Originally Published June 27, 2020

The Emini is in breakout mode entering a seasonally bullish time of the year. But, it formed a strong sell signal bar on the weekly chart. If the bears get a big selloff next week, the Emini will probably work down below 2700 this summer.

The bond futures market has a High 1 bull flag on the monthly chart, but it is in a tight trading range. July should trade at least a little higher.

The EUR/USD Forex market rally has stalled at the 2 year bear trend line for 4 weeks. It might have to test down to the breakout point just above 1.10.

30 year Treasury Bond futures monthly chart:

High 1 bull flag after failed breakout below ii

The 30 year Treasury bond futures formed consecutive inside bars on the monthly chart in April and May. This is an ii pattern (inside-inside). April’s high was below the March high and its low was above the March low. May was then inside of April’s range.

This is a Breakout Mode pattern. That means it is equally likely to lead to a rally or a selloff. Also, the 1st breakout fails half of the time.

The bond futures sold off below the ii pattern in June. However, it is now back at the high of the month. If June closes around here, traders will conclude that the bear breakout failed. Furthermore, June with be a High 1 bull flag buy signal bar on the monthly chart.

The bulls hope for a new high. But even if they get one, it will probably be brief. The bond market should work down to the November 2019 low within a couple years. That is the bottom of the most recent buy climax and is a magnet once there is a reversal down.

Reversal down from extreme buy climax

The most important feature on the monthly chart is the January to March buy climax. That was the most extreme buy climax in the history of the bond market. March reversed down and closed in the middle of its range.

After a reversal from a buy climax, traders look for a pause. Exhausted bulls take profits and then typically wait for about 10 bars before buying again. They want to give the bears a couple opportunities to reverse the trend before buying aggressively again.

Sometimes, however, there is one more buy climax before the reversal down begins. That is what traders are now deciding. Will this month lead to one more new high and then a reversal down? Or, will there be a brief rally to a lower high for a couple months and then a swing down to the November 2019 buy climax low?

We will find out this summer. If June closes near its high on Tuesday, it will make higher prices likely in July.

EUR/USD Forex weekly chart:

Stalling for 4 weeks at bear trend line

The EUR/USD Forex weekly chart has been sideways for 4 weeks after a strong 3 week rally. The bulls hope this is a bull flag. But each of the bars has a prominent tail on top. All 4 bars tested the 2 year bear trend line and reversed down. This is not how an impending breakout typically looks.

Furthermore, when there is a strong breakout, traders expect a pullback to test the breakout point. That is the May 1 high of 1.1018. Therefore, despite the strong rally, the EUR/USD will probably pull back for a week or two to test the breakout point and the 20 week EMA.

Can the rally resume and break strongly above the March high without a pullback? Given the appearance of the past 4 weeks, a pullback is more likely.

EUR/USD might close above EMA on monthly chart

The EUR/USD monthly Forex chart tested the March high and is forming a lower high in June. It is not near the 12 year bear trend line.

There are still 2 trading days remaining in June. So far, the month has a small bull body.

More importantly, its close is currently above the 20 month EMA. If June closes above the EMA, it would be the 1st time in over 2 years. Also, there would be consecutive bull bars on the monthly chart for the 1st time since the current bear channel began in February 2018.

2 year bear channel is weakening

June’s high is below the March high. The monthly chart is still in a bear channel. But these are significant signs that the price action is changing. The bulls are getting stronger and the bears are getting weaker.

Because the monthly chart is still forming lower highs and lows, it is in a bear trend. However, it has been sideways for about a year. It is therefore also in a trading range.

A bear trend often transitions into a trading range before reversing up into a bull trend. What do traders need to conclude that the monthly chart has become a bull trend? A couple consecutive bull bars closing near their highs and above the March high would be enough.

Spike and Channel bear trend usually evolves into a trading range

Even if they get their strong breakout above the March high, the bear trend was a Spike and Channel pattern. It spiked down for a couple months in April and May 2018 and then entered a bear channel.

When the bulls get a break above the bear channel, the rally usually tests the start of the channel. That is the top of the 1st pullback from the spike down. Here, it is the September 2018 high of 1.1816. Then, there usually is a reversal down and that leads to a trading range.

Consequently, even if the bulls get a bull trend over the next several months, it will probably just be a bull leg in what will become a bigger trading range. That trading range could last a couple more years.

Monthly S&P500 Emini futures chart:

June might become minor sell signal bar

The monthly S&P500 Emini futures chart has been in a trading range for 2 1/2 years. The Emini has rallied for 3 months, but the bodies have been shrinking. This represents a loss of momentum as the rally approaches the resistance at the top of the range.

When a market is in a trading range, traders expect reversals near the top and bottom. The Emini is now near the top. Traders are looking for a pullback to the middle of the range.

If June closes below the open of the month on Tuesday, it will have a bear body. It would then be a bear sell signal bar for July. That would make lower prices likely in July.

But the 3 month rally was surprisingly strong. Consequently, traders will look to buy in the middle of the range after a 1 – 2 month pullback. They do not believe that a reversal from here will continue to below the March low.

End of month and end of quarter

Remember, there are still 2 trading days remaining in June. The June candlestick could look very different once it closes.

It is important to note that there is a bullish tendency at the end of quarters and ahead of holidays. Both of these factors are in effect at the end of June.

If June were to rally in the final 2 days and close above the midpoint of the month, that would increase the chance of higher prices in July. More traders would suspect that the rally will continue up to a new all-time high.

There is another important consideration. Most institutions have huge profits this quarter. Many will want to take some profits before the end of the quarter. If enough do, the Emini could fall dramatically in the final 2 trading days.

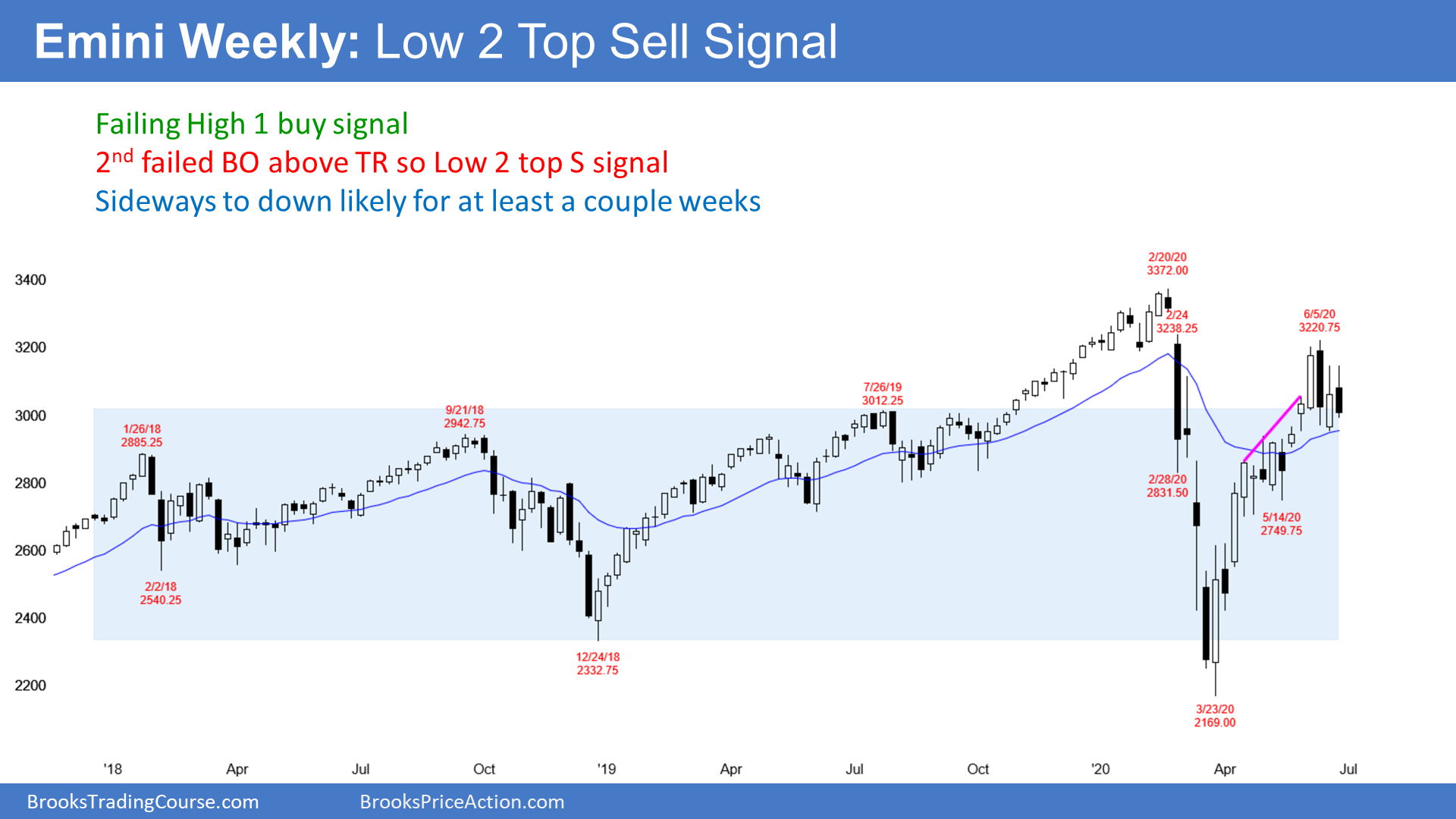

Weekly S&P500 Emini futures chart:

Low 2 sell signal near top of 2 1/2 year trading range

The weekly S&P500 Emini futures chart has been sideways for 4 weeks. This follows a strong 3 month rally is in a tight bull channel.

Many bars over the past 10 weeks have had prominent tails. That is trading range price action. It typically eventually leads to a trading range. The past 4 weeks of sideways trading might be the start of the trading range. Traders need more information before they conclude that the 3 month bull leg has ended and a bear leg has begun.

There have been 2 legs up in the 3 month rally. This week went above last week’s high and triggered a High 1 bull flag buy signal. But instead of continuing up for a 3rd leg, the Emini immediately reversed down.

The week closed near the low. It is therefore a Low 2 top (micro double top with the high from 2 weeks ago) sell signal bar for next week. Traders are wondering if the bulls are exhausted. If they are, traders will expect a retracement of about half of the rally.

Traders know that trends resist change. Also, the gap above the February 24 high is an important magnet above. That was the start of the pandemic crash. The Emini is near enough to make traders think that the rally still could get there before there is a reversal down.

Traders deciding if the the rally will continue or reverse down

The 4 weeks of sideways trading is a reflection of these mixed signals. It is in Breakout Mode. The bulls want a rally from here to continue up to a new high. At a minimum, they want a test into the February gap.

However, the bears want a double top with the February high. A reversal down from here or from the gap would be a lower high double top. They expect a retracement of about half of the 3 month rally.

Daily S&P500 Emini futures chart:

Weak reversal down from lower high major trend reversal

The daily S&P500 Emini futures chart reversed down strongly on June 11. Since then, it has then been in a tight trading range. The bulls hope that the trading range is just a pause in the 3 month rally. They see the trading range as a double bottom bull flag. They want the rally to resume and test the gap above the February 24 high. Then, they want it to continue up to a new high.

Friday’s selloff stopped at the support of the 200 day MA and the 3,000 Big Round Number. It closed just below 10% down from the all-time high. The Emini is therefore back in correction territory. These 3 prices are magnets and could be support next week.

Every trading range has both a credible buy and sell signal. The bears see a small wedge rally a lower high after a reversal down from a buy climax. This week’s reversal down is from a lower high major trend reversal. There is also a double or triple top in the tight trading range. But the Emini is still in the trading range.

So, what is more likely, a bull or bear breakout? The Emini would not be in a tight range if either side had a significant advantage. It is neutral. When that is the case, it becomes bullish for a day or two and then bearish for a day or two. Most most breakout attempts will fail.

Everyone knows there will be a breakout within a couple weeks. But traders also know that the 1st breakout up or down will fail. They need to see a couple consecutive closes above or below the range to conclude that the breakout is successful.

The bulls want a new all-time high

How can the market rally when 10% of the country is out of work and consumer spending is way down? There is a simple fundamental reason and I have mentioned it many times. The Fed said that it would “print infinite money” to protect the economy.

Traders have concluded that there is a floor under the market. If it can’t go down, maybe it can only go up. Institutions are buying an overbought market with mediocre earnings during a pandemic when consumer spending is greatly reduced because they believe that the one fundamental fact is more important.

From a technical perspective, the Emini has been in a trading range for 2 1/2 years. This rally is simply a bull leg in that range. In a trading range, legs go up and legs go down. This is just an up leg. It is strong, but so was the down leg. No matter, the Emini is still in a trading range. A rally made sense when the Emini broke below the bottom of the range in March. A selloff makes sense now that the Emini is back near the top of the range.

How far can a bull breakout go?

The minimum goal for the bulls is a test into the gap above the February 24 high. That gap was very big and it was the start of a 35% selloff. It is therefore very important. The Emini is near enough to make many traders believe that the Emini could get there.

If it gets there, the rally will be a test. The bears sold strongly at that price in March. Will they sell again? Or, will the bulls be strong enough to take the market to far above the old high?

There is a 50% chance that the Emini will test into the gap and a 40% chance of a new high. Furthermore, there is a 30% chance of a strong breakout to far above the old high.

But there is a lot of supply around the old high. If the Emini gets a couple closes below the June 15 low, the odds will be that the 15% correction is underway.

Most corrections are not clear until they are about half over. Two closes below the June low would be more than a 10% selloff from the June high. If that is half of the correction, the 2nd half would take the market down to around 2600. That has been my target for since April.

What does “seasonally bullish” mean?

One of the reasons why I do not pay too much attention to trades based on the calendar is that it is impossible to make money trading them. The margin is small, at best, and the stop usually has to be far relative to the expected gain.

For example, when I say that there is a bullish window from June 26 to July 5, what am I saying? Does it mean that the stock market will rally strong from the 1st day of the window until the final day? No, it means that when I tested this many years ago, I noticed that 75% of the time, the close of July 5 was was above the close of June 25. It only has to go up 1 tick during that period to qualify.

It is important to understand that if you look at a yearly chart where each bar is one year, the longest pullback in history was only 3 bars. That occurred in the Great Depression. Even a 2 bar (year) pullback is rare.

The stock market has been in a bull trend forever. That means the probability of any day being higher than any prior day is more than 50%. In fact, in any 5 day period, there is a 56% chance that the market will be up.

Therefore, saying that the stock market has a 75% chance of being up during the current window is not significantly greater than any other 5 to 10 day window. Consequently, traders should look at calendar tendencies more as entertainment than as a tool to make money.

Disappointed bulls from February

Many of the bulls who bought in February and who did not exit are afraid of a double top and another big selloff. They are hoping that the rally will go a little higher to allow them to exit without a loss.

That stock that they are eager to sell is supply. There might be too much of it to overcome any buying by traders wanting a new high. We will find out in July.

Sometimes the market will go a little above the old high before traders sell. Some want to see if the breakout will be so strong that they are willing to hold onto their stock. If they think it is not strong enough, they will sell.

A reversal down from above the February high would still be a double top. I would call that a higher high double top.

If there is a trend reversal down, where is support?

The bears want a reversal down. It does not matter if it began this week, or if it comes from a test of the gap or from above the old high. They see the 2 1/2 year trading range and are confident most breakout attempts up or down will fail.

They know that the 3 month rally was surprisingly strong. Additionally, they understand that a reversal down will be a leg in the trading range and not the start of a bear trend that will fall below the March low. They expect a higher low and for the bulls to look to buy somewhere in the middle of the range.

In a trading range, traders expect reversals to reach around the middle of the range. That is 2800. Also, a 50% retracement of the 3 month rally is around 2700. And so is a measured move down based on the height of the June trading range.

The breakout above the March 31 high of 2619.00 was never tested. That is around 2600, which is another Big Round Number and therefore a magnet.

Within a trading range, there are always many targets. I just mentioned some of the more significant ones. But somewhere between 2600 and 2800 is what most traders expect.

Legs in trading ranges tend to go further than what seems reasonable. Since the Emini is still in a trading range, traders expect a bear leg to begin soon. There is a 50% chance that it will reach to around 2600 before the bulls buy aggressively again.