Pre-Open market analysis

Yesterday sold off early, but the day formed a trading range. It closed above the open after a 2 day selloff. It is therefore a buy signal bar for today. However, it was a doji day, which is a weak buy signal bar. Also, it is in the middle of its 5 week range so the context is not strong for the start of a trend.

But the ledge at the top of the 5 week trading range is a strong magnet above. A ledge top is 4 or more bars with almost exactly the same high. Consequently, the odds favor at least a brief bull breakout. Therefore, the odds favor higher prices over the next week.

It is important to remember what I have said several times over the past few weeks. Even though a move above 2944.25 is likely, there is still better than a 50% chance of a reversal down from failed breakout. Traders should still expect a move to below 2800 unless the bulls get 2 or more closes above the month-long trading range.

Overnight Emini Globex trading

The Emini is up 26 points in the Globex session. There will probably be a big gap up. There is only a 20% chance of either a bull or bear trend from the open when there is a big gap up.

A big gap up typically leads to a trading range for the 1st 1 – 2 hours. The bulls will look to buy a double bottom or wedge bottom near the EMA. However, the bears want a double top or wedge top and a swing down.

I have been saying that traders should expect a breakout above the 2944.25 ledge top. The Emini is currently only 12 points below. Consequently, the bulls will probably get their breakout today or tomorrow.

Yesterday’s setups

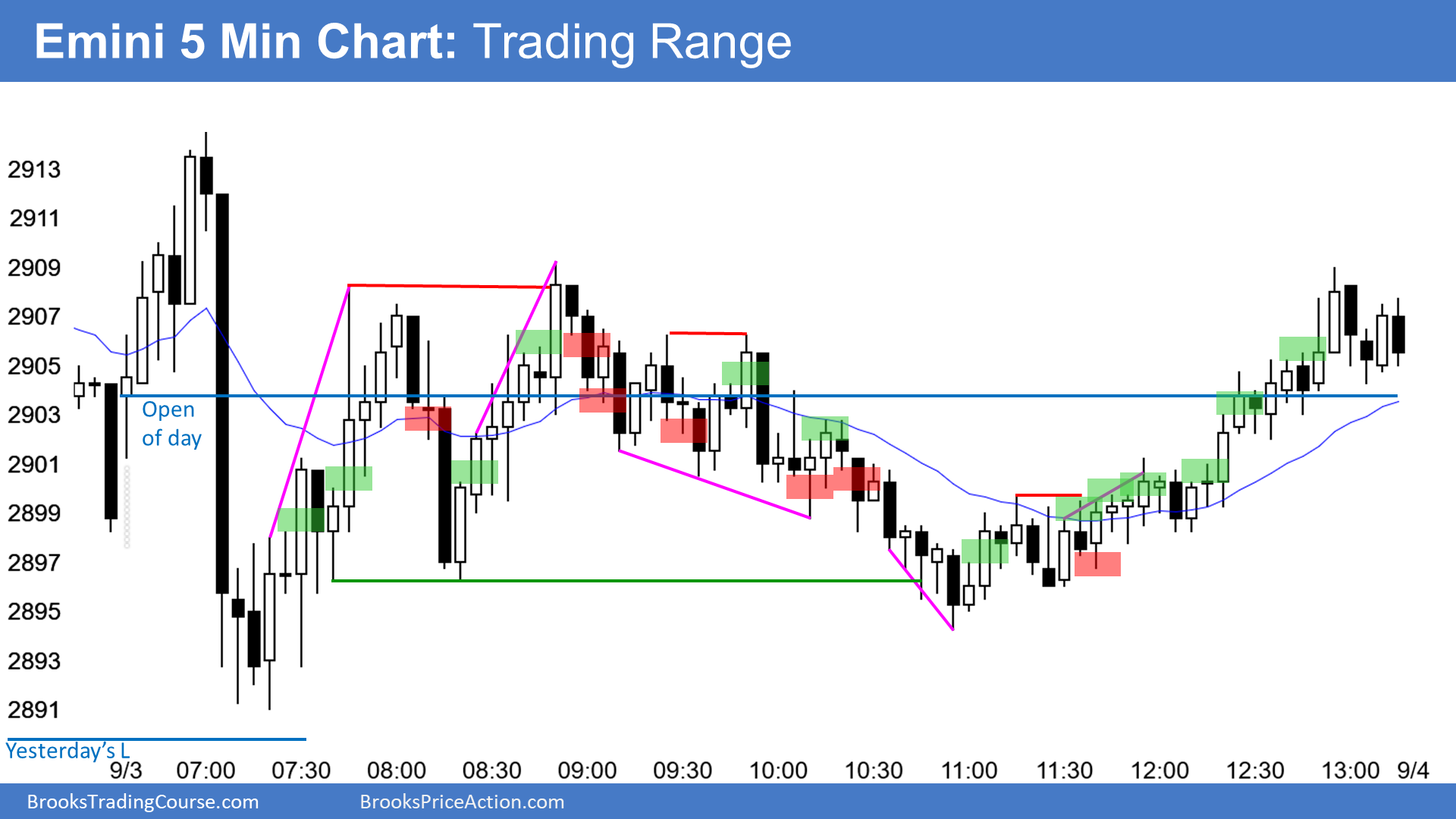

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.