Pre-Open Market Analysis

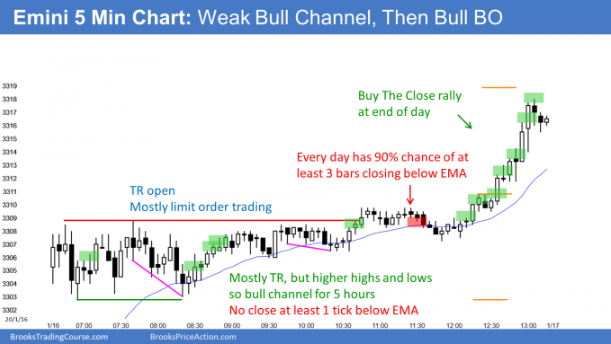

The Emini gapped above the 3,300 Big Round Number yesterday, but spent most of the day going sideways. It was in a weak bull channel, but it trended up strongly into the close. The bulls want follow-through buying over the next few days. The bull trend is extremely strong on the daily charts. Traders continue to expect this melt up to continue higher, even though it is climactic.

Yesterday’s late rally was a Bull Surprise. Surprises typically have follow-through. However, the rally was so strong that bulls will look to take some profit by the end of the 2nd hour today. That typically will result in at least a couple hours of sideways to down trading by the end of the 2nd hour.

Today is Friday so weekly support and resistance can be important. This is especially true in the last hour. There are no important weekly targets nearby. Therefore, the bulls will simply try to get the week to close near its high. However, the bears want a conspicuous tail on the top of this week’s candlestick on the weekly chart. They will try to get a selloff in the final hour.

Overnight Emini Globex Trading

The Emini is up 11 points in the Globex session and today will probably gap up. The open will likely be far above the EMA. When that is the case, many bulls are hesitant to buy, especially if the first few bars are not big bull bars closing near their highs.Traders do not want to pay a price that is far above average for price action that is not far above average. Consequently, a big gap up usually results in an early trading range. The bears hope for a double top or wedge top and then a swing down.The bulls want to buy closer to the EMA. Once the Emini goes sideways to down the to the EMA, they will look to buy a double bottom or a wedge bottom for a swing up.Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.