Pre-Open Market Analysis

Tuesday was a bad sell signal bar on the daily chart for the micro wedge top. Yesterday gapped down and triggered the sell signal, but then rallied for 4 hours. There was a late selloff but it was a bear trap. The Emini reversed back up to near the high of the day. It is therefore a buy signal bar for today.

However, there will probably be a 1 – 2 week pullback that starts in November. Therefore, the bulls might wait for the pullback before aggressively buying again.

The Emini has been unable to break strongly above 3100. This is disappointing the bulls. If they do not get their breakout soon, they will exit. Their long covering could be the start of a 2 week correction.

Tomorrow is Friday. If the Emini closes above Monday’s open, there will be 6 consecutive bull bars on the weekly chart. That is unusual and therefore extreme. Consequently, there is an increased chance of a selloff to below the open of the week by tomorrow’s close.

Overnight Emini Globex Trading

The Emini is down 7 points in the Globex session. This is despite yesterday being a buy signal bar on the daily chart. Since it has been stalling at 3100 for 5 days, there is an increased chance of more sideways trading again today.The weekly buy climax is getting extreme. There is therefore an increased risk of several bear trend days and a 2 week pullback beginning this month. The bulls might get one more brief new high before the pullback begins, but the bears will likely soon be in control.

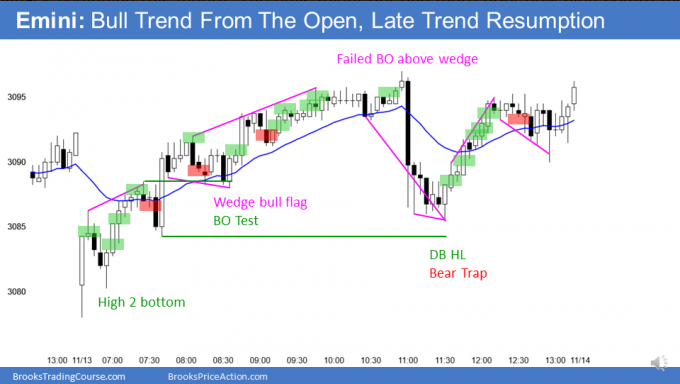

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.