Pre-Open market analysis

This is the start of the 9th week in a strong bull trend. But, 9 consecutive bull bars on the weekly chart is rare. Therefore, either this week or next week will probably have a bear body. Furthermore, there is a parabolic wedge rally on the daily Emini chart. That will probably lead to at least a 2 week pullback.

Because the momentum up is strong, the bulls keep buying. They are trying to break above the October-November-December triple top. With last week closing on its high, this week might gap up. If so, the bulls will try to keep the gap open and continue the rally to above the top.

A pullback has been likely, but it has not yet begun. Therefore, if there is a break above the triple top, it could be big. If there are too many institutions betting on the pullback, they might buy back their shorts in a panic if the bulls get their breakout.

Overnight Emini Globex trading

The Emini is down 8 points in the Globex session. There is a parabolic wedge top on the daily chart. It increases the odds of a 2 – 3 week selloff. This is especially true with the buy climax on the weekly chart.

However, Friday was a bull day closing on its high. Typically a chart has to stop going up before reversing down. Therefore, today will probably not be a big bear day.

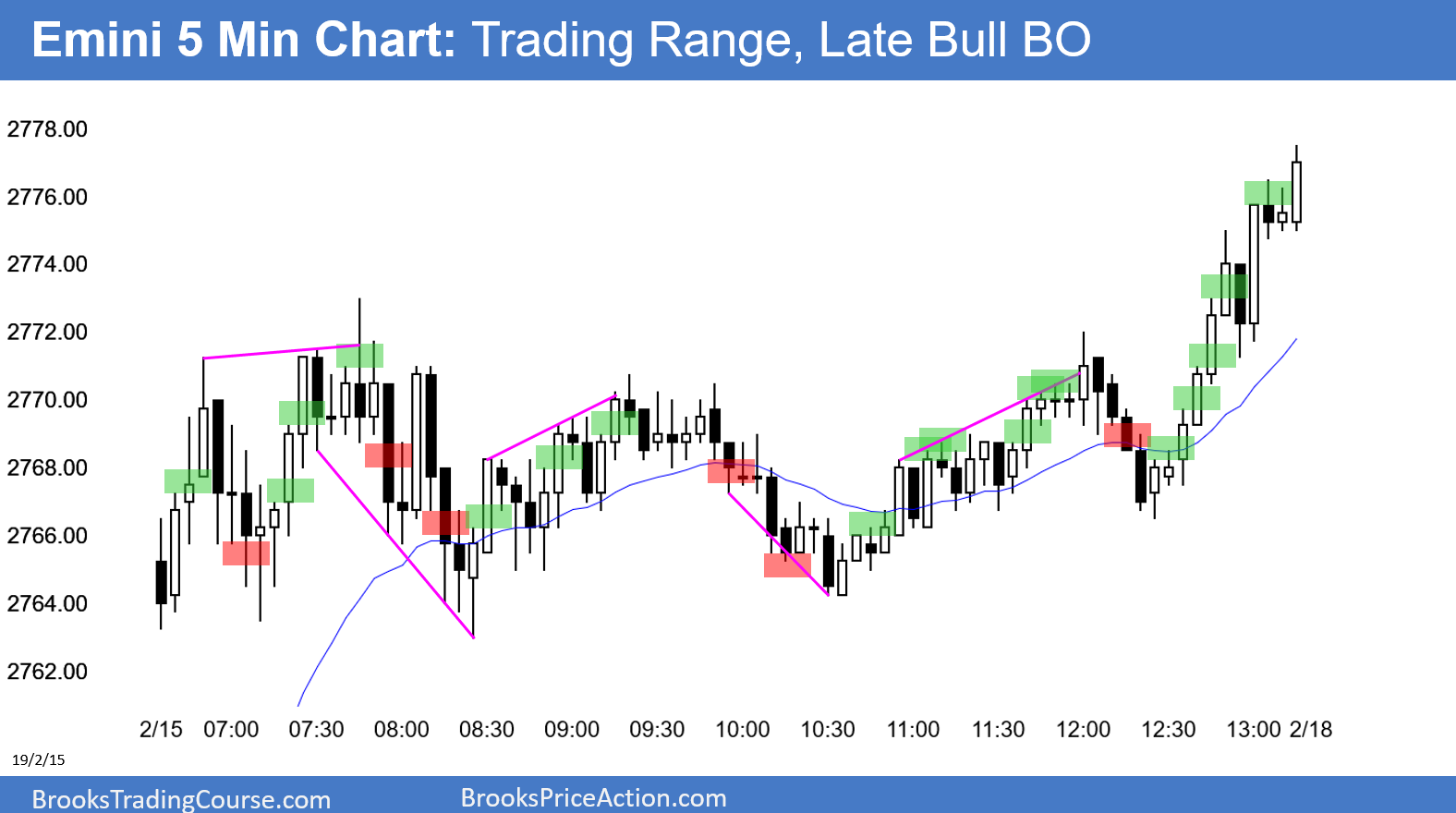

In addition, the past 3 days were mostly sideways on the 5 minute chart. The strong bull trend on the daily chart is losing momentum now that it is near last year’s triple top. As a result, a strong bull day is also unlikely. That makes another mostly sideways day likely.

Because the momentum up is strong and the daily chart is at resistance, there is a small, but real chance of a series of big bull days. Likewise, the buy climax at resistance increases the chance of a dramatic selloff for several weeks.

Neither is likely. But, if either becomes clear, traders should not be in denial. There is the potential for a surprisingly big move up or down within a couple weeks.

Friday’s setups

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.