Pre-Open market analysis

The Emini is in a strong bull trend on all higher time frames. Yet, the rally is so extreme that it is climactic. Therefore there is an increased risk of a 100 point pullback lasting 2 – 3 months.

The daily chart is in a bull channel. Hence, there is a 75% chance of a bear break below the trend line. But, there is no top yet. The Emini has been in a tight range for 10 days. Consequently, it will likely continue sideways today. The next catalyst is Friday’s unemployment report.

Overnight Emini Globex trading

The Emini is up 2 points in the Globex market. It is at the top of a 2 week trading range. The odds are that today will continue yesterday’s trading range trading on the open. Furthermore, today will probably be mostly a trading range day. However, day traders need to be ready for a series of strong bear trend days beginning within the next month or two. Once they begin, they will tend to have strong selloffs in the final hour.

Yesterday’s setups

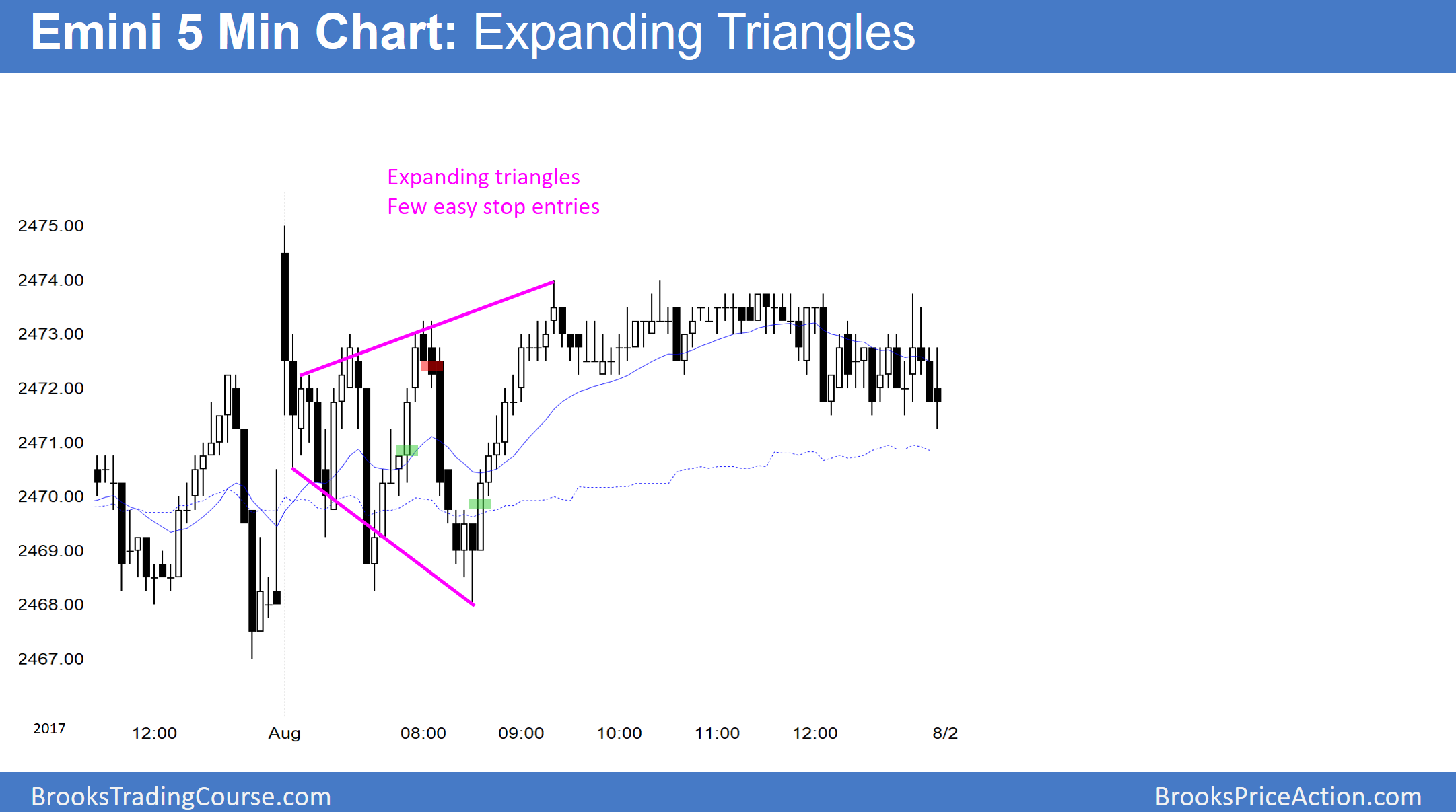

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.