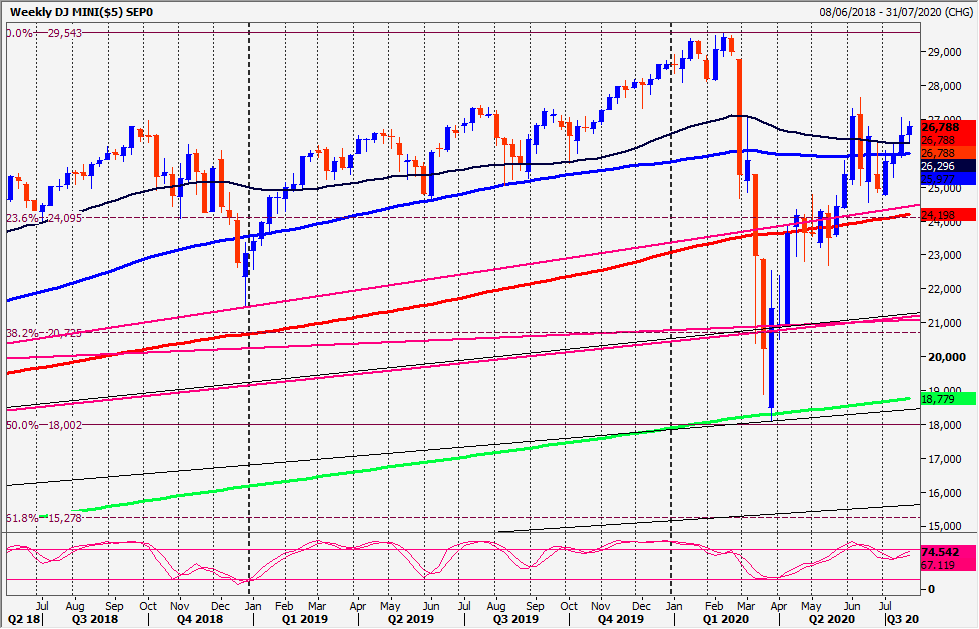

September Emini Dow Jones Futures remain much more stable then the Emini S&P 500 and Nasdaq.

Today’s Analysis

Emini Dow Jones holding above first support at 12640/610 targets 26670/700 and 26800/850 before a retest of last week’s high at 27000/063. If we continue higher look for 27110/130.

We have 2 minor support levels at 12640/610 and again at 26520/500. Below here targets 26410/390 before a retest of this week’s low at 26330. Best support at 26200/160.

Nasdaq did test strong resistance at the new all time high of 11040/060 as predicted and topped exactly here leaving a DOUBLE TOP SELL SIGNAL.

There is significant risk to the downside now. If you are not short and cannot give you a 100% reliable sell level (other than 11000/11050) but it would be worth entering shorts with stops above 11100 and running them for a while. Yesterday’s initial bounce held 10930/940 so let’s assume this is first resistance.

Holding here, targets are 10830/820 and 10790/780 with minor support at 10720/710. So a break below 10660 is the next sell signal, targeting 10550/530 and support at 10450/400. There is a good chance of a bounce from here on the first test, but brave longs need stops below 10350.

If you want to try shorts, the best 2 levels are 10930/940 and 11000/11050. A break above 11100 has to be taken as a buy signal.

Trends

- Weekly Outlook Positive

- Daily Outlook Positive

- Short Term Outlook Neutral

Chart