Pre-Open Market Analysis

Tuesday’s rally was a spike and the start of a channel. Wednesday completed the channel and evolved into a trading range. There was a late selloff that turned yesterday into a sell signal bar on the daily chart. It is therefore a Low 1 sell setup. Yet, after Wednesday’s big rally, the odds favor more trading range trading today. This is especially true with the possibility of another government shutdown on Friday.

The big selloff was strong enough so that at least a small 2nd leg sideways to down is likely. Yet, the monthly chart is so bullish that the bull trend will resume in 1 – 3 months.

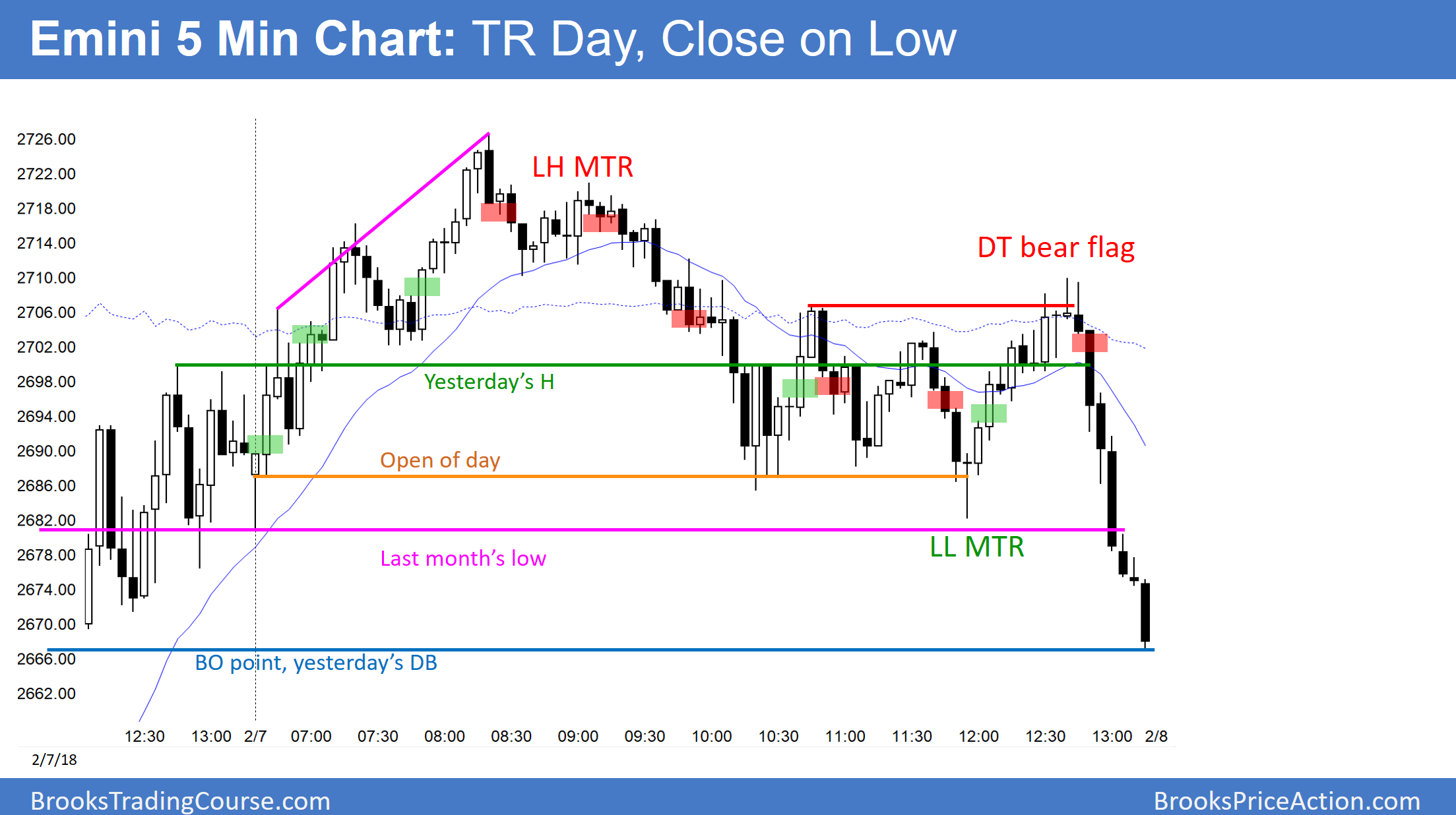

Overnight Emini

The Emini is up 12 points in the Globex session. Since the big reversals over the past few days make a trading range likely, the odds favor at least one swing up and one swing down again today. This is especially true given the uncertainty of tonight’s budget deal.

Because yesterday is a sell signal bar on the daily chart, the odds are today will trade below yesterday’s low. Yet, the Emini is probably going to be sideways for at least a few more days. This means that there will probably be buyers below yesterday’s low.

The most important prices still are the close of 2017, the 20 week EMA, and the January low. All are in the 2770 – 2780 area, and they will be magnets again today. This will continue until there is a strong trend up or down that goes far from this area.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.