Pre-Open Market Analysis

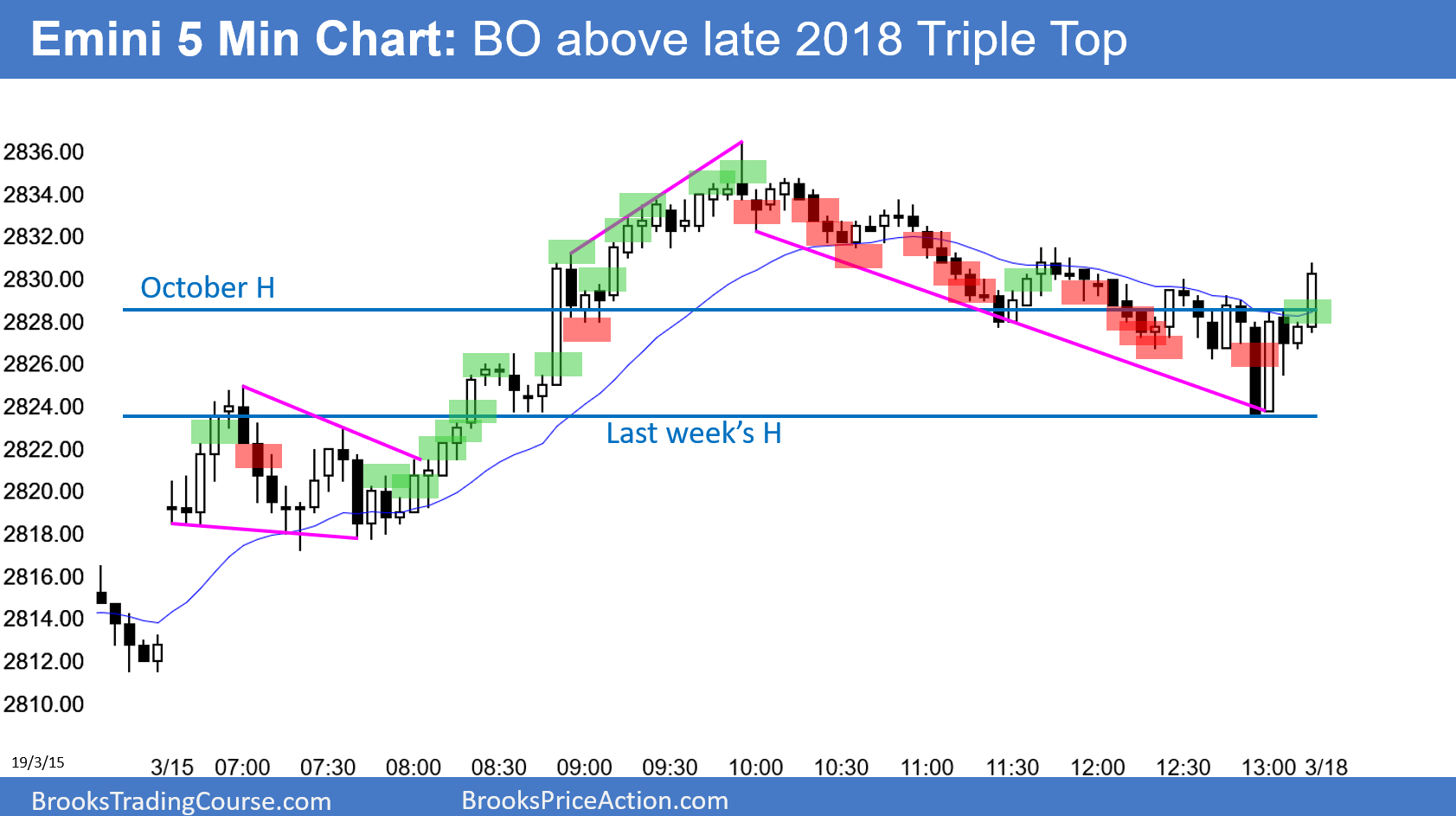

Friday's Emini S&P 500 broke above the top of the October-November-December triple top. It was therefore a new 6-month high.

However, the daily chart has been in a trading range for 16 months. Most breakouts fail. The next target for the bulls is the all-time high, which is far above.

The 3-month rally has been unusually strong with only a 2-week pullback. That is typically not enough to rest exhausted bulls. Therefore, the breakout will probably pull back more within a couple of weeks.

Many bulls will want several more weeks of sideways to down trading to be certain that there are not enough strong bears to create a lower high major trend reversal on the weekly chart. If there is no strong selloff after a few weeks, the bulls will buy again and try for a new all-time high.

The Bulls Need Follow-Through Buying

Will the bulls get follow-through buying today? The odds are against a strong bull trend day because the next target, the all-time high, is probably out of reach without more of a pullback. If there is follow-through buying, it will probably be limited to a few days. Also, after Friday’s buy climax, today will probably have at least a couple hours of sideways to down trading.

The bears who gave up on the breakout above the October high will sell again soon. They want to make the breakout fail.

The bar after a breakout is always important. If the bears can create a strong bear bar today, today would be a sell signal bar for tomorrow. Traders will wonder if the breakout will fail and reverse down. There is therefore an increased chance of a bear day today. Most likely, today will be neutral.

Risk Of Blow-Off Top

The pain trade is still up. Because a pullback from above the 2825 resistance is likely, traders are beginning to position themselves for one. The bulls will start to take profits and the bears will short.

When that is the case, if the Emini does not turn down, both the bulls and bears will buy. This is because the bulls will be trapped out and the bears will be trapped in. They might do so in a panic. That increases the chances of a surprisingly big bull trend day this week. A Surprise Bar late in a bull trend is more likely to be an exhaustive buy climax than the start of a measured move up.

Overnight Emini Globex Trading

The Emini is up 1 point in the Globex session. While Friday broke above important resistance, the daily chart is still in a yearlong trading range. Traders should expect breakouts to fail, even when the rally has been exceptionally strong.

Consequently, there will likely be another pullback beginning within a couple of weeks. In addition, it will probably be deeper than the one that ended last week. That means that there is a growing chance of bear trend days.

However, the daily chart has rallied strongly for 3 months. Most days therefore have closed above their open and many were strong bull trend days. In a bull trend, bull days are more likely than bear days. Day traders are continuing to buy selloffs.

With the Emini going sideways for 5 hours after breaking above the October high on Friday, the odds are that today will be mostly sideways as well. However, the chart is at a very important price. As a result, there is an increased chance of a big trend day up or down.

Also, even if today is a trading range day, the legs will probably last at least a couple hours, which is long enough for swing trades.

Friday’s Setups

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.