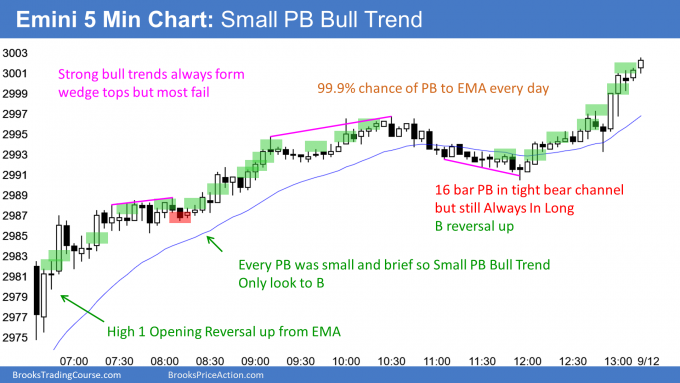

Yesterday was a Small Pullback Bull trend. It broke above the 4-day tight trading range and closed above the 3,000 Big Round Number. The Emini will probably make a new high within a couple weeks and possibly today. The bears need a strong reversal down this week to turn the EMini back to neutral.

Since yesterday was a buy climax, there is a 75% chance of at least a couple hours of sideways to down trading today that begins by the end of the 2nd hour.

Overnight Emini Globex

The Emini is up 7 points in the Globex session. It pulled back from an overnight break above the August high. There is typically selling around a prior high, like the August high and the July all-time high. The bulls who bought around those highs are relieved to be able to exit around breakeven, and many sell out of their longs. Consequently, the Emini might go sideways for a day or two around the July all-time high.Because yesterday was a buy climax, day traders expect some exhaustion. That means trading range trading. Exhausted bulls start to look to buy pullbacks instead of at the market. Once pullbacks begin, the bears sell reversals down for scalps.Can today be a big trend day? The bulls are exhausted and the chart is near resistance. That reduces the chance of a big bull day. The bull channel yesterday was tight and that makes a strong bear day less likely. Today will probably have a lot of trading range price action.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.