The E-mini formed an inside day yesterday after Wednesday being an outside day. An E-mini ioi Breakout Mode setup (inside-outside-inside pattern). Yesterday is both a buy and sell signal bar. Because yesterday had a bear body, it is a lower probability buy signal bar. But since the 2-week bull channel is tight, and yesterday had a big tail below, it is a low probability sell signal bar. If it is bad for both the bulls and bears. Who is it good for? Limit order traders. There might be more sellers above and buyers below.

Both yesterday and Wednesday spent a lot of time around the open of the week. That means it is important. The bears want the weekly chart to have a bear body. It would then be a sell signal bar.

However, the bulls want a bull body. That would increase the chance of sideways to up trading next week.Because the open of the week is important, it could be a magnet in the final hour today. If the E-mini is within 10 to 20 points of the open going into the final hour, it might get drawn to the open of the week at the close of the week.

Overnight E-mini Globex trading

The E-mini is down 7 points in the Globex session. It has been forming a triangle over the past 3 days, on the day session chart around a cluster of magnets. These are the open of the week, the 3,900 Big Round Number, and the 60-minute EMA.

The most important price is the open of the week. If the E-mini closes below the week’s open, this week will have a bear body and be a sell signal bar on the weekly chart. The bigger the bear body is, the more reliable the sell setup will be. If the E-mini is within 10- to 20-points of the open in the final hour, traders should look for a reversal to the open.It is important to understand that when there is a magnet like this, the market often decides to ignore it at the end of the day. For example, there could be either a late strong rally to far above it, or a late strong selloff to far below it.

Can today be either a strong trend day up or down? Any day can, but it has been paying a lot of attention to those magnets this week. That increases the chance that the week will remain small, and traders will wait for next week to decide on the direction of the next move. But if there is a series of strong trend bars up or down on the open, there will be an increased chance of a trend day today.

Yesterday’s setups

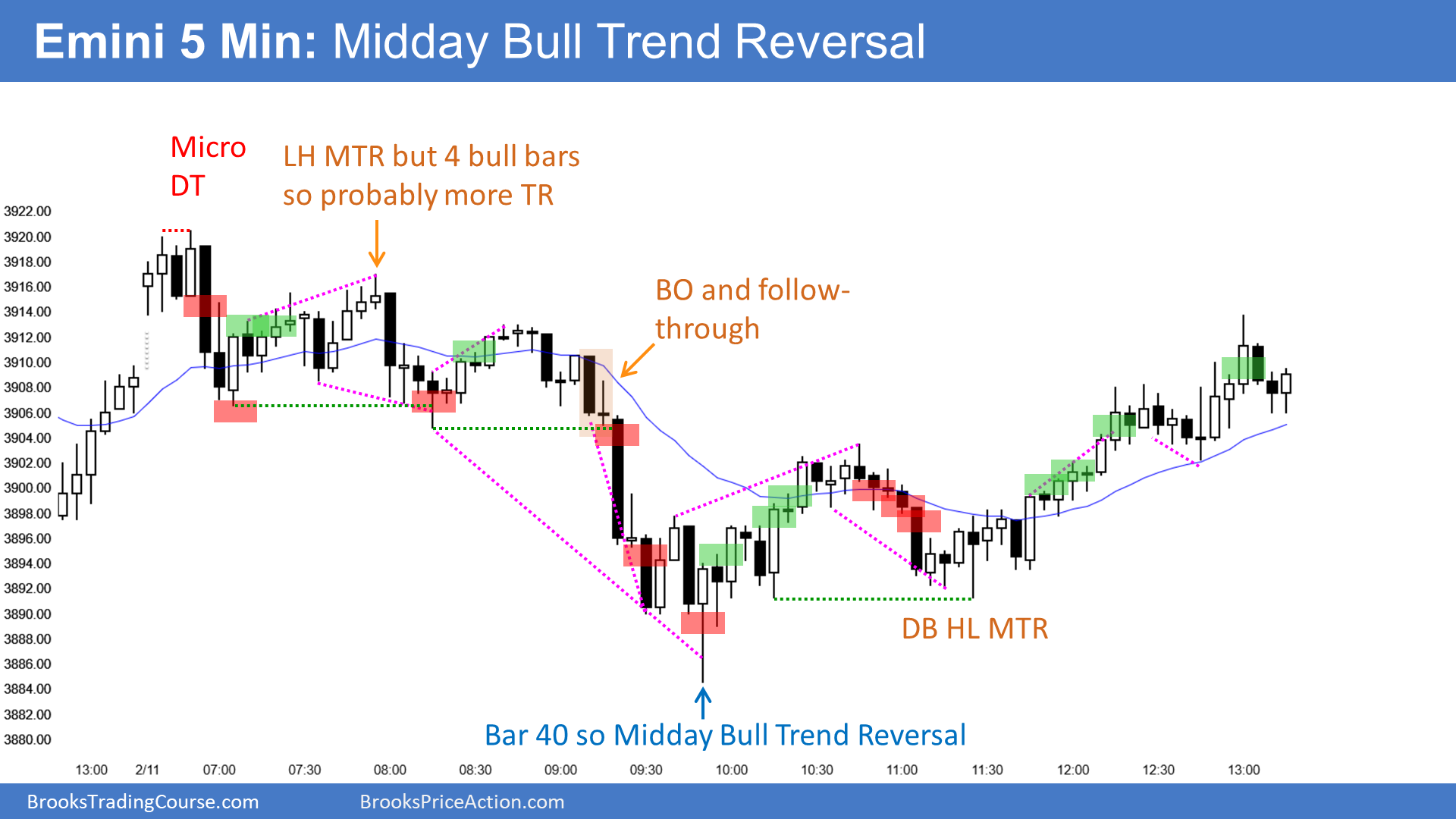

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro E-mini.