Pre-Open Market Analysis

The bulls on Friday broke above an ioi on the daily chart. This triggered a buy signal. Yet, the Emini still in its 5-day tight trading range. The bulls therefore need follow-through buying this week, which they probably will get.

The Emini has consecutive inside bars on the weekly chart. This is an ii Breakout Mode pattern. Theoretically, the bulls buy above and the bears sell below. Because both inside bars are big bull bars closing on their highs and the weekly chart has pulled back to its moving average in a strong bull trend, the odds favor a bull breakout.

However, since the 2-week selloff was strong, a breakout above last week’s high might lack follow-through buying. If so, the weekly chart will continue mostly sideways for at least a couple of weeks. Because it is still in a bull trend, the odds favor a test of the all-time high within a month or two.

Last week’s high is 2754.75. The odds are that today will trade above it and therefore trigger a weekly buy signal. Yet, the huge 2-week selloff created confusion. Therefore, traders might hesitate to continue to buy all of the way up to a new all-time high. Consequently, the bulls might be disappointed by a lack of follow-through buying above last week’s high.

Overnight Emini Globex Trading

The Emini is up 9 points in the Globex market. It is therefore currently above last week’s high. If it opens here, it will create a small gap up on the daily and weekly charts. If the bulls can keep the gap open for a few days, they will create a sign of strength. This would increase the odds of a new all-time high before there is another leg down in the developing trading range on the daily chart.

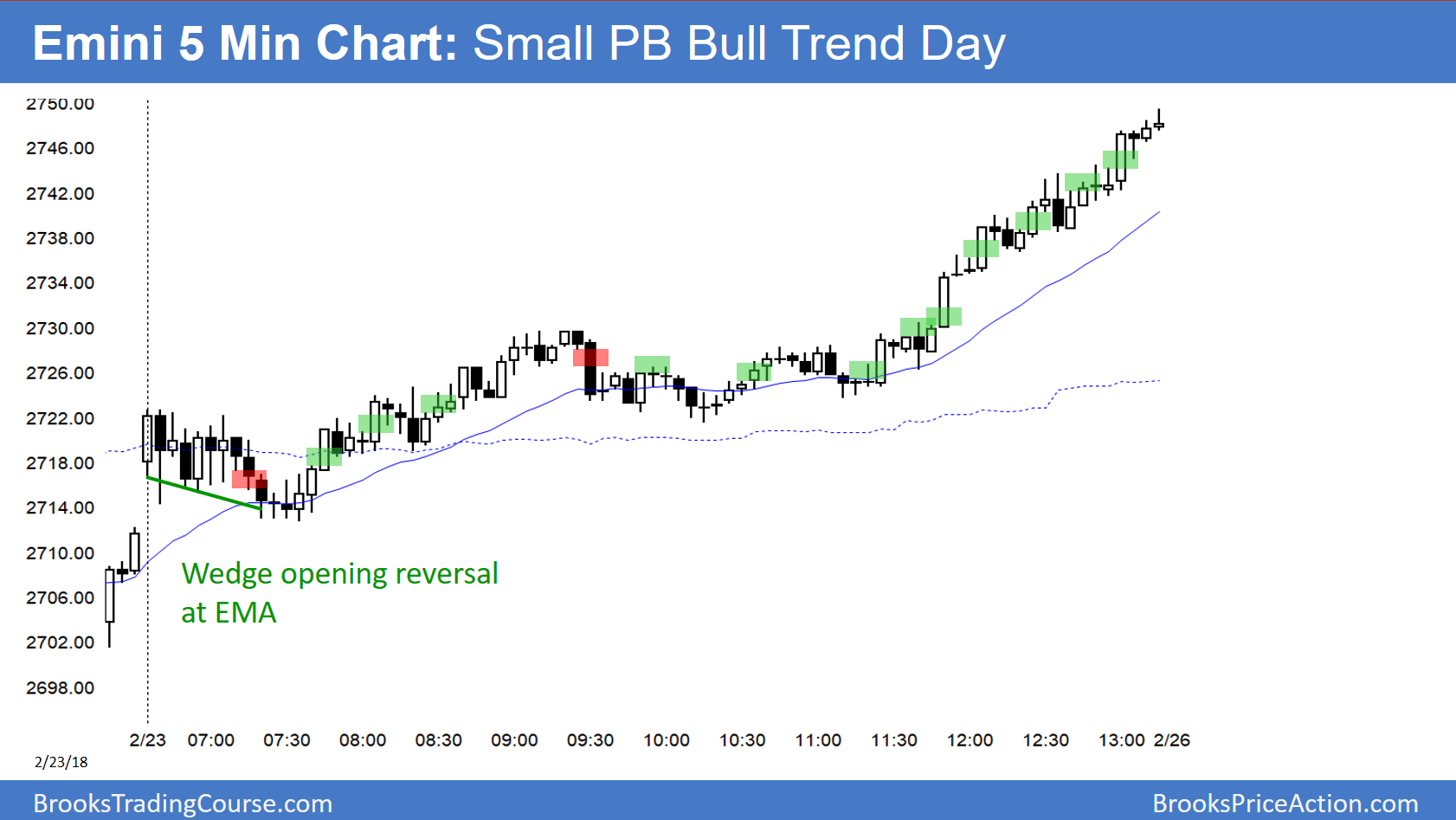

A gap always increases the odds of a trend day up or down. The weekly chart is in a bull trend and has a strong buy setup. Hence, if there is a trend today, it will more likely be up than down. But, traders still do not yet know if the bull trend on the daily chart has resumed or if the strong 2-week rally is just a bull leg in a developing trading range.

What takes place over the next few days should help provide some clarity. If the rally continues up strongly, the odds favor a tight bull channel up to a new all-time high. If the rally stalls within a few day and forms a bear reversal bar, the bears will see a wedge lower high since the February 7 high. That would probably lead to a 2-week bear leg in the range.

Friday’s Setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.