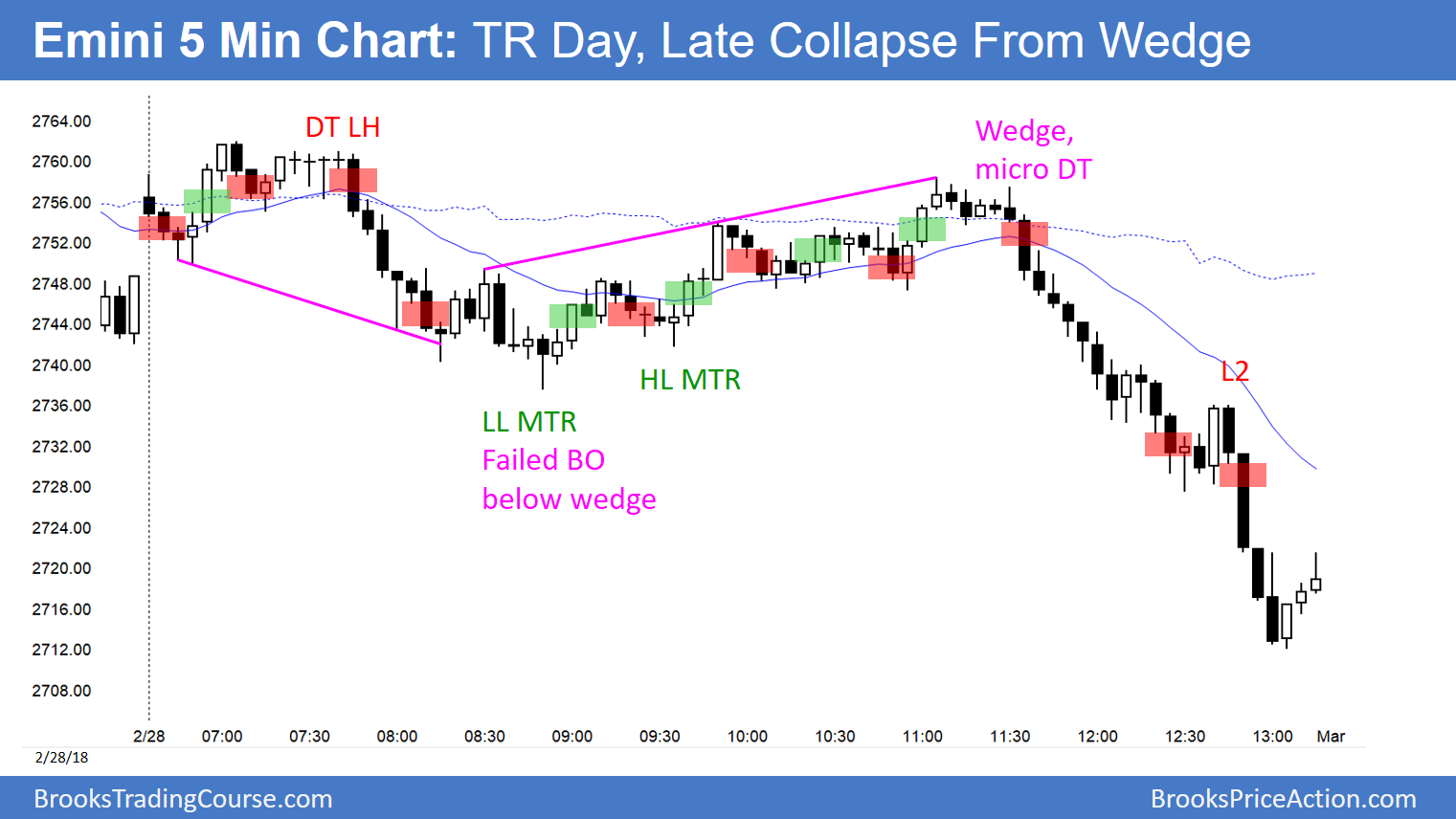

Emini follow-through selling after wedge lower high major trend reversal

I will update around 6:55 a.m.

Pre-Open market analysis

The 3 week rally has been strong. However, Tuesday was a big bear bar on the daily chart and yesterday was a 2nd big bear bar. Therefore, it confirmed the reversal and increased the odds of a couple legs down over the next 2 weeks.

Overnight Emini Globex trading

The Emini is up 1 point in the Globex market. After yesterday’s sell climax, there is a 75% chance of at least 2 hours of sideways to up trading that starts by the end of the 2nd hour.

This week is the entry bar for the bulls on the weekly chart. Their minimum goal is a bull body on the weekly chart. Consequently, they need tomorrow to close above the 2759.50 open of the week, which is just above yesterday’s sell climax high.

That is therefore an important magnet. While it is 40 points away, this 2 day selloff on the daily chart is probably a bear leg in a trading range. Consequently, the odds are the bears will be disappointed. One thing that would disappoint them is if this week has a bull body, or only a small bear body. Since a trading range is likely on the daily chart, there is about a 50% chance of a 40 point rally by tomorrow’s close.

Alternatively, if this 2 day selloff is a resumption of a bear trend, this week will probably be a bear trend bar on the weekly chart. That means that tomorrow will close near the low of the week. Furthermore, today and tomorrow could be additional big bear trend days.

While this is unlikely, day traders will sell aggressively and hold for a swing down if there is a continued strong trend. A 40 point reversal up by tomorrow’s close is more likely.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.