Emini January Effect, Trump Tax-Cut Rally Continuing

I will update around 6:55 a.m.

Pre-Open Market Analysis

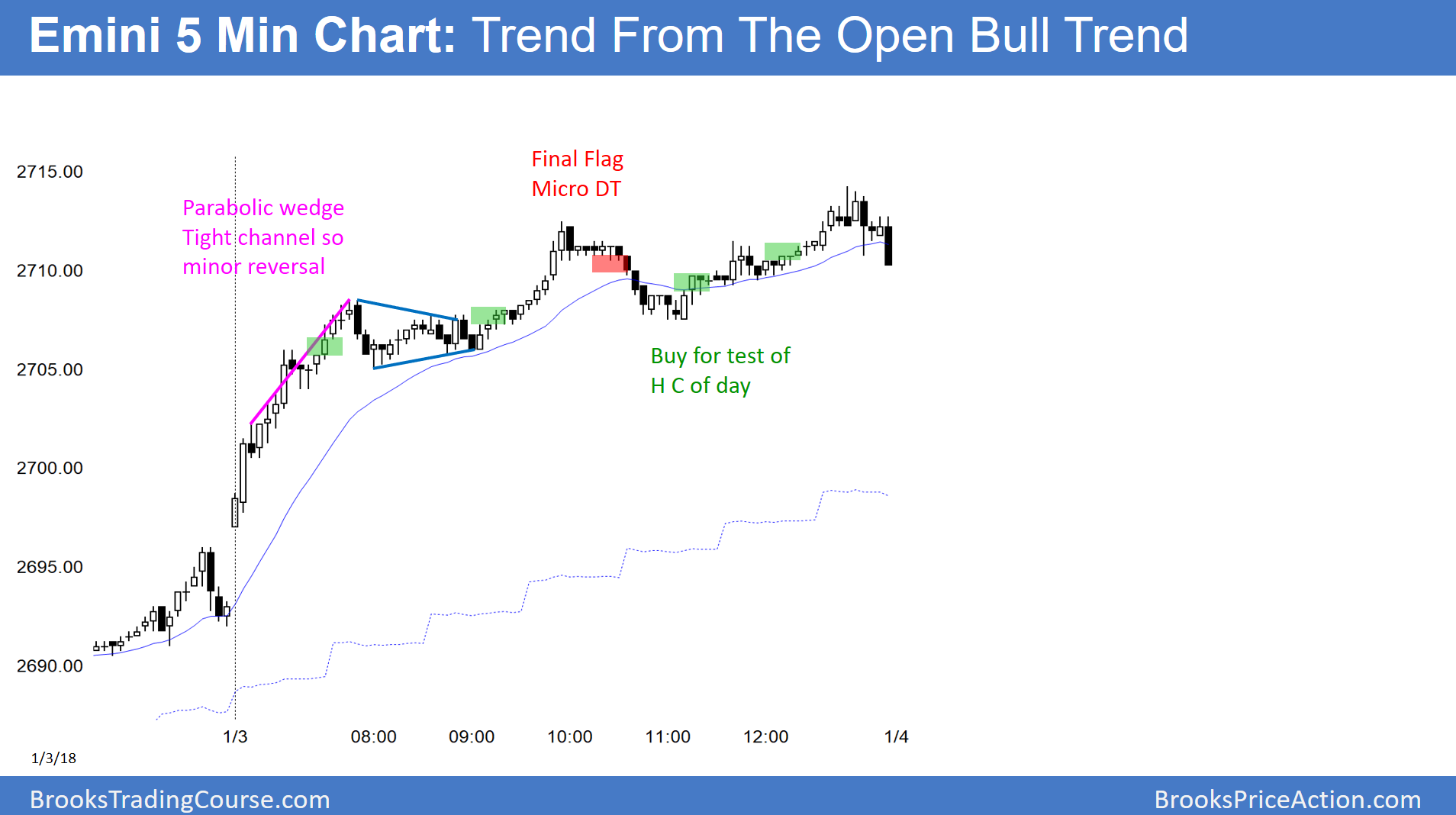

Yesterday was a trend from the open bull trend day for the Emini S&P 500. Because it rallied in a big wedge bull channel, the odds favor a transition into a trading range today. There is still no top on the daily chart, despite the buy climax. Therefore, the odds continue to favor higher prices over the next week or so.

There is often buying in early January after December tax selling. This is the January Effect. However, the tight trading range of the past 3 weeks might be a Final Flag. If so, this 2 day breakout will fail within the next week and get pulled back into the range.

Overnight Emini Globex

The Emini is up 8 points in the Globex session. If it opens here, it will gap up. However, yesterday’s bull channel had 3 legs up. The gap up would be the 4th leg up in the channel. Channels often have 4 – 5 legs before converting into a trading range. There is a 75% chance of a bear break below the bull channel today. In addition, the breakout will probably result in at least 2 – 3 hours of sideways to down trading. The targets for any selloff are the higher lows in the channel that began with the 8 am pullback yesterday.

Even if there is a 10 point reversal in the next day or two, the bears will likely need at least a micro double top. Therefore, the bulls will buy the 1st pullback, limiting the downside risk over the next couple of days.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.