Pre-Open market analysis

Friday was a surprisingly big bear day on the Emini daily chart. Since September 3, I have been saying that the Emini would break above the 2940 top of its 4 week range, but then pull back below the top of that ledge. Friday might be the start of the pullback below the 2940 top of the ledge.

What happens once there is a dip below the top of a ledge? The bulls try to get a reversal up. They see the selloff as a breakout test of support. They then buy, hoping for a resumption of the bull trend.

However, the bears want the selloff to continue down and begin a bear trend. Unless they get several bear days this week, the probability favors the bulls. Most reversal attempts in bull trends form bull flags.

The Emini is down 2 points in the Globex session. Friday’s midday selloff was big enough to qualify as a Major Bear Surprise Bar. That means it can dominate the trading for the next few days. It increases the chance that the Emini is beginning its pullback to below the 2940 top of the August ledge on the weekly chart.

Overnight Emini Globex trading

The bulls never want any selloff. They, therefore, will buy around Friday’s and last week’s low. They will try to form a micro double bottom on the daily chart at the 20 day EMA.

Friday’s big selloff and then big reversal up created confusion. Confusion typically leads to a trading range. Therefore, there is an increased chance of buyers around Friday’s low and then a trading range within Friday’s lower trading range.

A big move down like on Friday increases the chance of follow-through selling within a few days. It also increases the chance of a trend up from a double bottom. This confusion will probably lead to early trading range trading today.

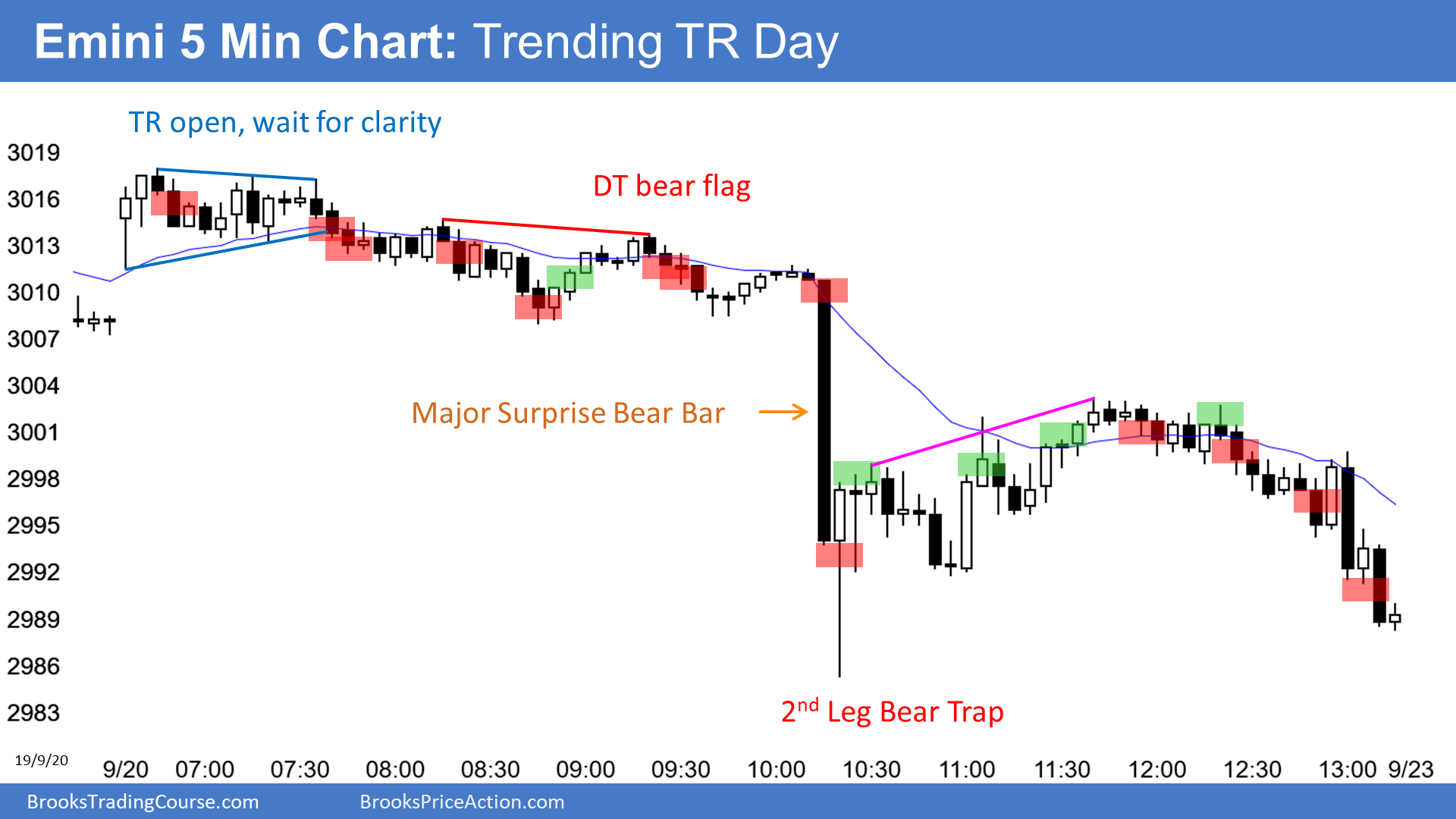

Friday’s setups

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.