Emini Wedge Rally Before Senate Trump Tax-Cut Vote

I will update around 6:55 a.m.

Pre-Open Market Analysis

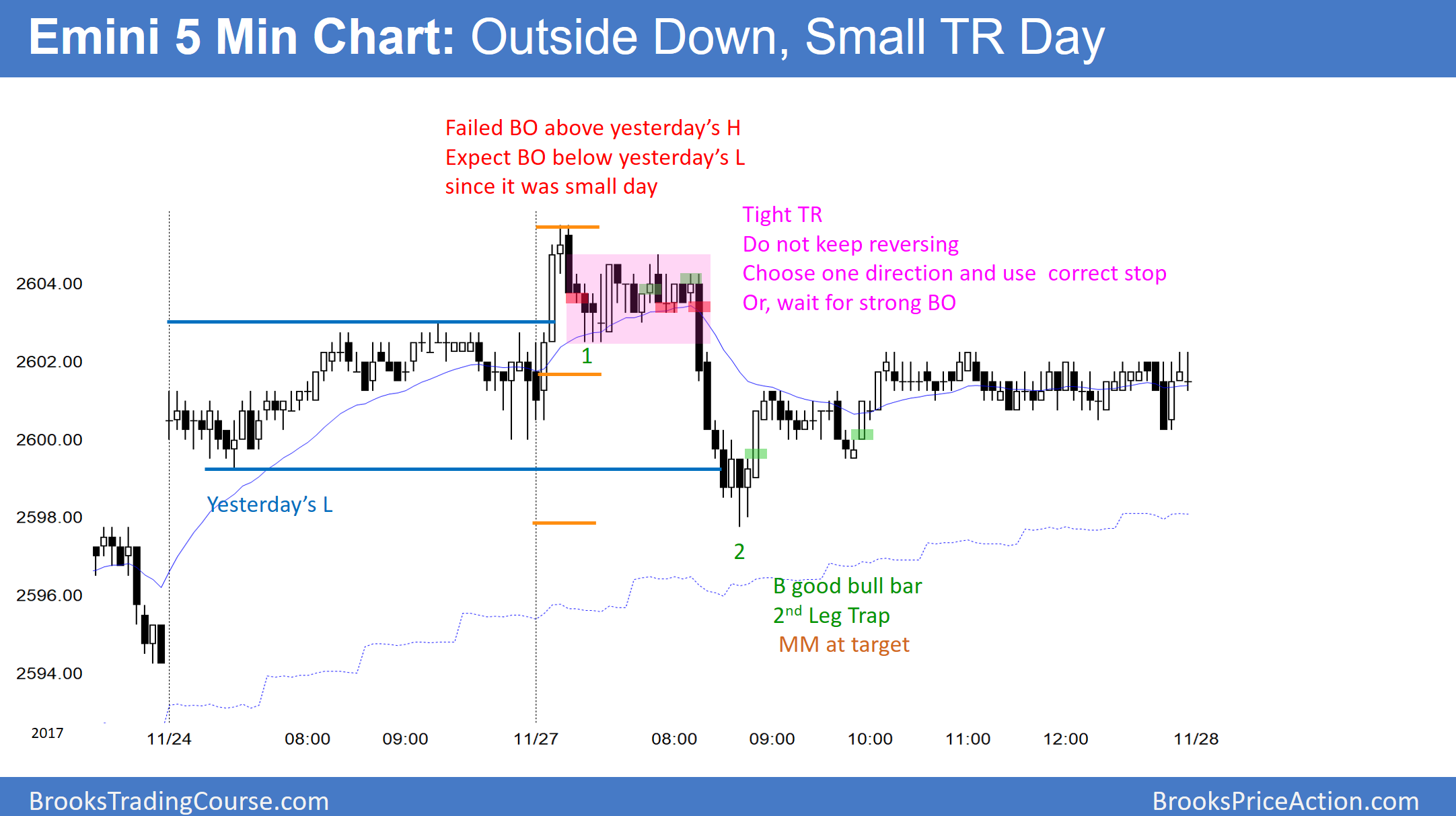

By trading below Friday’s low, yesterday triggered a sell signal on the daily Emini chart. Yet, as a doji, it was a weak sell signal bar. In addition, yesterday was a small outside day, not a big bear day. It was therefore not a strong sell entry bar for the bears. Consequently, the daily chart will probably be mostly sideways again today.

The weekly chart had a bull bar last week after a 4 bar tight trading range. Three of those bars were dojis, which means a one bar reversal. This increases the odds that last week will be the 1st half of a 2 bar reversal. That means that there is an increased chance that this week will sell off and be a bear trend bar on the weekly chart.

Until the daily chart has consecutive big bear days, the odds are that every reversal will fail. Yet, the buy climaxes on the daily, weekly, and monthly charts have never been this extreme. Consequently, the odds favor a 5% pullback starting soon.

Overnight Emini Globex Trading

The Emini is up 3 point in the Globex market. Since the sell signal bar Friday and the sell entry bar yesterday were both week, traders do not yet believe that the top is reliable. Until the bears get at least 2 big consecutive bear days, the bulls will buy every reversal attempt. Consequently, the odds continue to favor higher prices.

The 2 week rally has been much weaker than all of the prior breakouts this year. In addition, the buy climaxes on the daily, weekly, and monthly charts have never been this extreme. Therefore, there is an increased risk of a big bear day coming at any point.

Even though the bull trend has been very strong, this 2 week rally has been week. That makes a big bull trend day less likely over the next few days. However, extreme buy climaxes sometimes end with dramatic, huge bull trend days. Therefore, traders should be ready for a surprisingly big day up or down. If there is a huge day, down is more likely. Since the past 3 days have been small, today will most likely be another trading range day.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.