Pre-Open Market Analysis

The 2 dominant forces today are the buy climax on the daily chart and the 11 am FOMC announcement. The daily chart has rallied in a bull micro channel for 8 days. That is unusual and therefore a buy climax. It is coming 3 months into a climactic rally.

Yesterday closed below its low and it is therefore a sell signal bar for today. Today will probably trigger the sell signal by trading below yesterday’s low. However, after 8 bars without a pullback, the 1st reversal down might be minor. It could last just a day or two. The bears might need a micro double top before they can begin a 1 – 2 week leg down.

The Emini has been in a trading range for 16 months. Consequently, the odds are that the breakout above the 2018 triple top at 2825 will fail. A failure does not mean a bear trend. It simply means a temporary end of the rally.

The momentum up has been strong. Therefore, the rally might continue for another week or two before there is at least a 3-week selloff to around the March 8 higher low.

FOMC Announcement At 11 AM PST

The FOMC is the other major force today. It is always a potential major catalyst for a big move up or down. Day traders should exit positions before the 11 am PST announcement and wait for at least 10 minutes after the report before trading again. Then, they should be open to anything.

Since the 60-minute chart has not touched its 20 bar EMA about 50 bars, the odds are that it will get there tomorrow. If it does not reach the target before the report, there will probably be a selloff after the report that gets there.

Overnight Emini Globex Trading

The Emini is up 1 point in the Globex market. Yesterday’s bear trend reversal was exceptionally strong. It might dominate the price action for several days. Day traders should be aware that a lower high could lead to a big swing down. Therefore, if there are 2 – 3 consecutive bear bars, especially if they are big and close near their lows, day traders should try to swing part of their short position.

Day traders should trade normally until about 30 minutes ahead of the 11 am PST report. Then, they have to be careful, and they should exit positions before the report.

In addition, they should wait at least 10 minutes after the report before trading again. This is because there is typically a quick move in the wrong direction within the 1st few minutes. The Emini usually needs at least 10 minutes to establish a trend.

Yesterday’s Setups

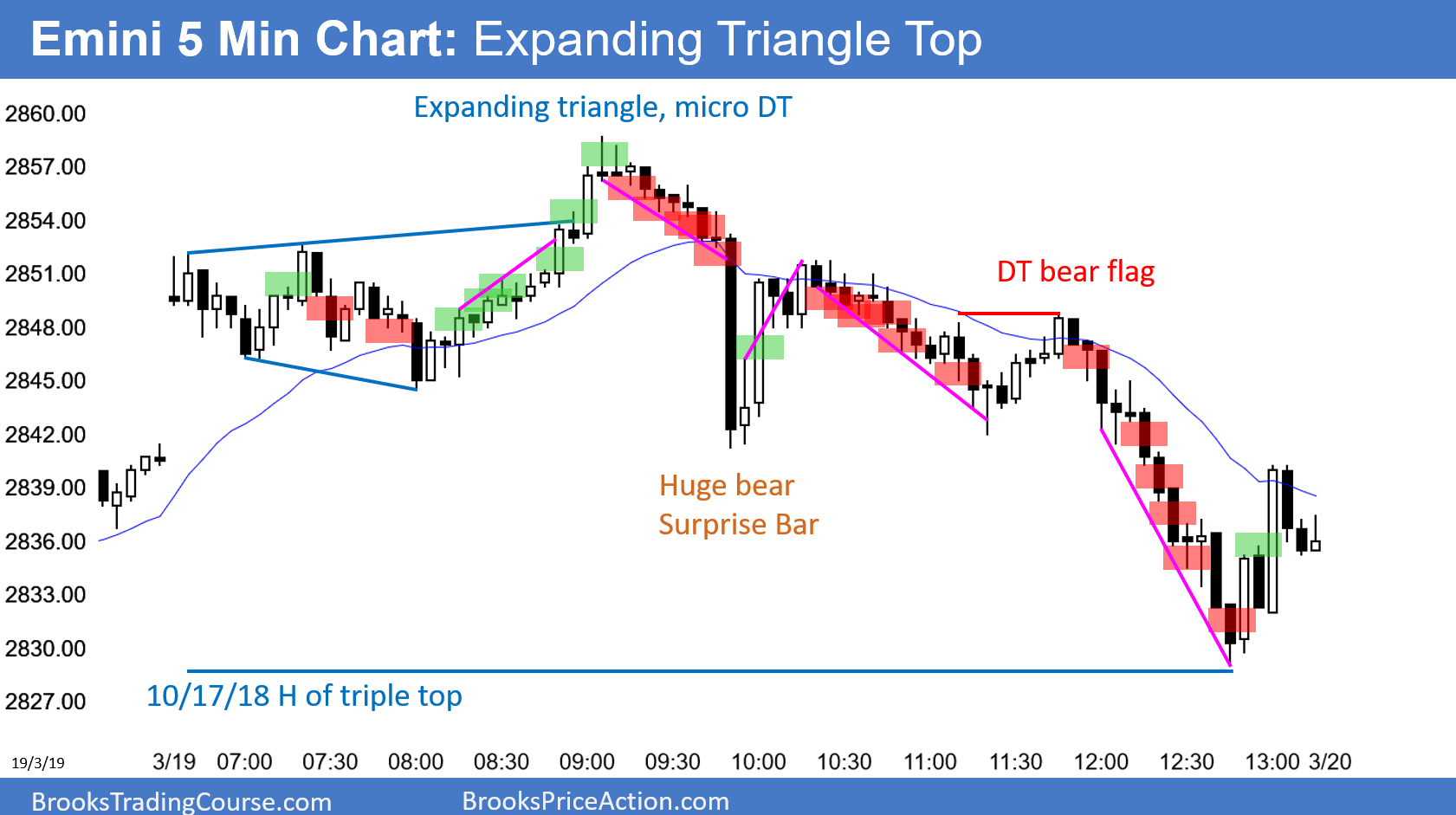

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.