Pre-Open Market Analysis

Most of the trading over the past 2 days has been sideways. Furthermore, traders are deciding if there will be one more small leg up after the strong bull trend days on Wednesday and Thursday. This uncertainty makes a trading range day likely today, especially after a 2-day buy climax.

Friday was a doji day after the 2-day buy climax. Because the Emini is in the Sell Zone above the December 12 crash high, any reversal down can be the start of a 50% correction. Therefore, there is an increased chance of a bear trend day today. In addition, a 2 – 3 week reversal down will probably begin this month.

After 2 big bull bars, most bears want a micro double top on the daily chart. Therefore, there might be more buyers than sellers below Friday’s low, especially since Friday is a weak sell signal bar.

Overnight Emini Globex Trading

The Emini is down 2 points in the Globex session. Since Friday is a sell signal bar on the daily chart in a buy climax, traders are expecting a transition into at least a small trading range.

A trading range has legs up and down. Therefore, the Emini will probably trade below Friday’s low, or tomorrow will likely trade below today’s low. That pullback would trigger a sell signal on the daily chart. But, the bull trend has been strong and Friday is a weak sell signal bar. Consequently, day traders will look for a reversal up from around Friday’s low. The Emini might go sideways for several days before it begins its 2 – 3 week pullback.

The daily chart is in a buy climax and in the sell zone above the December 12 high. As a result, day traders will be selling reversals down from around Friday’s high. Because of the buy climax, traders expect a 2 – 3 week pullback. That increases the chance of some bear trend days starting this week.

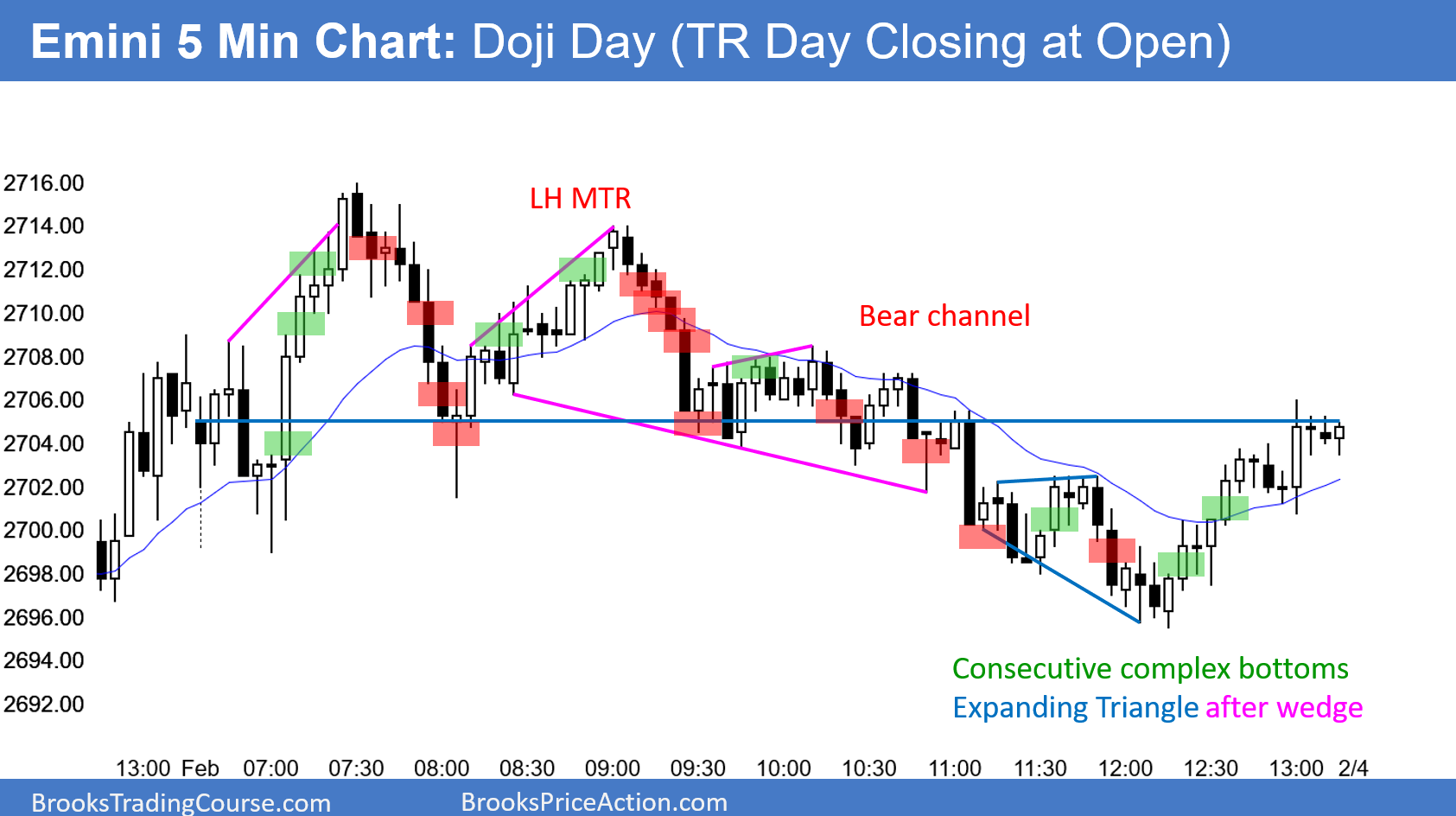

Friday’s Setups

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be always In or nearly always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.