The Emini is reversing up from a small wedge bottom on the daily chart. When Friday went above Thursday’s high, it triggered a minor wedge bottom buy signal. The rally should last a few days.

Last week is a High 2 buy signal bar on the weekly chart at the 20 week EMA. Today will probably go above last week’s high and trigger the buy signal.

There is currently a 40% chance that this week was the end of the 4-week pullback. However, it is more likely that the Emini will fall below last week’s low before there will be a new high. With a likely tumultuous election, there might not be another new high this year.

September ends of Wednesday. I have been saying for the past week that September should close above the August low because the monthly chart had 5 big bull bars. An outside down bar in a strong bull trend usually closes above the low of the prior bar. This reduces the chance of a big selloff early this week.

Overnight Emini Globex Trading

The Emini will probably have a big gap up open today to above last week’s high. Because of the wedge bottom on the daily chart, the rally should reach to around the September 16 lower high this week at around 3400. Day traders will therefore be more inclined to buy.

But when there is a big gap up, the Emini is far above the EMA. The bulls do not want to pay far above the average price unless the early bars are far above average. That increases the chance of an early trading range. If there is a trading range open, the bulls will look to buy either a wedge pullback or a double bottom around the EMA. Also, the bears will sell a wedge rally or a double top in the 1st couple hours, expecting a test down to the EMA.

Can today reverse down on the open and form a big bear trend from the open, like Thursday? Probably not. This is true even though today will open around the resistance of the 20-day EMA. Today’s gap up is is a 2nd reversal up from a cluster of support at 3200. The odds favor sideways to up trading for at least a couple days.

Friday’s Setups

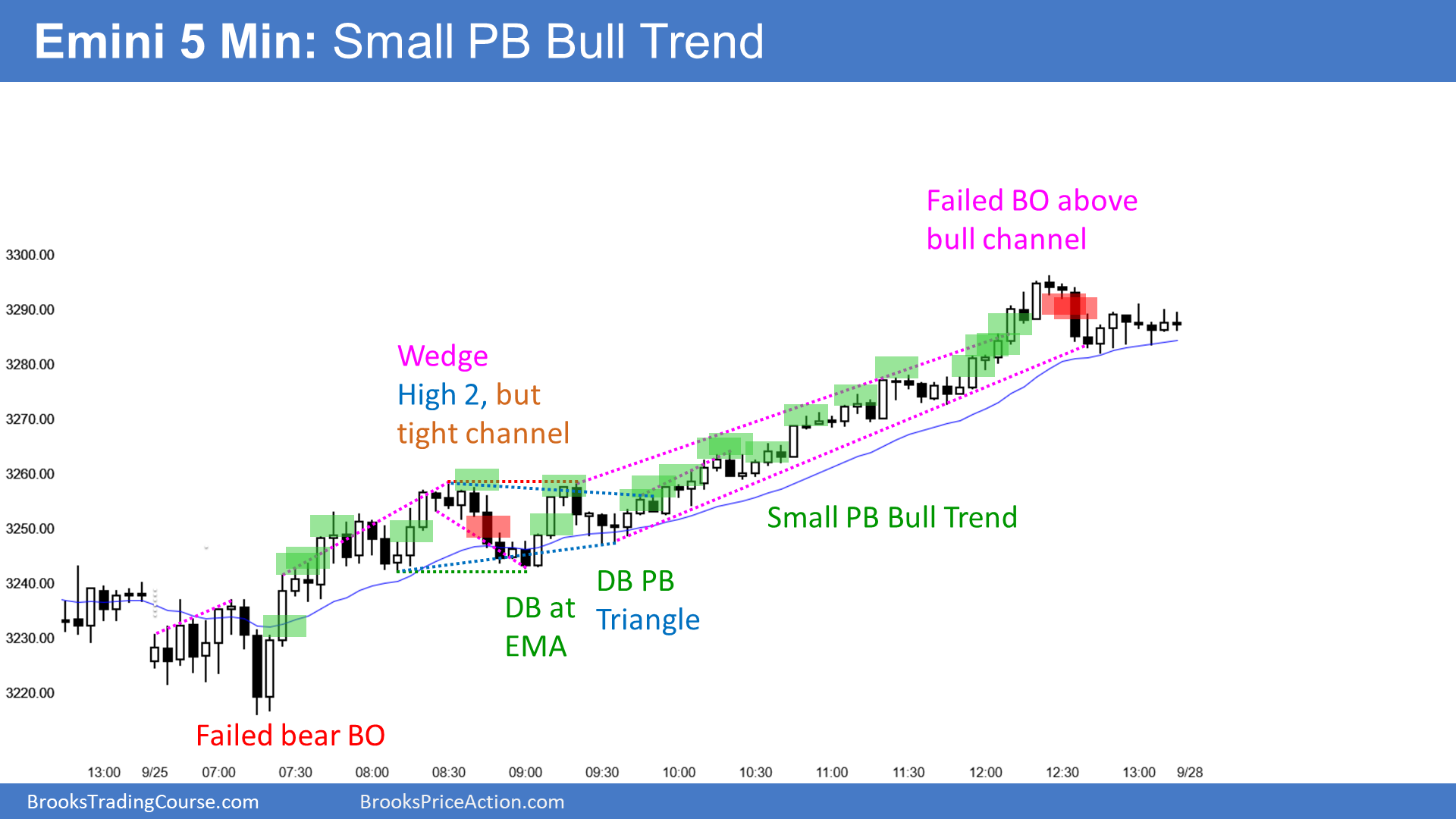

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.