Pre-Open Market Analysis

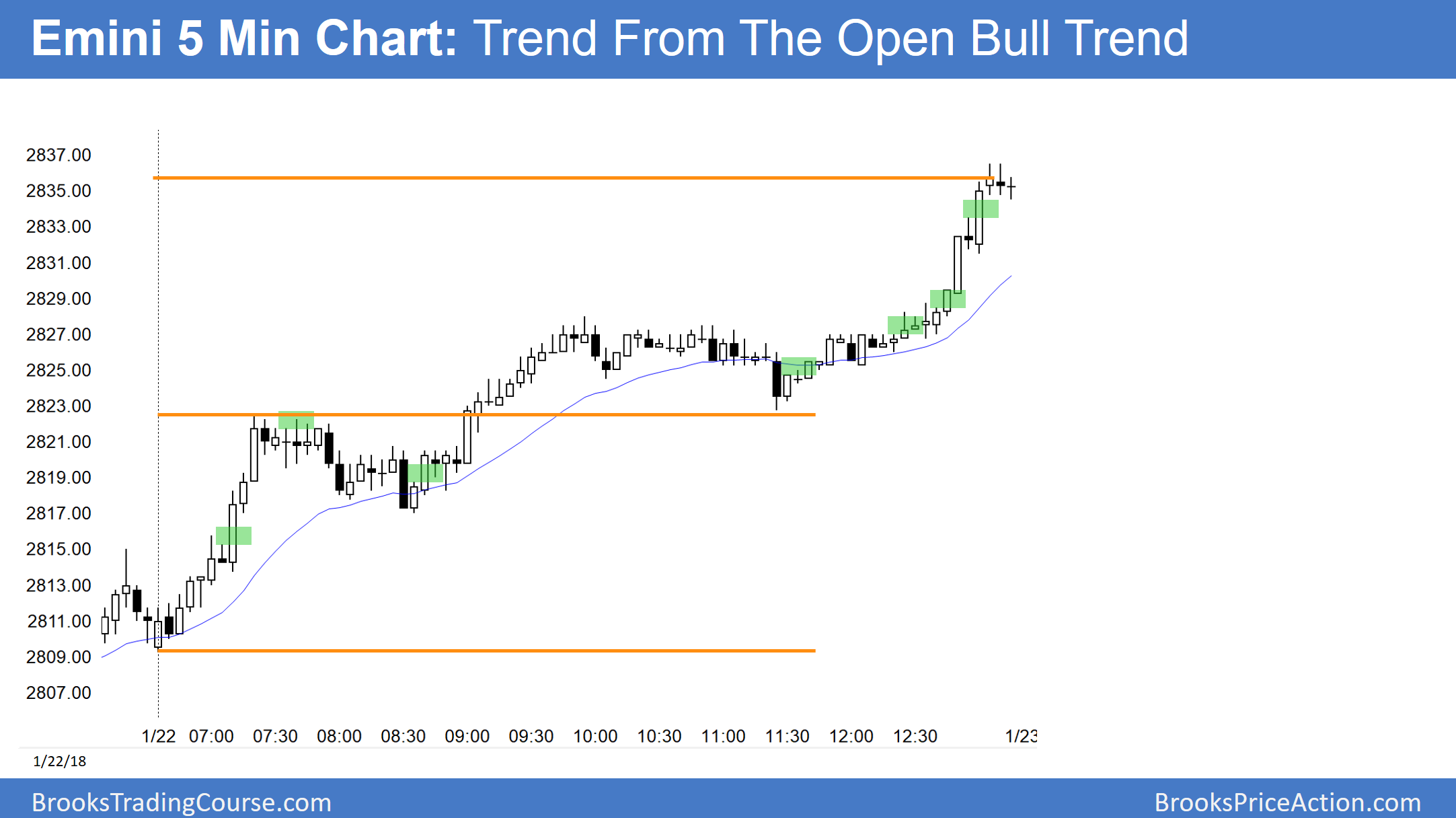

Yesterday broke strongly above a wedge top on the 60-minute chart. The measured move up is around 2860. It was a Trend From The Open bull trend, and and finished the day with 3 pushes up on the 5-minute chart. This is therefore a wedge rally on the 5-minute chart. However, the final leg up was strong. Hence, the bears will probably need at least a micro double top before they can create a swing down.

Last week had a big tail on the bottom of the bar on the weekly chart. That is a pause after a 2-week buy climax. The pause might continue this week. If so, this week will also close near its open. Since it is currently a bull trend bar, there is an increased chance of a reversal down in the 2nd half of the week.

If instead this week closes on its high, it will be a consecutive buy climax with the 2-week rally from the week before last. That would increase the chance of a 2-bar reversal on the weekly chart. This means there would be an increased chance of a reversal down next week.

Despite the buy climaxes on all higher time frames, the bull trends are exceptionally strong. Consequently, there is a 70% chance that the bulls will buy the 1st reversal down. This is true even if it is climactic and big. Therefore, the odds are that any reversal down over the next few months will be a bull flag. This means that it would lead to a test back up to the all-time high.

Overnight Emini Globex Trading

The Emini is down 1 point in the Globex market. The rally into yesterday’s close increases the chance of at least a small 2nd leg up before there is a swing down. Yet, it was climactic. Therefore, there is a 50% chance of at least 2 hours of sideways to down trading beginning by the end of the 2nd hour.

As strong as yesterday was, it was extreme. This means that there is only a 25% chance of another very strong bull trend day today.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.