Pre-Open market analysis

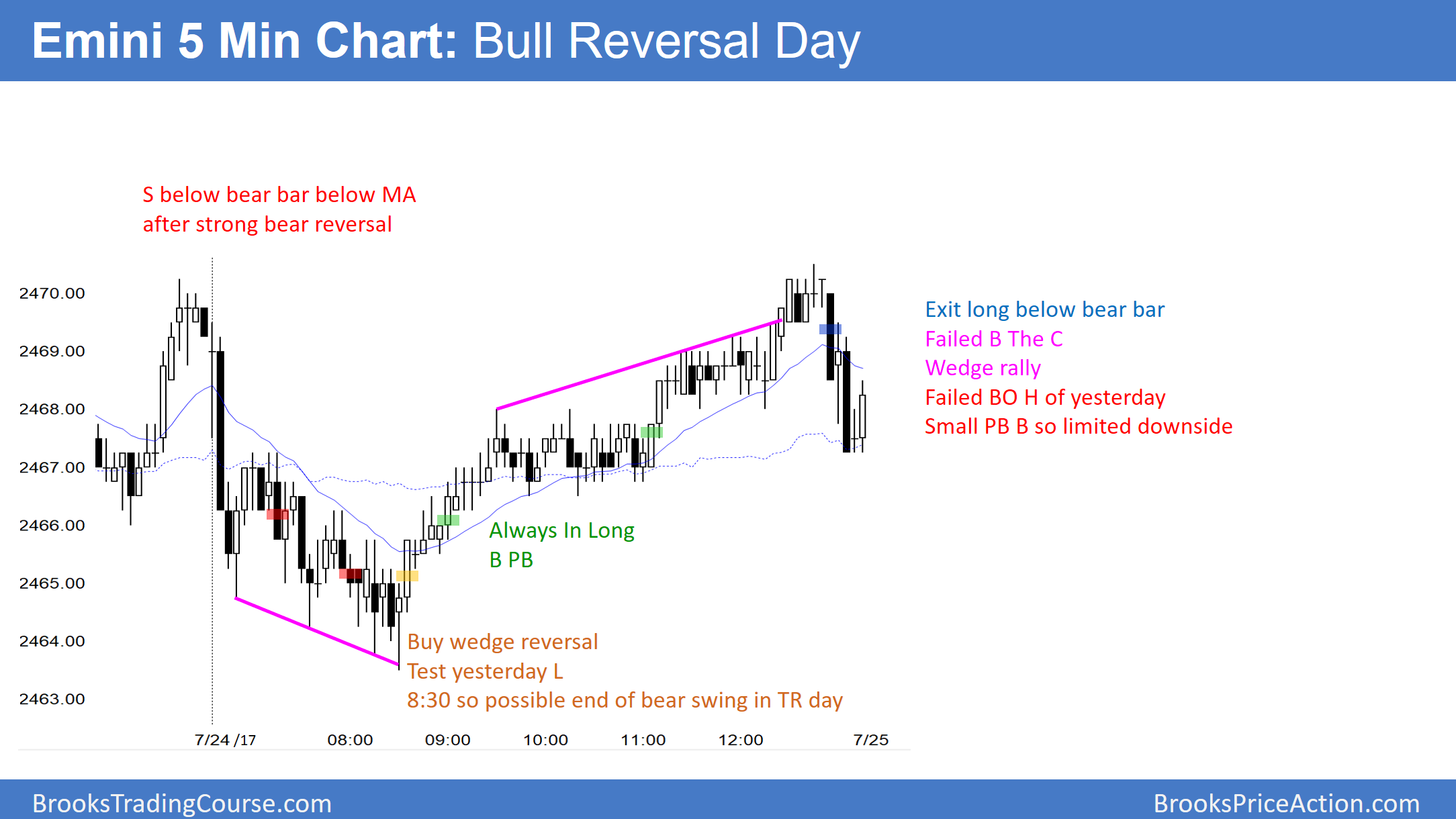

While yesterday was a bull reversal day, it was not a strong bull trend day. Instead, it was the 3rd consecutive trading range day. Friday is still a buy signal bar, but the daily and monthly charts have parabolic wedge rallies. In addition, the weekly chart has an extreme buy climax. Although the odds favor 1 – 3 days above Friday’s high, the odds are against a protracted bull breakout from here.

Furthermore, Wednesday’s FOMC announcement is a catalyst. This means that it can lead to a sharp move up or down, or in both directions. For example, the Emini could rally strongly to 2500 and then reverse down for 2 months. While it could break strongly above 2500 and continue up indefinitely, the weekly buy climax makes that unlikely.

Overnight Emini Globex trading

The Emini is up 7 points in the Globex market. It therefore will probably gap up above the 2 day bull flag and make a new all-time high. Because the daily chart is in a parabolic wedge bull channel, there is an increased chance that today’s rally will lead to a reversal down today or tomorrow.

In addition, a gap up has an increased chance of leading to a trend day. The odds slightly favor the trend being in the direction of the gap. Therefore, if today is a trend day, a bull trend day is more likely than a bear day.

FOMC catalyst tomorrow

Tomorrow’s FOMC meeting is a catalyst. Hence, it can lead to a strong move up or down. While the daily, weekly, and monthly charts are all in buy climaxes, there is no top yet. Furthermore, climactic rallies can go a long way before pausing. Hence, the odds still favor at least slightly higher prices. However, traders need to be ready for a reversal down at any point. Since it would be following an extreme climax, the 1st leg down could be big and fast.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.