Pre-Open Market Analysis

Friday’s selloff was strong enough so that the odds favor a 2nd leg down on the daily chart after the 1st bounce. However, since Friday was already a 2nd leg down after a small 1st leg, it is possible it is a 2nd Leg Trap in a bull trend. If so, the bull trend on the daily chart could resume today or tomorrow. More likely, the selling will probably continue at least until the Emini reaches the 20 week exponential moving average, which is now below 2700.

Since Friday was a sell climax, there is only a 25% chance that today will be a 2nd big bear day. However, traders should sell rallies at least until there is 2nd leg down on the daily chart and the Emini falls to the 20-week exponential moving average. Consequently, investors should wait to buy. Since the daily chart might be in a 2nd Leg Trap, traders should quickly switch to bullish if there is a strong reversal up. The odds favor the bulls over the next few months.

If the bears get a consecutive big bear day today, the daily chart will be in a bear trend. This is not likely. Yet, even if the selloff reaches 10%, it will still be a bull flag on the monthly chart and a good buying opportunity.

Since the weekly chart is close to the 20-week EMA, it is more likely that this selloff will not reverse up to a new high without 1st touching the average. But, the odds are that there will be a new all-time high within a month or two because the bull trend is so strong on the monthly chart.

Overnight Emini

The Emini is down 7 points in the Globex market. Every big selloff for the past year has had bad follow-through over the next few days. This is likely here as well. As a result, the odds are against today being another big bear day. More likely, the market will be confused for a few days. Consequently, the odds favor a trading range, which means legs up and down for day traders. If there is a huge reversal up lasting 2 or more days, the odds will shift back to favoring a new high before a test of the 20-week EMA.

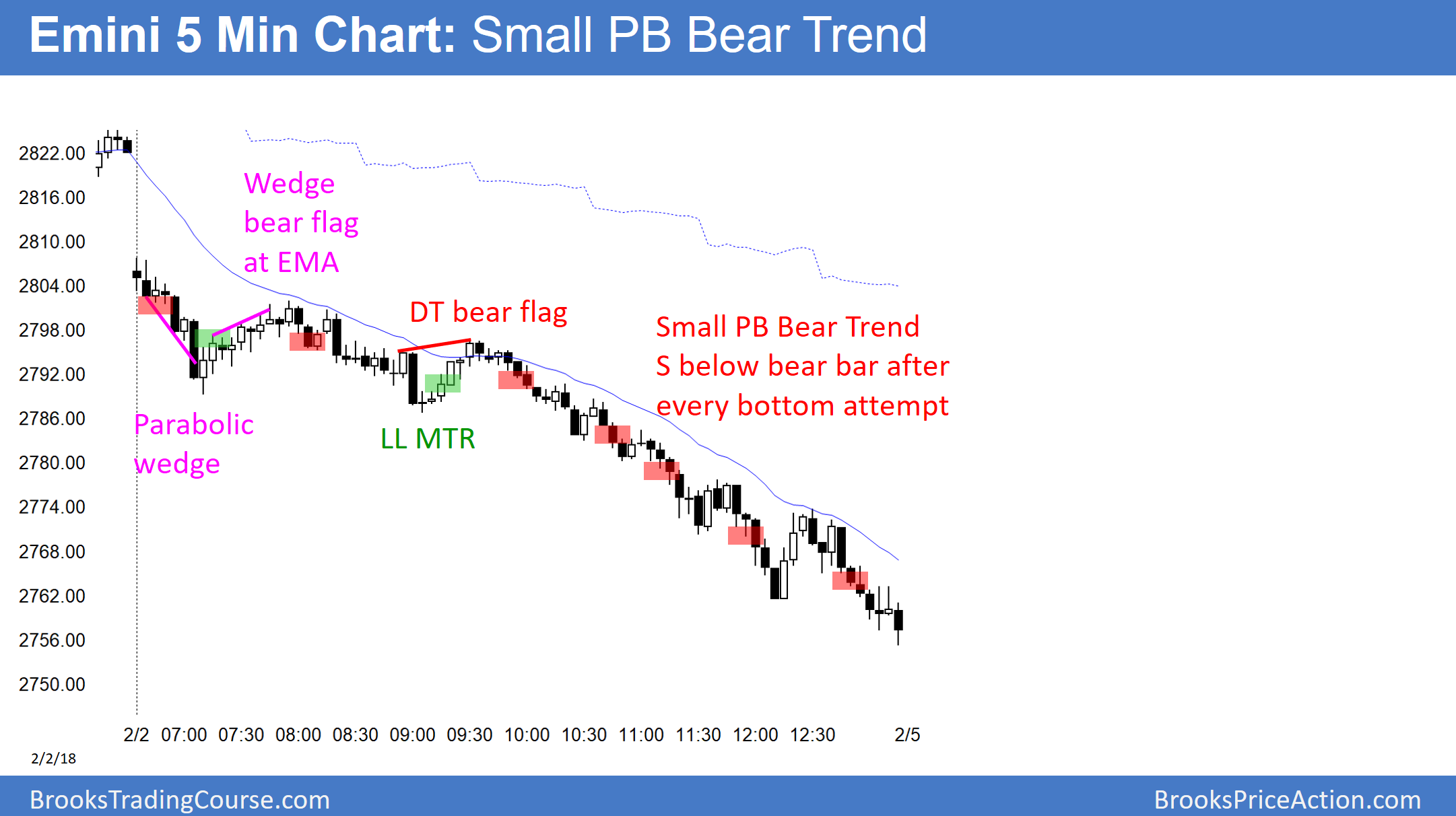

Friday’s Setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.