Investing.com’s stocks of the week

Pre-Open market analysis

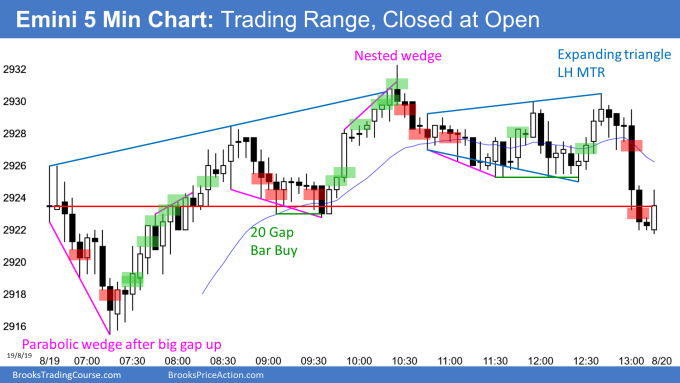

The Emini gapped up and rallied for the 1st half of the day. But there was a lot of trading range price action and the day closed exactly at the open. This formed a perfect doji bar on the daily chart and a sign of neutrality.The Emini is near the top of a 2 week trading range. Also, the August selloff was strong enough to have at least a small 2nd leg down. Consequently, this rally will probably test below 2800 before making a new all-time high. It is, therefore, a bear rally.Overnight Emini Globex trading

The Emini is up 3 points in the Globex session. While the momentum up over the past 3 days has been good, the Emini is near the top of its 2 week trading range and at the resistance of the 20 day EMA. Furthermore, yesterday was neutral. The bulls are losing momentum. Finally, this rally is probably only a bull leg in a developing 3 week range and not a resumption of the June/July bull trend.

Traders will begin to look for sell setups within a week or so. However, trading ranges often break through support and resistance before reversing. As a result, the rally might have to go above last week’s high before the bears take control again.

The momentum up favors the bulls, but the location favors the bears. This creates uncertainty and it will likely result in more sideways trading today and possibly for several days.

Yesterday’s setups