Pre-Open Market Analysis

The Emini formed a trading range day yesterday, but had a small, late bull breakout. By going above Monday’s high, yesterday triggered High 1 bull flag buy signal on the daily chart.

There is a magnet above at 2900. The Emini will probably test above it today or tomorrow. If the bulls can get 2 closes above it, the odds will favor a continuation up to the all-time high within a month.

On the other hand, there is a nested wedge on the daily chart and a buy climax on the weekly chart. If the bears can begin to create bear days, the odds will switch in favor of a 2-month pullback. The Emini has been sideways for 6 days because traders are deciding between the 2 alternatives.

Tomorrow is Friday and therefore the weekly chart is becoming important.

The past 7 weeks have formed a small wedge rally on the weekly chart. So far, this week is small. It is therefore a bad follow-trough bar on the weekly chart after the 2-week rally. If the bears can close the week below the open, this week will be a sell signal bar for next week for a small wedge top.

Overnight Emini Globex Trading

The Emini is up 3 points in the Globex session. The bulls will probably get a break above 2900 today or tomorrow. If they fail, there will be a micro double top on the daily chart with Monday’s high. When a market tries to go one way several times and fails, it then typically tries to go the other way. As a result, if there is a rally to around 2900 but it begins to reverse, the selloff could lead to one or more bear trend days.

Can the bulls get a big break above 2900? While it is possible, the daily and weekly charts are late in strong bull trends. The bulls might start to take profits on strength.

For example, if there is a big bull trend day closing far above 2900 within the next week, the bulls might sell the close instead of buying more. Their thought could be that it is too extreme and therefore unlikely to go much higher. It would then be a great opportunity to take a big profit that might be brief. That is how an exhaustive buy climax works.

Most days over the past 2 weeks had a lot of trading range price action. Since markets have inertia, today will also likely have at least one swing up and one swing down.

Because of the repeated tests of 2900, there is an increased chance of a big trend up or down. But, with the week being small, it will probably stay small and close around the open of the week.

Yesterday’s Setups

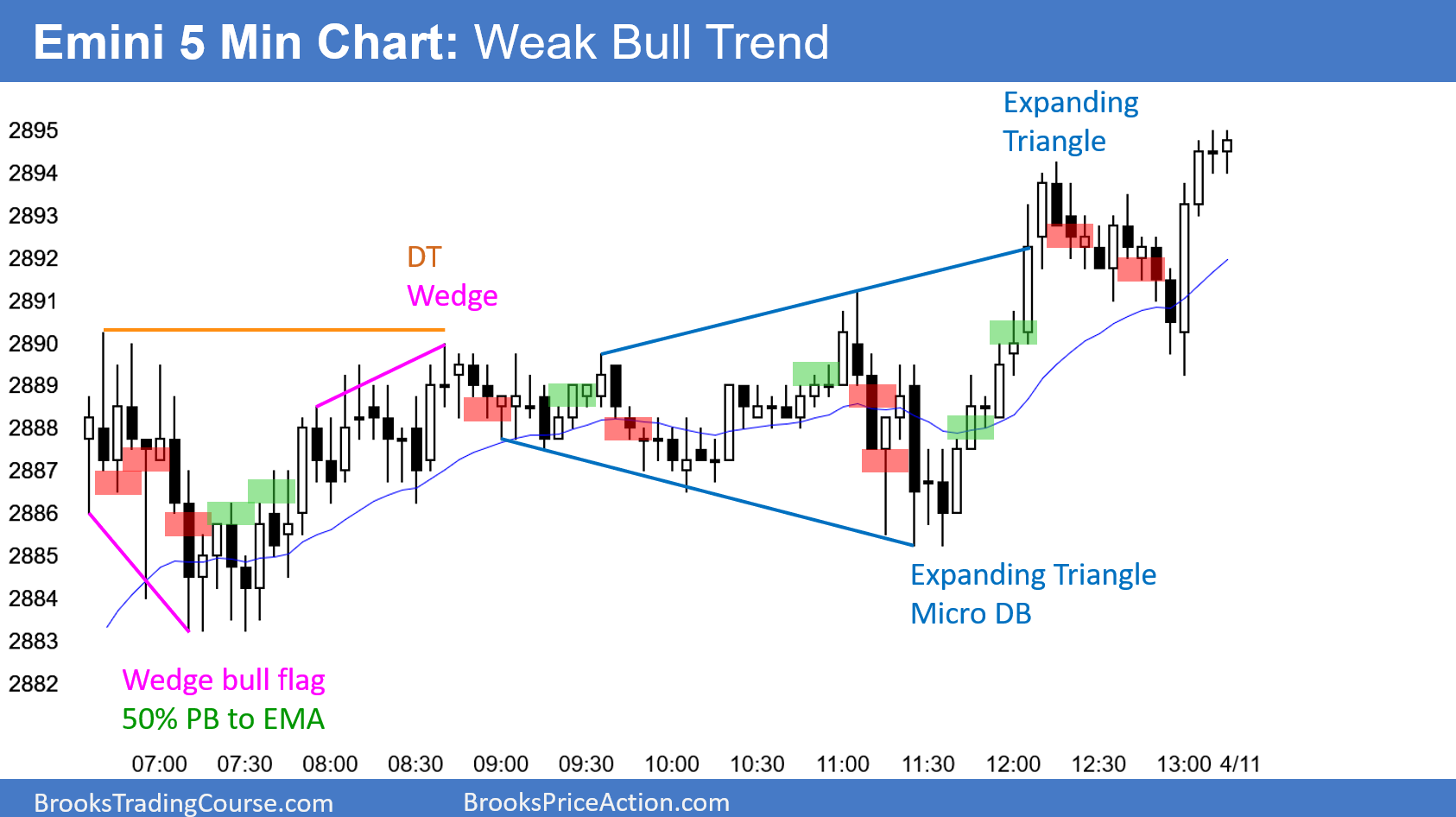

Emini: Weak Bull Trend And Expanding Triangle

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.