Pre-Open market analysis

Last week was the 2nd consecutive doji bar on the weekly chart. It is a buy signal bar for this week, but a bear doji bar is a low probability setup for a swing up.

The weekly chart triggered a sell signal last week, yet the setup was weak. The daily chart had a bear inside bar on Friday. Also, Thursday was a big bear day. Therefore, Friday is a sell signal on the daily chart. But, the daily chart lacks strong legs up or down. Hence, a buy or sell signal is likely to lead to a 3 – 5 day move and not a trend.

The daily chart last week reversed up twice from above the May 22 high. There is therefore a gap between those two lows and the May breakout point. The bulls want a 160 or 190 point measured move up. But, unless they break above the March high in the next few weeks, the bears will probably get a swing down for several weeks. Furthermore, the daily chart is in a trading range, which disappoints bulls and bears. The odds are that the gap will close this week and disappoint the bulls.

June 26 to July 5 is up about 70% of the time. There is therefore a slight seasonal bias starting this week. However, the most important factor is the March high. The bulls need a strong breakout above it. Else, the 3 month rally is just a bull leg in a 5 month trading range.

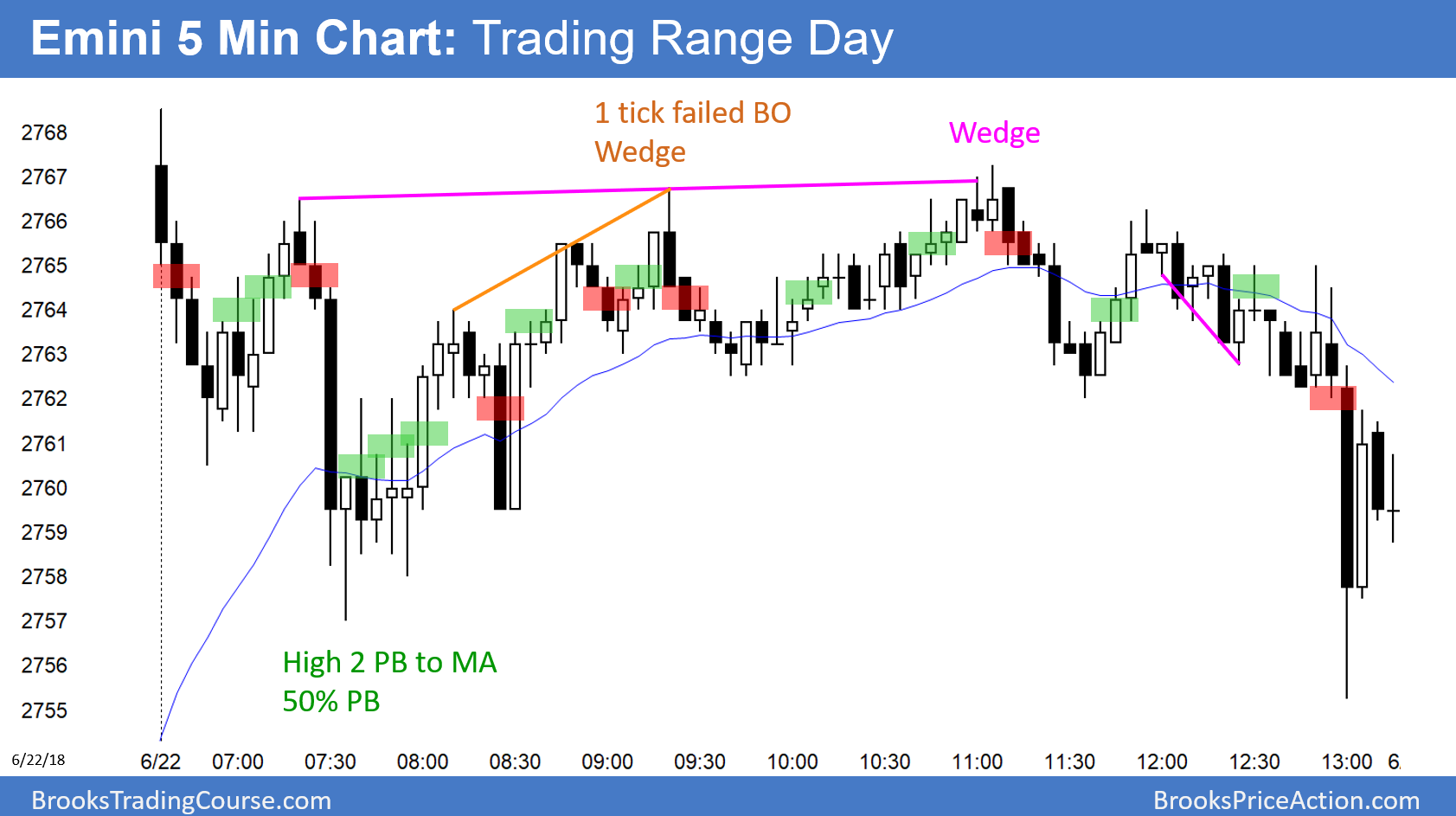

Since the Emini is near major resistance, a big trend up or down can come at any time. However, most days have spent a lot of time in trading ranges, so that is likely again today.

Overnight Emini Globex trading

The Emini is down 14 points in the Globex market. This is not how a reversal up from a gap usually behaves. It therefore increases the odds that the gap above the May 22 high will close this week. If so, it would be another sign that the rally from the April low is just a bull leg in the 5 month trading range.

Friday was mostly sideways, as were most days over the past month. Also, the Globex session was mostly sideways. This increases the chance that today will have a lot of trading range trading as well.

Friday’s setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.