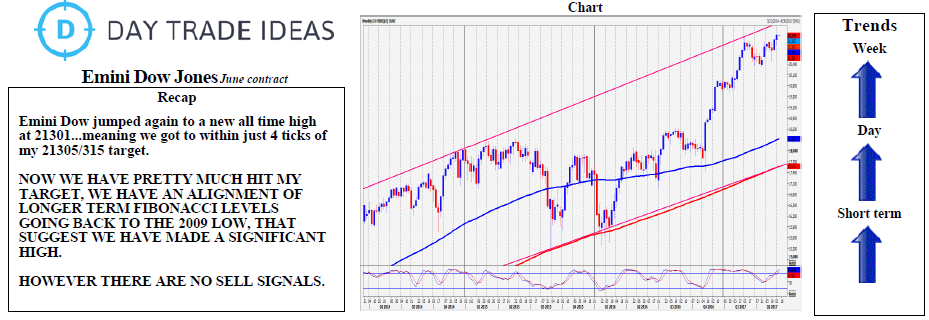

Emini Dow Jones topped 4 ticks from 21305/3015 and collapsed to just 2 ticks above support at 21150/140. The levels are working! Suddenly it is more volatile so some investors may have decided it is time to take some profit.

First support at 21220/210 then 21160/150. A break lower is certainly possible today targeting strong support at 21070/060 and the best chance of a low for the day. Longs need stops below 21000. We then meet what should be the best support for this week at 20935/925 – (3.5 week trend line, 23.6% Fibonacci and 2 week low).

Bulls obviously need to beat 21305/315. It is likely to be remain a slow crawl higher but we should target 21390/21410.