New Low In Year-Long Bear Channel

In June, the EUR/USD weekly Forex chart had its strongest bear rally since September. However, this week broke to a new low, resuming the yearlong bear channel. Every breakout to a new low over the past year reversed up within about a week. Traders should therefore expect the same this time.

The legs up and down over the past year have all lasted at least a couple weeks. Furthermore, they were around 200 – 300 pips tall. Consequently, traders should expect a reversal up within a couple weeks. They might be waiting for Wednesday’s FOMC announcement.

Bear Channels Do Not Last Forever

While reversals have been reliable for the past year, nothing lasts forever. Traders know that there will a bull or bear breakout at some point. For the past year, I have consistently said that until there is a strong breakout, traders should continue to bet on reversals. Nothing has changed.

The bears are hoping for a successful breakout below the bear channel. That happens 25% of the time. But if the bears begin to get 2 or more big bear bars closing below this week’s low, traders will conclude that there will be a swing down.

There are 2 other possibilities. If there is going to be a breakout of the channel, there is a 75% chance of a bull breakout above a bear channel. Traders should think of a bear channel as a bull flag.

Channels Often Spend A Lot Of Time In Trading Ranges

The final possibility is that a channel begins to go sideways. This one has been sideways for 5 months.

Once the bears stop getting lower lows, the pattern is a trading range. At that point, the probabilities shift. Instead of the odds favoring a bull breakout, the chance of a bear breakout increases to the same as for a bull breakout.

A trading range is a Breakout Mode pattern. There is always both a buy and a sell setup within a trading range. The bulls and bears have an equal chance of a successful breakout.

Channels often spend a lot of time in trading ranges. But as long as a bear channel keeps forming new lows, the bear trend is still in effect. That is currently the case after this week’s new low.

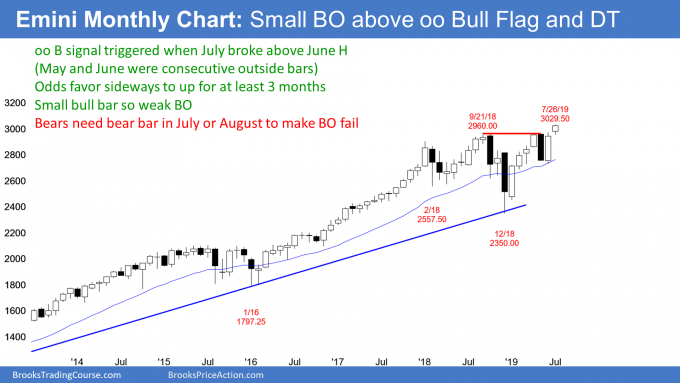

Monthly S&P500 Emini futures chart:

Weak oo buy signal above September/May double top

The monthly S&P500 Emini futures chart has 3 trading days left in July. July so far is a small bull trend bar. That is disappointing for the bulls, who wanted a big breakout above the September/May double top.

May traded above the April high and then below the April low. May was therefore an outside down month. June was an outside up month. When there are consecutive outside bars in a bull trend and the 2nd one is up, those bars form an oo (outside-outside) bull flag.

If the next month goes above the high, it triggers a buy signal. There is then a 60% chance of at least 3 more sideways to up bars. Consequently, traders should expect sideways to up trading for at least into September.

When I say sideways to up, that allows for a pullback. For example, July is a small month. The bears would not need much selling for August to trade below the July low. That would be a pullback. But since the Emini should trade sideways to up through September, traders will be more willing to buy than sell below the July low.

Weekly S&P500 Emini futures chart:

8 week bull micro channel is losing momentum

The weekly S&P500 Emini futures chart had a bull bar this week. Its low was above last week’s low and its high was barely last week’s high. It is now the 3rd consecutive sideways bar so there is now a 3 bar tight trading range.

A tight trading range is a relatively neutral pattern and it is both a buy signal and a sell signal. Because this week had a bull body, it closed near its high, and it is in a strong bull trend, it is a more reliable buy signal bar. Next week is more likely to go above this week’s high than below its low.

However, last week was a big bear bar and 2 of the prior 3 weeks were dojis. The bull trend is losing momentum. There will probably be sellers not far above the high.

Because the 2 month rally is strong and this week had a bull body, it is a weak sell setup. Traders will buy not far below.

If this week is both a weak buy and sell setup, what will happen over the next couple of weeks? Traders should expect that if the Emini goes up, it will soon reverse down. If it goes down, it will probably reverse up. The 2 month rally will likely transition into a trading range within a few weeks.

8 week bull micro channel is a buy climax

This week was another bar with a low above the low of the prior week. This is therefore the 8th week in a bull micro channel. That is getting extreme. Extreme means unsustainable and climactic. This increases the chance of a pullback within the next couple weeks.

A pullback simply means that the low of the week falls below the low of the prior week. An 8 week bull micro channel is climactic, but it also represents eager bulls. They have been willing to buy above the prior week’s low for 2 months. Many bulls will be eager to buy below the prior week’s low once they finally have the opportunity.

Consequently, the 1st pullback will probably only last 1 – 3 weeks. This means it will be a minor reversal and not a major trend reversal into a bear trend. It will form a bull flag. Traders expect that the bull trend would then soon resume.

If there is then a new high and another reversal down, there would be a higher probability of a deeper pullback and one lasting longer. Second signals are more reliable. But since there is an upward bias on the monthly chart into September, the downside risk is still small.

Expanding triangle top on weekly and monthly charts

The bulls have a problem with their strong 2019 bull trend. Look the collapse after the sharp rally in January 2018. Next, there was a strong reversal up from the February low. There was another collapse from the new high in May 2018. It fell to below the February 2018 low. But the bulls bought it aggressively and the Emini is now above the May/September double top.

Do you see the pattern? The Emini is forming a series of higher highs and lower lows. This is an expanding triangle and it is present on the monthly chart as well. Each of the past 4 strong trends up and down reversed.

Will this time be different? Probably not. Traders should therefore expect a significant reversal down from above the May high. The rally is now at the top of the expanding triangle. That is the line drawn across the January 2018 and May 2018 highs. It currently is around 3040.

How far down can the Emini fall this year?

The reversal down will likely come from a failed breakout above the line at the top of the expanding triangle. In the S&P500, traders like to talk about 1 – 2% overshoots. That means the top of the rally from December will probably be around 3050 – 3150 before there is another strong reversal down.

Can the reversal continue down to below the December low? There is currently only a 30% chance of that in 2019. The bears have a 50% chance of a retracement of about half of the rally from the December low within a year. That makes the June low around 2700 a reasonable target.

At some point, an expanding triangle evolves into some other pattern. Most often, it becomes an ordinary trading range (remember, triangles are trading ranges that either expand or, more often, contract).

The Fed will probably cut interest rates at Wednesday’s FOMC meeting

What happens if the Fed cuts interest rates? Nobody knows. We will find out if more dollars buy or sell the news.

Since the upside over the next few weeks is small, a strong rally will soon reverse. Because the weekly chart has been in a micro channel for 8 weeks, the bears will probably only get a minor reversal down.

With limited upside and downside for a few weeks, the Emini will probably enter a trading range for several weeks. The bottom of the range might be around 2900. The top could be this week’s high or a little higher.

Daily S&P500 Emini futures chart:

Double top ahead of Fed interest rate cut

The daily S&P500 Emini futures chart this week traded slightly above last week’s high. If it reverses down next week, traders will see this week’s rally as forming a slightly higher double top with last week’s high. The neck line of the double top is last week’s low. Traders expect a break below the neck line to lead to a measured move down.

Parabolic wedge buy climax

There is another problem for the bulls. When there are 3 or more legs up in a tight bull channel, there is a parabolic wedge buy climax. June 11 was the 1st of 5 legs up in a tight bull channel. A buy climax at some point attracts profit takers. After 5 leg up, they will probably take some profits soon.

Once the bulls take profits, they will not immediately buy again. Traders typically look for at least 2 legs and 10 bars sideways to down. If the bears fail to get a strong reversal down by then, the bulls will again look for buy setups.

When there is a reversal down from any wedge, the 1st target is the bottom of the most recent leg up. That is the July 9 low of 2965.75. More often, the profit-taking gets to around the start of the wedge. Most computers see that as either the June 12 or June 26 lows, which are around 2900. Traders therefore should expect a 2 – 3 week selloff down to around 2900 beginning within a few weeks.

Market Overview: Weekend Market Update

The Emini has an 8 week bull micro channel on the weekly chart ahead of Wednesday’s FOMC meeting. This is a buy climax and makes a pullback likely within a couple weeks.

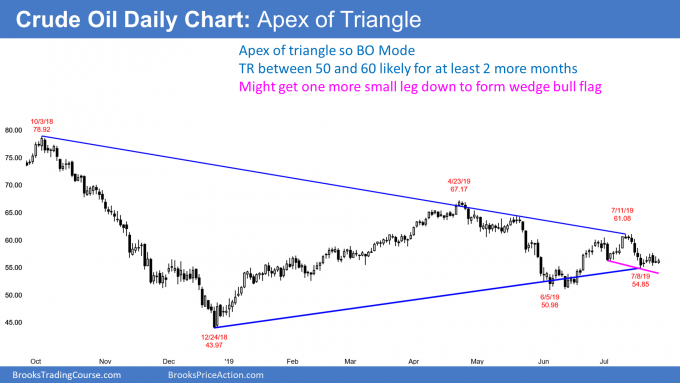

Crude oil is at the apex of a 9 month triangle. It might have to fall below last week’s low before testing 60 again.

The EURUSD weekly Forex chart broke below the May low this week. Consequently, the 5 week trading range ended and the bear trend has resumed. However, every leg up and down over the past year reversed, and that is likely this time as well.

Crude oil Futures market:

Month-long triangle in middle of 3 year trading range

The crude oil futures has been in a trading range for more than 3 years. Since October 2018, it has 2 lower highs and 2 higher lows. A contracting trading range with 5 or more legs is a triangle, which is a Breakout Mode pattern. Traders believe that the odds of a successful bull breakout are about the same as for a successful bear breakout. A successful breakout is one that has at least a couple legs and lasts 10 or more bars.

When a market is in Breakout Mode, there is a 50% chance that the 1st breakout up or down will fail and reverse.

The daily chart has been sideways for 7 days. Traders are deciding if the 3rd leg down is complete, or if there will be one more push down for a few days.

If there is and there is then a reversal up, there would also be a wedge bottom with the July 3 and July 19 lows. That would increase the chance of a rally back up to the July high and $60 over the following couple weeks.

Middle of 3 year trading range

I have been writing all year that 2019 would enter a trading range within the big 3 year trading range. This is because there was a big rally until October 2018 and then a big selloff until December 2018. Big Up, Big Down creates Big Confusion.

When traders are confused, they are confident of only one thing. They do not believe any move up or down will get far. They therefore look for reversals and take quick profits. When traders buy low, sell high, and take quick profits, their trading creates a trading range.

Reversals within a range are often not clear. When that is the case, traders like to see 2nd signals. For example, there was a double bottom in June. In July, there was a higher high double top, and the 2nd leg up also had a micro double top.

Tight trading range is a Limit Order Market

The past 7 days have been in a tight trading range. That means traders are buying near the prior day’s low and selling near the prior day’s high.

This is a Limit Order Market, which is bad for stop order traders. It is usually better to wait for a strong breakout up or down and then enter in the direction of the breakout.

Alternatively, wait for a breakout up or down that reverses, and enter in the direction of the reversal. This is what traders should expect for at least another week.

EURUSD weekly Forex chart: