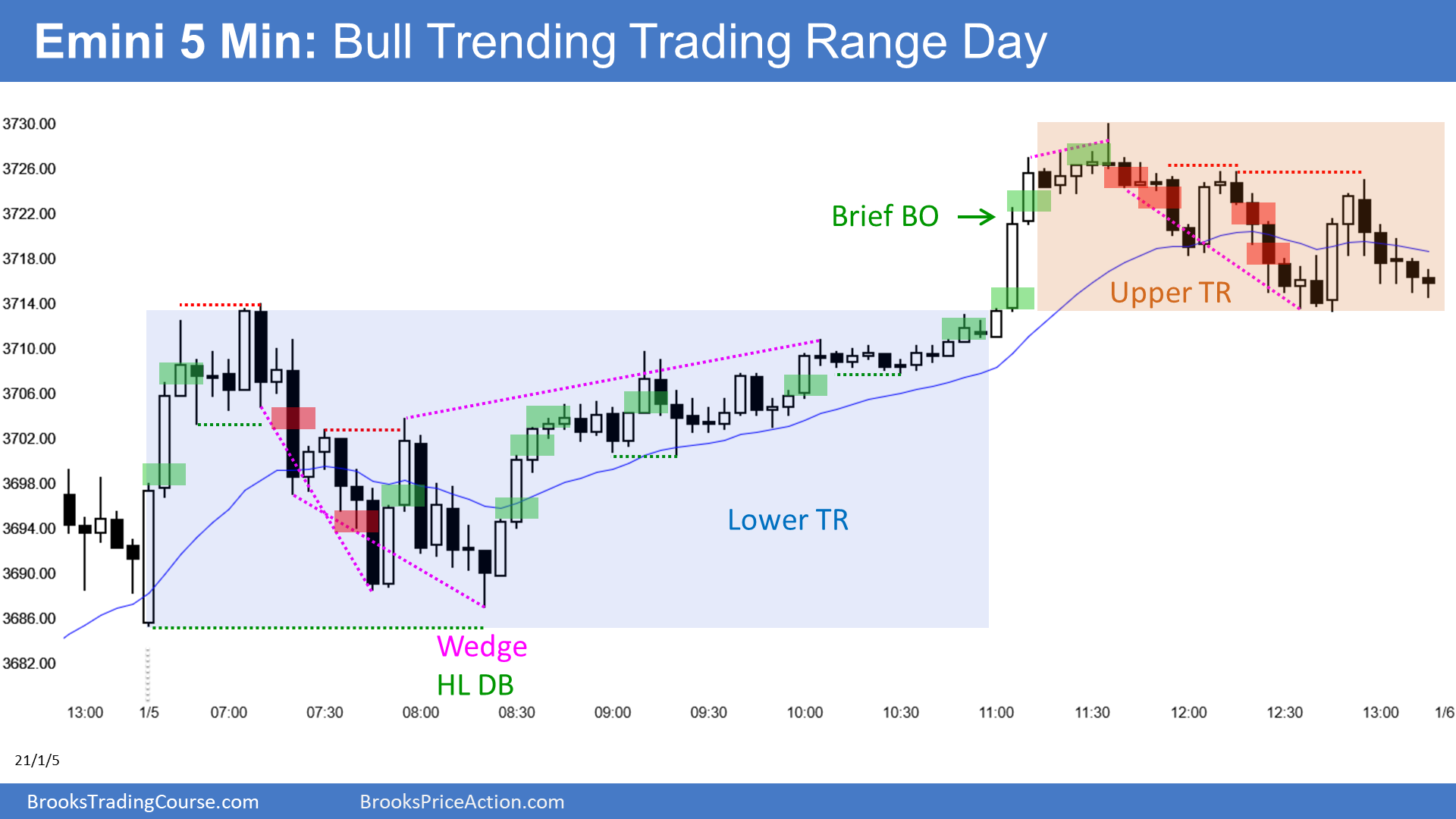

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.