Pre-Open Market Analysis

The Emini has been in a Small Pullback Bull Trend for 4 months. That is a strong bull trend and the bulls have bought every 1 – 3 day selloff. Consequently, the downside risk is small.

Yesterday again failed to break above the 3,300 Big Round Number. However, the late rally makes it likely that the bulls will try again today. Today might even gap above that resistance.

Can today be the start of a 2 – 3 week selloff? Probably not. After a strong rally, the bears typically need at least a micro double top before they can get a swing down. Therefore, the best the bears can probably get is a brief pullback over the next few days.

Overnight Emini Globex Trading

The Emini is up 11 points in the Globex session. Since it is above the 3,300 Big Round Number, it might gap above it today.The bulls want a gap up and they want the gap to stay open. If there is a gap up above major resistance, there is an increased chance of a trend day up or down. Because the bull trend is so strong on the daily chart, if there is a trend, up is more likely than down.It is important to remember that the rally on the daily chart is extremely strong. That means it is a buy climax. A buy climax sometimes attracts profit-takers. If many bulls take profits, the Emini could sell off strongly for 2 – 3 weeks.There is no sign of this at the moment. Traders therefore are continuing to buy, knowing that markets have inertia. They tend to continue to do what they have been doing. The Emini has been going up and traders will bet on this continuing until it clearly is not.Yesterday’s Setups

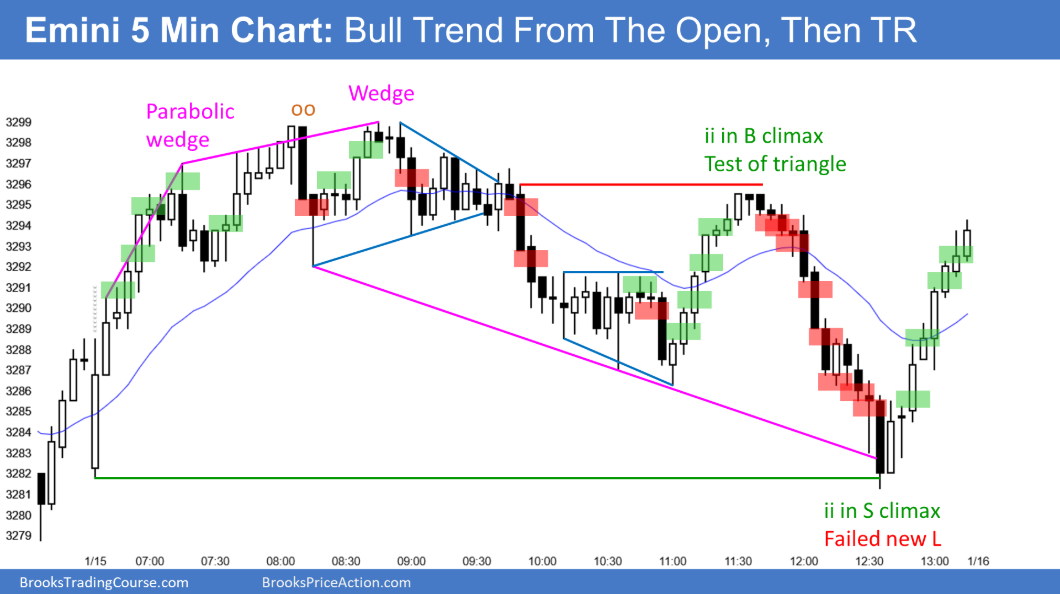

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.