Pre-Open market analysis

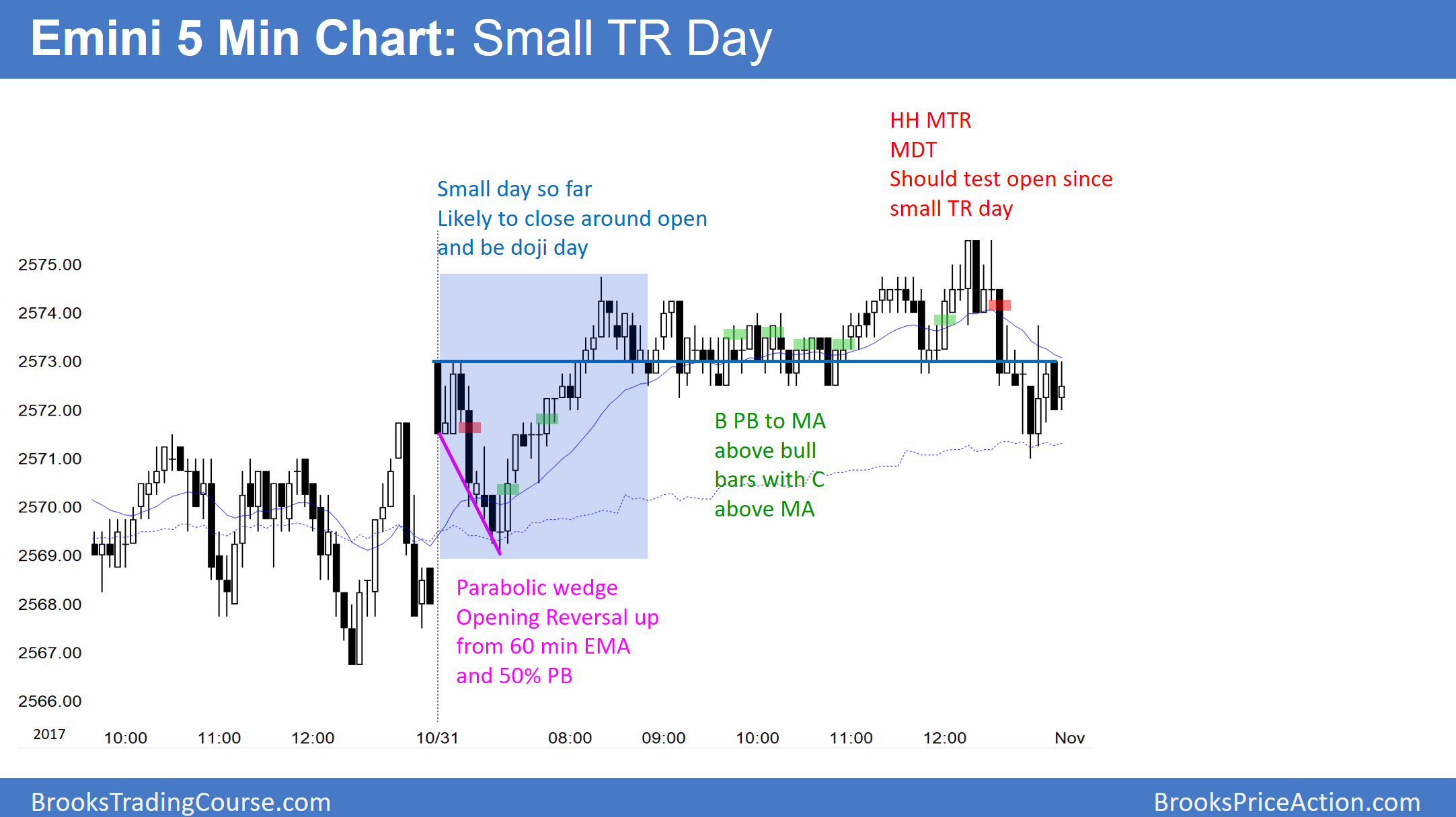

Today was inside yesterday, which was inside Friday’s range. This is consecutive inside bars (an ii Breakout Mode pattern). Both days were also dojis, and therefore even more neutral, awaiting the breakout after tomorrow’s 11 a.m. report.

The Emini rallied strongly last week, but pulled back for the past couple of days. Since the daily, weekly, and monthly charts are in bull trends, the odds continue to favor higher prices. However, all 3 higher time frames have the most extreme buy climaxes in the past 50 years. Therefore, the odds favor at least a 5% correction beginning in the next couple of months. But, trend have inertia and are always trying to reverse. The odds are that all reversals will continue to fail. Until there is a strong bear reversal with strong follow-through selling, the odds continue to favor at least slightly higher prices.

Since there is an FOMC interest rate announcement at 11 a.m., there is an increased chance of a trading range into the report. In addition, the odds favor a breakout after the report. The initial breakout after the report fails 50% of the time. Therefore traders should wait at least 10 minutes before entering after the report.

Overnight Emini Globex trading

The Emini is up 9 points in the Globex market. It will therefore probably gap up to a new all-time high. The bulls want a measured move up based on the height of the 40 point height of the 2 week trading range. However, the bears want a reversal down. If the bears get a reversal down today or tomorrow, it would create a wedge top in the buy climax. While that is a reasonable sell setup, most reversals in strong trends fail. Consequently, the odds continue to favor higher prices until there is a strong reversal down and consecutive big bear bars on the daily chart.

Since the 11 a.m FOMC announcement usually leads to a big move, all financial markets usually try to get neutral before the report. That means that the Emini will probably enter a trading range after around 9 a.m. However, when there is a big gap up on the open, there is an increased chance of a big trend for the 1st 2 hours. In addition, the odds are slightly greater that it will be in the direction of the gap. That means that there is an increased chance of a trend, and a bull trend is slightly more likely.

Trends can either begin on the 1st bar or after a trading range. If the Emini enters a trading range for an hour or so, traders will look for a wedge top or double top to sell or a wedge bull flag or double bottom bear the 5 minute moving average to buy. These are reliable swing setups that are common when there is a big gap up, but no immediate trend up or reversal down.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.