E-mini is down 3 points in the overnight Globex session. The bulls want the market to gap up on the open, triggering the second entry buy on the daily chart. If the market does not gap up on the open, the market will probably have to go above Friday’s high today at a minimum to see if there will be more buyers or sellers above.

Today will be important to see how the market will react to Friday’s high. If the bulls can get a strong rally and close above Friday’s high, that will increase the market’s odds to go higher. Today will probably be disappointing for the bulls, which would further traders’ expectation of a trading range on the daily chart. Monday’s two very important price levels will be the open of the day and last Friday’s high (4426).

Bulls Want To Trigger Friday's Buy

The bulls had a low 1 short trigger on Friday; however, Friday closed on its high, setting up a reasonable second entry buy setup on the daily chart following last week’s selloff. The bulls are hopeful that Monday will gap up, triggering the second entry buy, and the market will begin to rally back to the all-time high.

More likely, the market is evolving into a tight trading range, and both the bulls and the bears will be disappointed in the upcoming days. The bulls have a strong buy signal bar with Friday’s close; however, it is in a 4 bar tight trading range which lowers the probability for the bulls. And since Friday’s buy signal bar was big, bulls may look to buy a 50% pullback of the bar, just like bulls did on the Jan. 24 buy signal bar.

While Friday’s signal bar is not great for the bulls, there are still several magnets above that the market will likely have to reach in the next week or two. Two obvious magnets are the December lows and the 4600 round number. Bulls bought the December lows, confident those traders could scale in lower and look to take profits back at the December lows.

The bear selloff to the October lows is strong enough for a second leg down, so the odds are the first reversal up will be minor, leading to a bear flag or a trading range. As strong as the selloff was in January, traders still see the market as either a bull trend or a trading range, not a bear trend. For traders to conclude a bear trend is underway, the price has to begin forming lower highs and lower lows. This means that the bears will look to sell some major trend reversal setup in the form of a lower high.

Since a trading range is likely, it is important to remember that the pullback might retrace 66% of the January rally. This would give the bears a great risk-reward.

The bulls are hopeful that this past Friday is the start of a bull breakout above a bear flag, or that the pullback from the Jan. 25 selloff will lead to an endless pullback and form a small pullback bull trend. Currently, the odds are that the market will test the December lows, and the bears will look to sell a rally for a second leg sideways to down.

The most important thing to remember is that the market is forming a tight trading range between the December and October 2021 lows, so traders should begin to expect more confusion and disappointment.

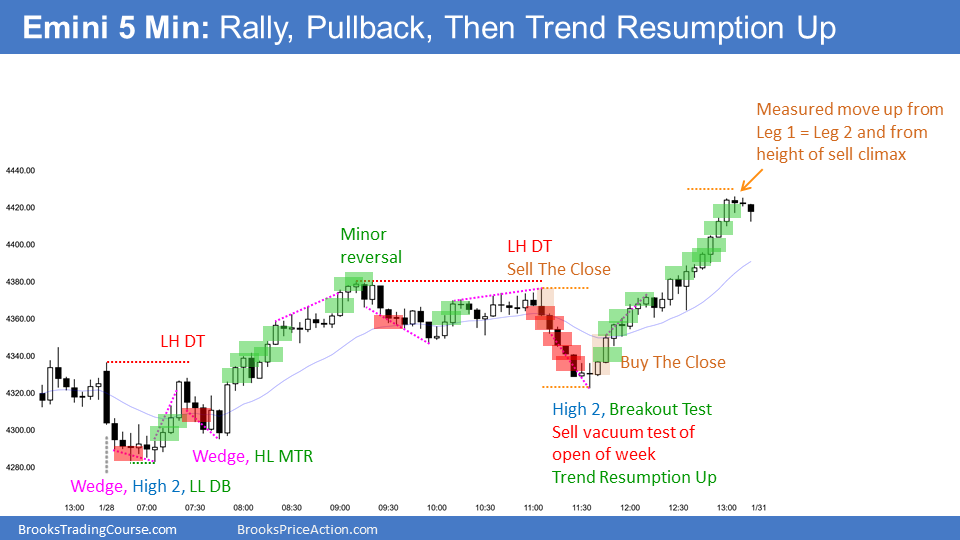

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro E-mini.