Trump Corporate Tax-Cut Rally Testing 2600 Big Round Number

I will update around 6:55 a.m.

Pre-Open Market Analysis

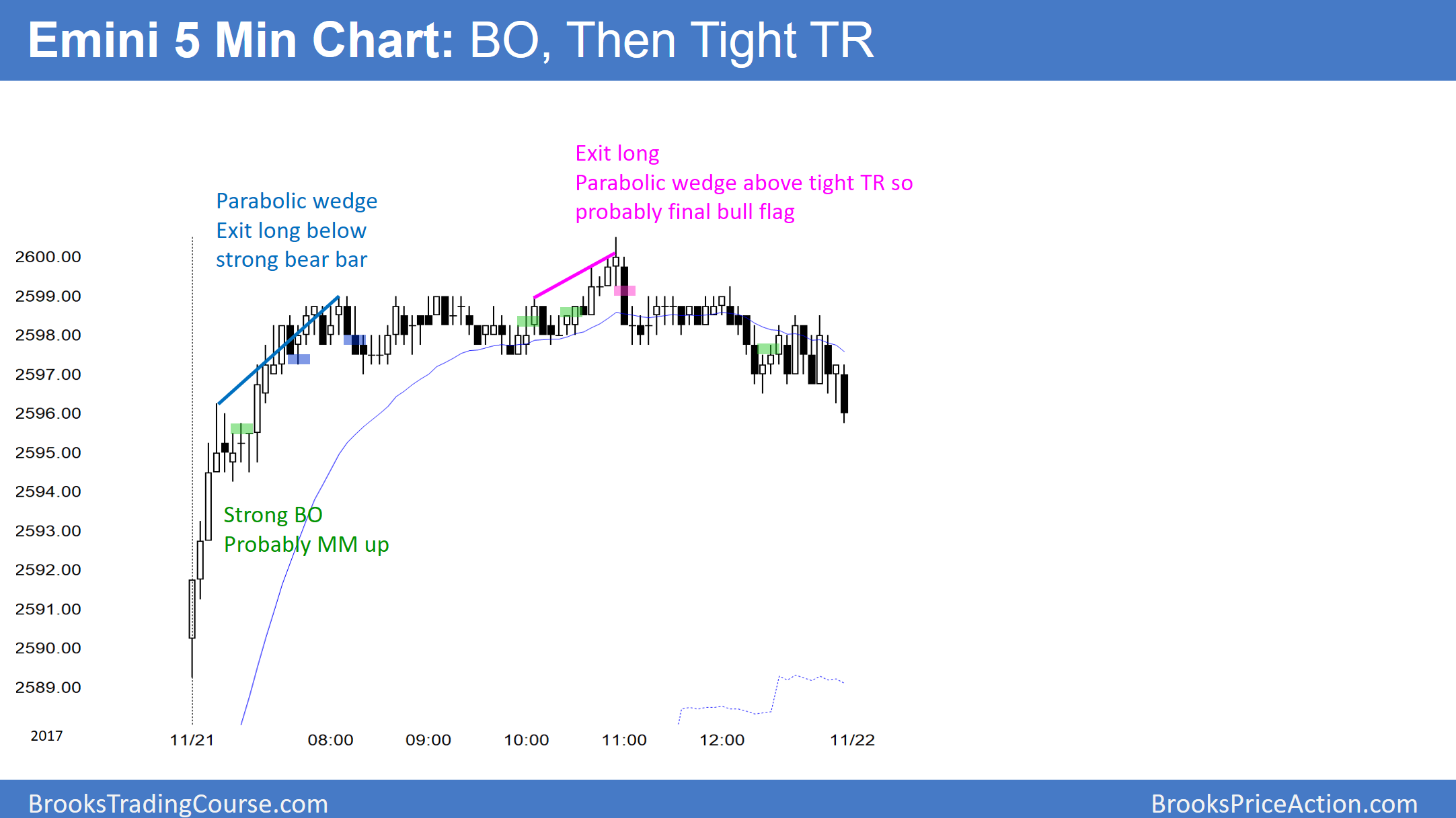

Yesterday was a small pullback bull trend day that broke strongly to a new all-time high. It spent the 2nd half of the day in a tight trading range. The bulls therefore will try to get trend resumption up today. The bears want a major trend reversal. While that is unlikely, if there is a strong reversal down, traders will swing trade their shorts.

Today is also a big travel day for Thanksgiving. Consequently, many traders will be thinking about other things, and the day is more likely to be a quiet day. As a result, yesterday’s tight trading range might continue through today.

When there is a buy climax like yesterday, there is a 50% chance of follow-through buying in the 1st 2 hours. However, there is only a 25% chance of a strong bull trend day. Additionally, there is a 50% chance of at least 2 hours of sideways to down trading that begins by the end of the 2nd hour.

Overnight Emini Globex Trading

The Emini is up 2 points in the Globex session. It will therefor likely open within yesterday’s 6 hour tight trading range. This increases the chances of more trading range trading today. The odds still favor at least a small rally for trend resumption up from yesterday’s strong bull trend. If there is going to be a rally, it will probably begin within the 1st 2 hours.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.