Pre-Open Market Analysis

The Emini had a bear reversal day yesterday. It then had a bull reversal from a double bottom. It was mostly a trading range day. Also, it is in the middle of its 2-month trading range. Traders are deciding if the 2-day selloff was the end of the 2 legs sideways to down from the month-long wedge rally. The correction does not have as many bars as a typical pullback has. Therefore, there is a risk that there will be one more leg down to 2600 – 2650.

The weekly chart so far has a bull inside bar. It is a High 2 bull flag above the 20-week EMA. Furthermore, the bulls are still on their buy signal from last week. This is true even though last week was an outside down bear bar. It did not fall below the lower of the 2 bull bars in the ii bull flag. Therefore, the bulls are theoretically still long.

Tomorrow’s close is important. If the week closes on its high, it will be a good buy setup for next week. That would increase the chance that the 10% correction is over and that the bull trend is resuming.

Alternatively, if this week is not a strong bull bar, it will increase the odds of more sideways to down trading for the next few weeks.

Overnight Emini Globex Trading

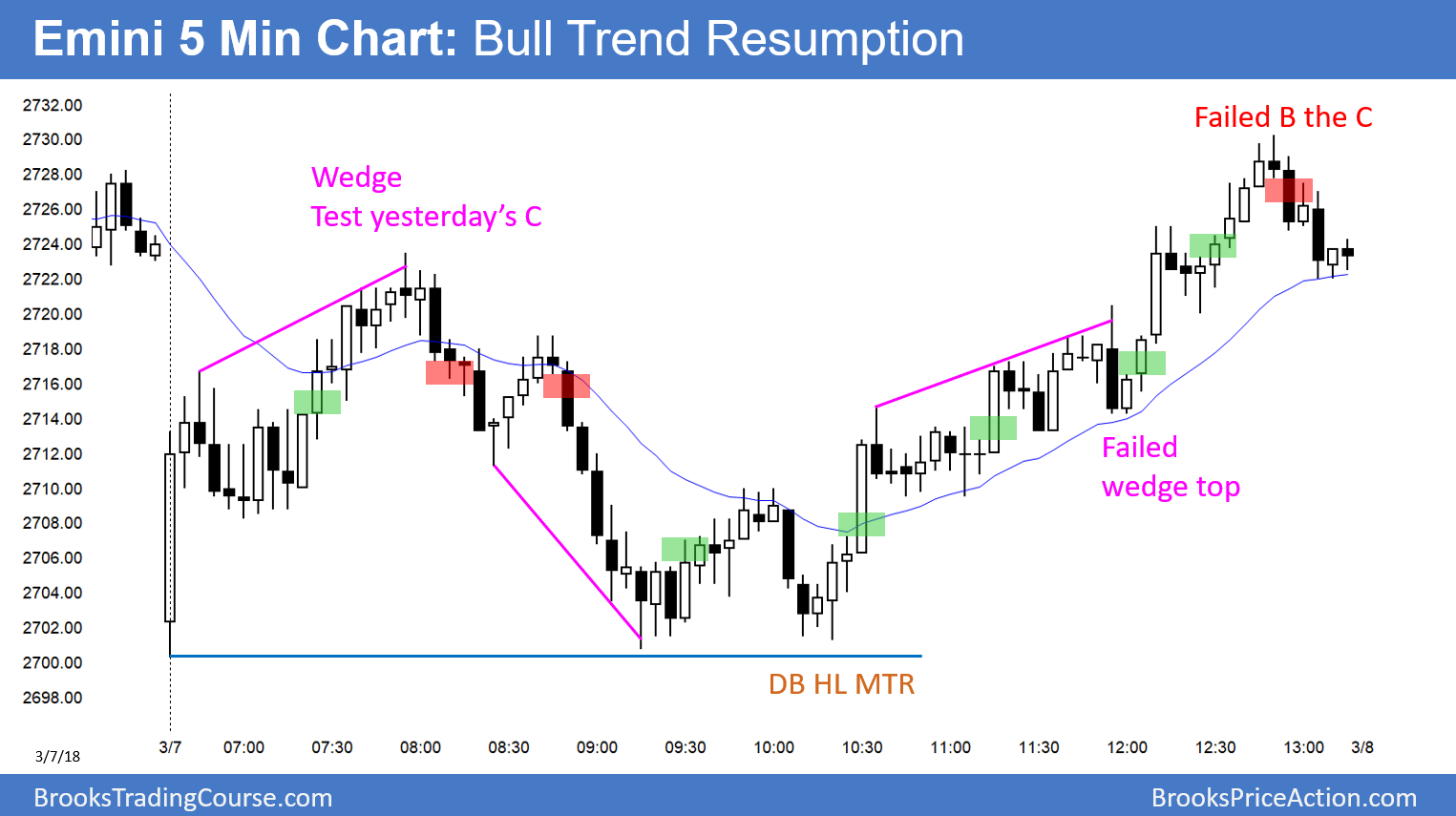

The Emini is up 11 points in the Globex market. The 4-day rally is still likely a pullback from the 1st leg down from a wedge top on the daily chart. However, it could be a resumption up from a 2 legged rally. If so, there might be one more new high and a bigger wedge top on the daily chart. The momentum up is good. Hence, there will probably be follow-through buying today.

The bears will try to create a 2nd leg down from the wedge top on the daily chart. There is a measured move target on the 60 minute chart around 2750. Therefore, they will look for a reversal pattern in that area. They hope it would lead to a selloff over the next couple of weeks.

Today and tomorrow are important. If the bulls can close the week on its high, the odds will favor a test of the February 2794.75 lower high within 2 weeks.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.