Pre-Open market analysis

The Emini had a small day yesterday. It is in a 3 week trading range above the daily moving average. Therefore,odds favor higher prices. Yet because the weekly chart is in an extreme buy climax, the probability is that traders will look to sell a reversal down from a new high. Since most days over the past few weeks have spend a lot of time in tight ranges, that is likely again today.

Risk of buy climax on daily chart

There is already a buy climax on the weekly chart. However, the inability of the bears to reverse the Emini down increases the chances of a buy climax on the daily chart as well. There is a reasonable possibility that a bull breakout could be big and fast.

When the is a buy climax, like on the weekly chart, the bears expect a reversal down into a pullback. They therefore continue to short. If the bulls can get a breakout at a time when the weak bears think the odds are beginning to favor them, the bears sometimes give up. This can result in a brief, big rally.

If that happens, the bulls might see it as a gift. If so, they will take profits and wait several week’s before selling again. Strong bears will see it as a great, brief opportunity to sell at an exceptionally high price. With strong bulls and bears selling, there is often a climactic reversal down. Since the weekly chart is in a tight bull channel, the best the bears will probably get is a trading range that lasts a couple of months.

Overnight Emini Globex trading

The Emini is down 3 points in the Globex session. There is no evidence to suggest that the 4 week’s of mostly trading range price action will end today. Because of the bull trend on the daily chart, the odds still favor higher prices.

Yesterday’s setups

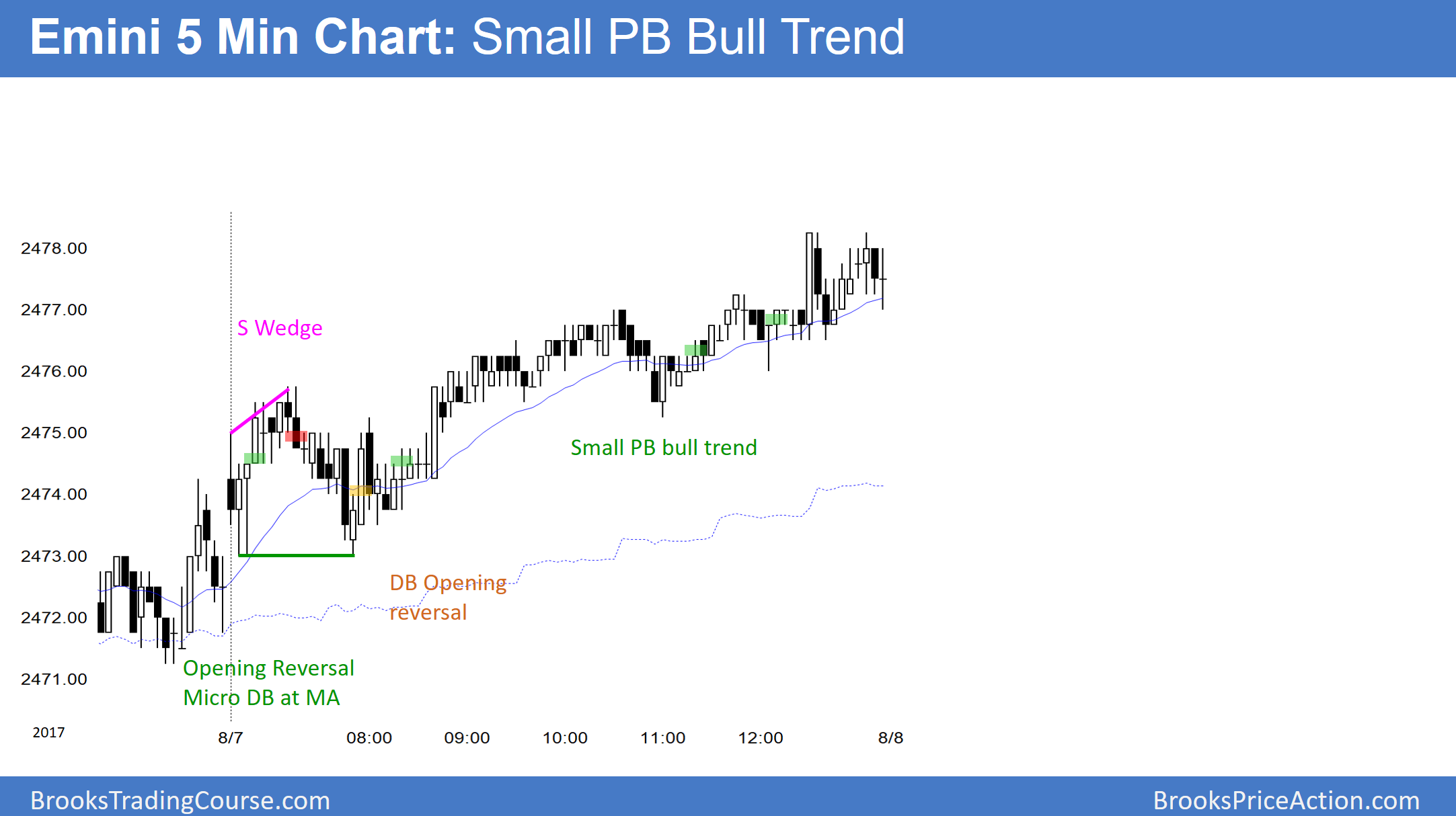

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.