Pre-Open market analysis

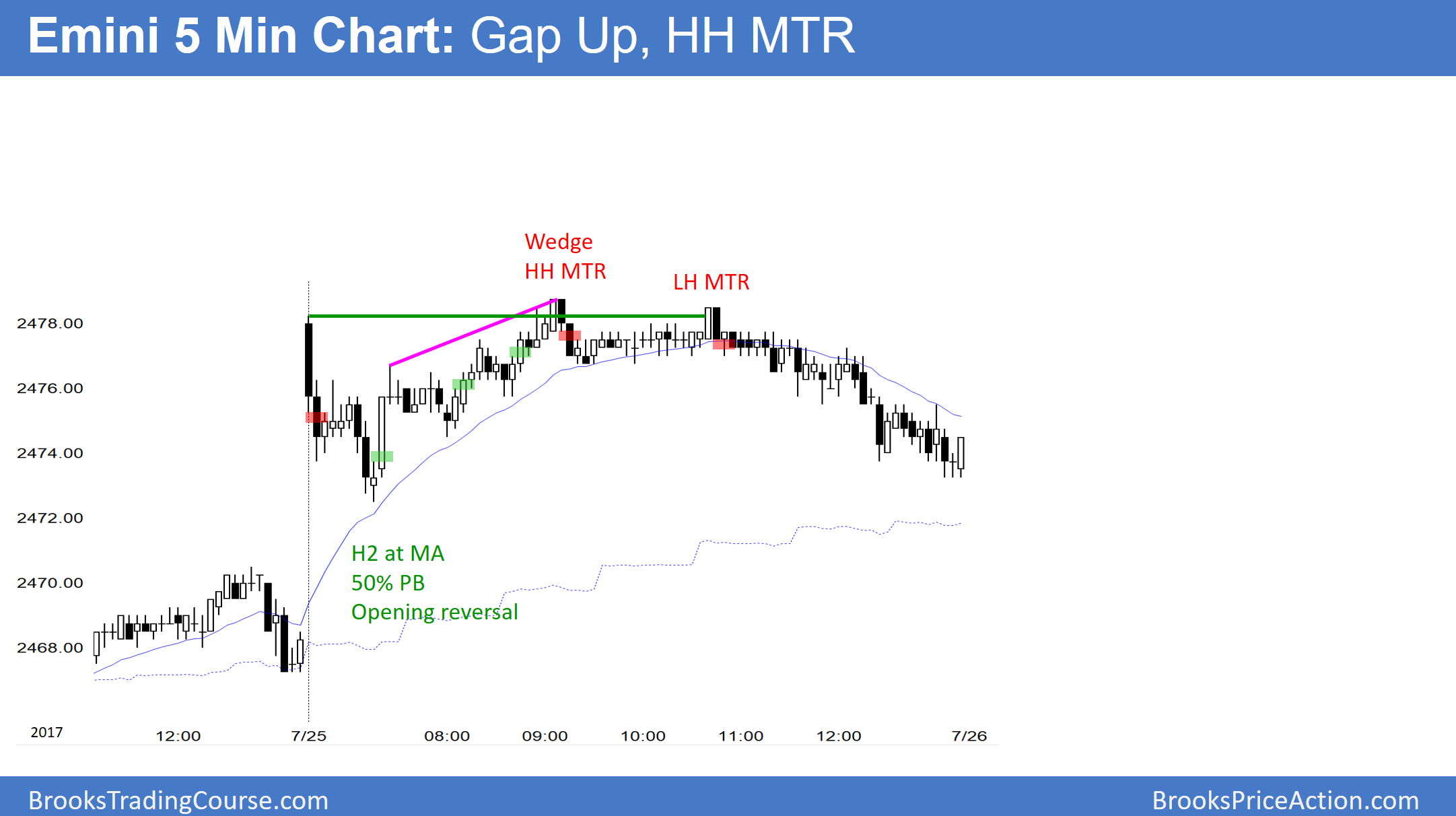

While yesterday gapped up to a new all-time high, it spent most of the day in a tight trading range. Since it closed near its low, it is a sell signal bar on the daily chart.

Because today has an FOMC announcement at 11 am, the Emini has an increased risk of a strong trend after the report. Traders have to be ready for a big breakout up or down.

There are buy climaxes on the daily, weekly, and monthly charts, but no top or reversal down yet. The momentum up is strong, and climaxes can extend much farther than what seems reasonable. Consequently, there is an increased chance of a strong trend after the report. The Emini usually is in a fairly quiet trading range for the hour or two before the report.

Day trading after the FOMC announcement

Most traders who want to enter after the report should wait at least 2 bars. This is because there is a 50% chance that the 1st breakout will reverse. Over the past 2 years, there have been far fewer strong trends after FOMC reports. Therefore, the odds favor trading range trading after the report. However, because the Emini is in a buy climax, if there is a trend, it could be very big.

Overnight Emini Globex trading

The Emini is up 5 points in the Globex market. The bulls see yesterday’s late selloff as a test of the selloff on yesterday’s open. It is therefore a double bottom bull flag. The bulls want a breakout above yesterday’s high, which is the neck line of that double bottom.

While the trading is usually normal for the 1st few hours, the Emini typically enters a tight trading range in the 1 – 2 hours prior to the FOMC announcement. I never care about what the Fed does. All I want to know is whether the Emini is going up, down, or sideways after the report. I base my trading decisions on the price action, which represents the consensus of all institutions. It’s hard enough making day trading decision in the limited time that we have. If we have to try to understand all of the variables involved with the report in addition to our day trading responsibilities, most traders would find it impossible to trade profitably.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.