Investing.com’s stocks of the week

Pre-Open Market Analysis

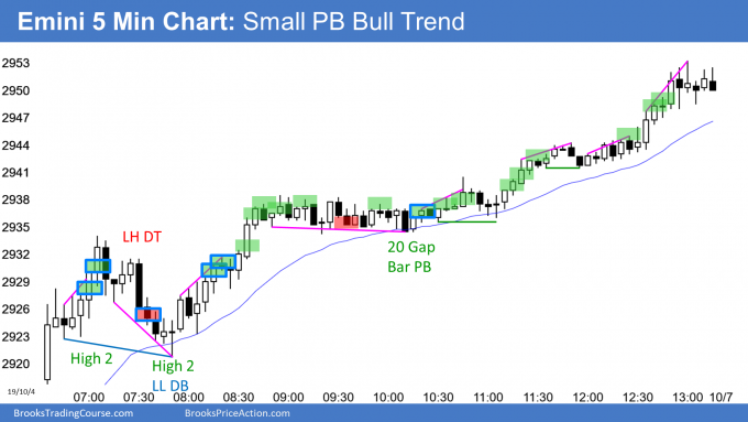

The Emini sold off strongly below the top of the August ledge last week. It then reversed up strongly, as it often does after an October selloff. The bull trend reversal had 2 big bull bars closing near their highs. That means the selloff was a bear trap. A bear trap typically has at least a small 2nd leg sideways to up. Consequently, the bulls will look to buy the 1st – 3 day pullback.

Furthermore, a reversal up from a sell climax usually tests the top of the sell climax. Therefore, last Tuesday’s high of 2994.00 is a magnet above.

Overnight Emini Globex Trading

The Emini is down 8 points in the Globex session. Since Friday was a buy climax, there is only a 25% chance of another strong bull day today. Day traders should expect at least a couple hours of sideways to down trading that begins by the end of the 2nd hour.Friday’s high was just above the 2946.00 top of the August ledge on the daily and weekly charts. Since that is such an important price, there is an increased chance of the Emini oscillating around it for a few days. This is especially true after a climactic 2-day rally.Friday’s Setups