Pre-Open Market Analysis

Yesterday was the 5th consecutive doji day in a 7-day tight trading range, There is both a small double top and double bottom. This is Breakout Mode.

The Emini is just below the December 12 top of the crash. That is a magnet above. In addition, the January rally was strong. Consequently, a bull breakout is slightly more likely than a bear breakout.

However, the January rally was a buy climax. Even if the bulls break above the December lower high, the Emini will probably retrace about 50% of the 5-week rally by the end of February.

Because of the dojis and tight trading range, the odds favor more sideways price action. There is no sign of an impending breakout yet.

Overnight Emini Globex Trading

The Emini is up 11 points in the Globex session. I, therefore, might gap up above yesterday’s high. That would create a 2-day island bottom.

If the gap is small, it will probably close within the first hour. However, the daily chart is in a bull bull flag. Therefore, even if the gap closes, there is still an increased chance of a bull trend day.

Since the past 5 days were doji days, traders will need to see a strong early breakout up or down before concluding that today will be a trend day. Without that, the odds favor at least one swing up and one swing down.

Yesterday’s setups

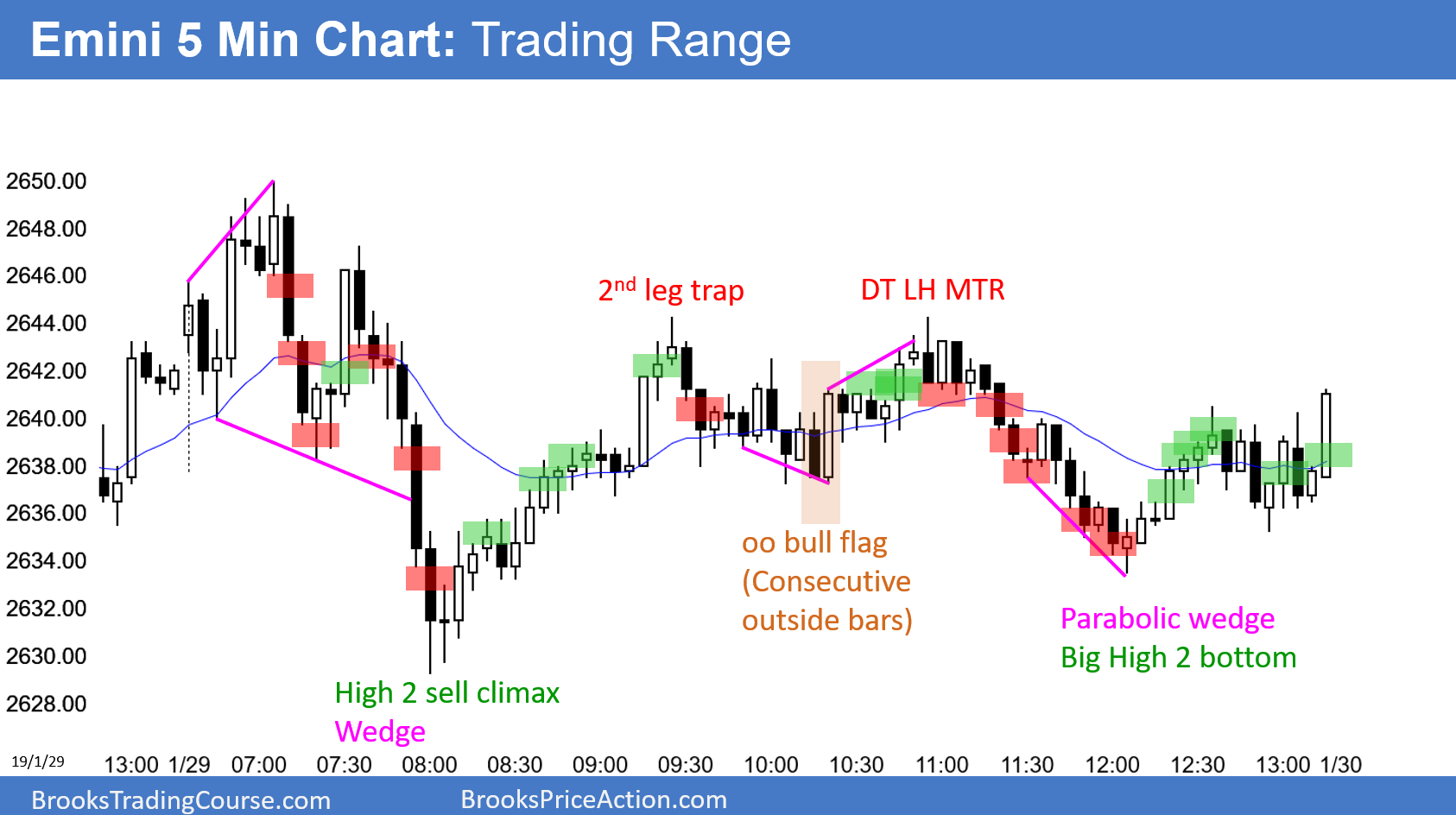

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.