Market Overview: S&P 500 E-Mini Futures

The market formed a weekly E-Mini retest high following last week’s pullback to the 20-week EMA. The bears want a reversal from a lower high major trend reversal or a double top with the all-time high and a double top bear flag with the August 30 high. The bulls hope the market is in the broad bull channel phase and want a breakout into new all-time high territory.

S&P 500 E-Mini Futures

The Weekly S&P 500 E-Mini Chart

- This week’s S&P 500 E-Mini candlestick was a big bull bar closing near its high and above the 20-week EMA.

- Last week, we said that the odds slightly favor the market to remain in the sideways to down pullback phase. Traders will see if the bears can create a follow-through bear bar or will the 20-week EMA or the bull trend line act as support?

- The bears failed to get a follow-through bear bar, and the 20-week EMA is acting as a support.

- Previously, the bears created a big bear bar testing the 20-week EMA.

- However, they failed to create a follow-through bear bar which indicates that they are not yet as strong as they hoped to be.

- They see the current rally as a retest of the prior high.

- They want a reversal from a lower high major trend reversal or a double top with the all-time high.

- The bears want a reversal from a double-top bear flag with the August 30 high.

- The bulls got a strong retest of the all-time high.

- They hope the market is in the broad bull channel phase and want a breakout into new all-time high territory.

- They see last week as a 50% pullback of the rally (from the August low) and hope to get at least a small second leg sideways to up to retest the August 30 high. They got what they wanted.

- If the market trades lower, they want the 20-week EMA or the bull trend line to continue acting as support.

- Since this week’s candlestick is a big bull bar closing near its high, it is a buy signal bar for next week.

- Because the candlestick closed near its high, the market may gap up on Monday. Small gaps usually close early.

- For now, odds slightly favor the market to trade at least a little higher.

- Traders will see if the bulls can create a retest and breakout above the August 30 high.

- Or will the market trade slightly higher but stall around the August 30 high area instead?

- If next week closes as a surprise big bear bar overlapping the prior two candlesticks instead, we may be entering into a tight trading range phase.

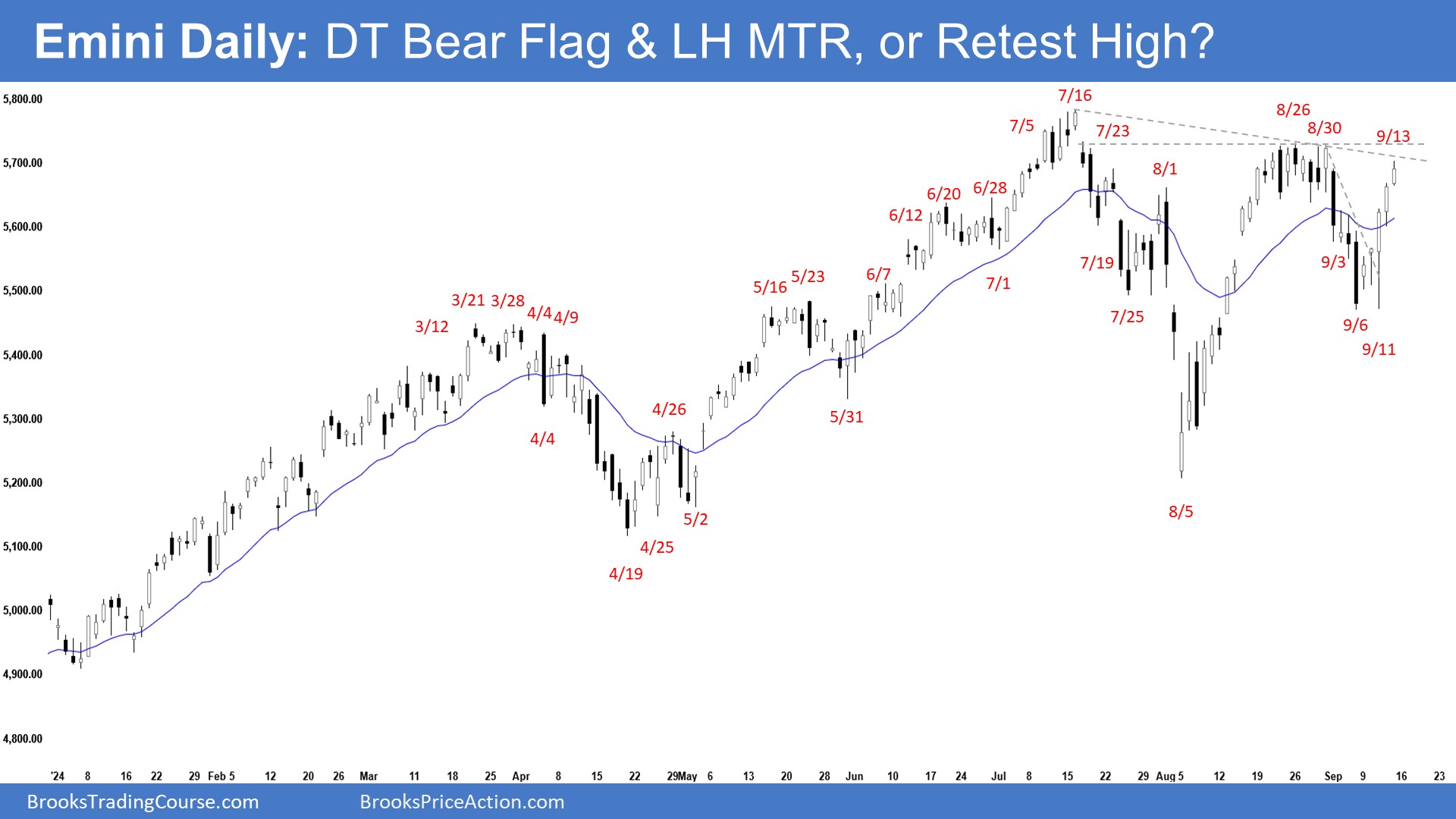

The Daily S&P 500 E-Mini Chart

- The market formed a pullback early in the week. Wednesday retested the September 6 low but reversed into a big outside bull bar with follow-through buying on Thursday and Friday.

- Last week, we said that the odds slightly favor the market to remain in the sideways to down pullback phase. Traders will see if the bears can continue to create more bear bars testing near the August 5 low or will the market trade slightly lower but stall and form a pullback instead.

- The bears see the current rally as a retest of the August 30 high.

- They want a reversal from a lower high major trend reversal and a double top with the all-time high.

- They want the market to stall around the August 30 high area and reverse from a double-top bear flag (Aug 30 and Sep 13).

- They need to create consecutive bear bars closing near their lows trading far below the 20-day EMA to increase the odds of a retest of the August low.

- The Bulls hope the rally is in a broad bull channel phase and want a resumption of the move.

- They got a strong rally testing near the all-time high in August.

- They see the recent move as a 50% pullback of the rally (from the Aug 5 low) and want at least a small second leg sideways to up to retest the August high. They got what they wanted.

- Next, the bulls want a strong retest of the all-time high followed by a strong breakout above.

- If the market trades lower, they want a reversal from a double-bottom bull flag with the September 6 low.

- For now, the market may still trade at least a little higher.

- Traders will see if the bulls can create a strong retest of the August 30 high followed by a breakout above.

- Or will the market trade slightly higher but stall around the August 30 high area and reverse lower in the weeks ahead instead?