Pre-Open market analysis

Friday had a surprisingly strong selloff. When a selloff is that strong, there is a 60% chance of lower prices over the next few days. But there is a 40% chance that it is a bear trap. If the bulls get a strong bull bar today, traders will conclude that the selloff was in fact a trap. Today would then be a buy signal bar for tomorrow.

I wrote over the weekend that a big bear bar alone is not a reliable indicator of a bear trend. Friday was a big bear bar and last week formed a big bear bar on the weekly chart. Both charts are still in tight trading ranges.

Weak sell signal bar since bad context

The daily chart has had many big bars up and down for 3 weeks. Until there is a breakout, there is no breakout. Traders need more information and should assume that Friday is just another day in the range.

Last week was a sell signal bar on the weekly chart. This week might have to go below last week’s low to see if the bears are willing to sell at the bottom of the 3 week range. Typically, they will not and the bear breakout will fail.

The bulls would like the week to remain within last week’s range. If so, this week would probably have a bull body. It would then be a buy signal bar on the weekly chart.

The minimum that the bears want today is no bull body on the daily chart. If they get a bear body, it will increase the odds of lower prices this week. Remember, for the past several weeks I have been saying that the August selloff would probably get a 2nd leg down. The minimum goals for the bears are a break below the August low and below 2800.

Overnight Emini Globex trading

The Emini is up 14 points in the Globex session. Today’s close will be important because today is the follow-through day after Friday’s big selloff. A bull close today makes a continuation of the 7 day range likely. But if the bears get even a 1 tick bear body, the odds will favor at least slightly lower prices this week.

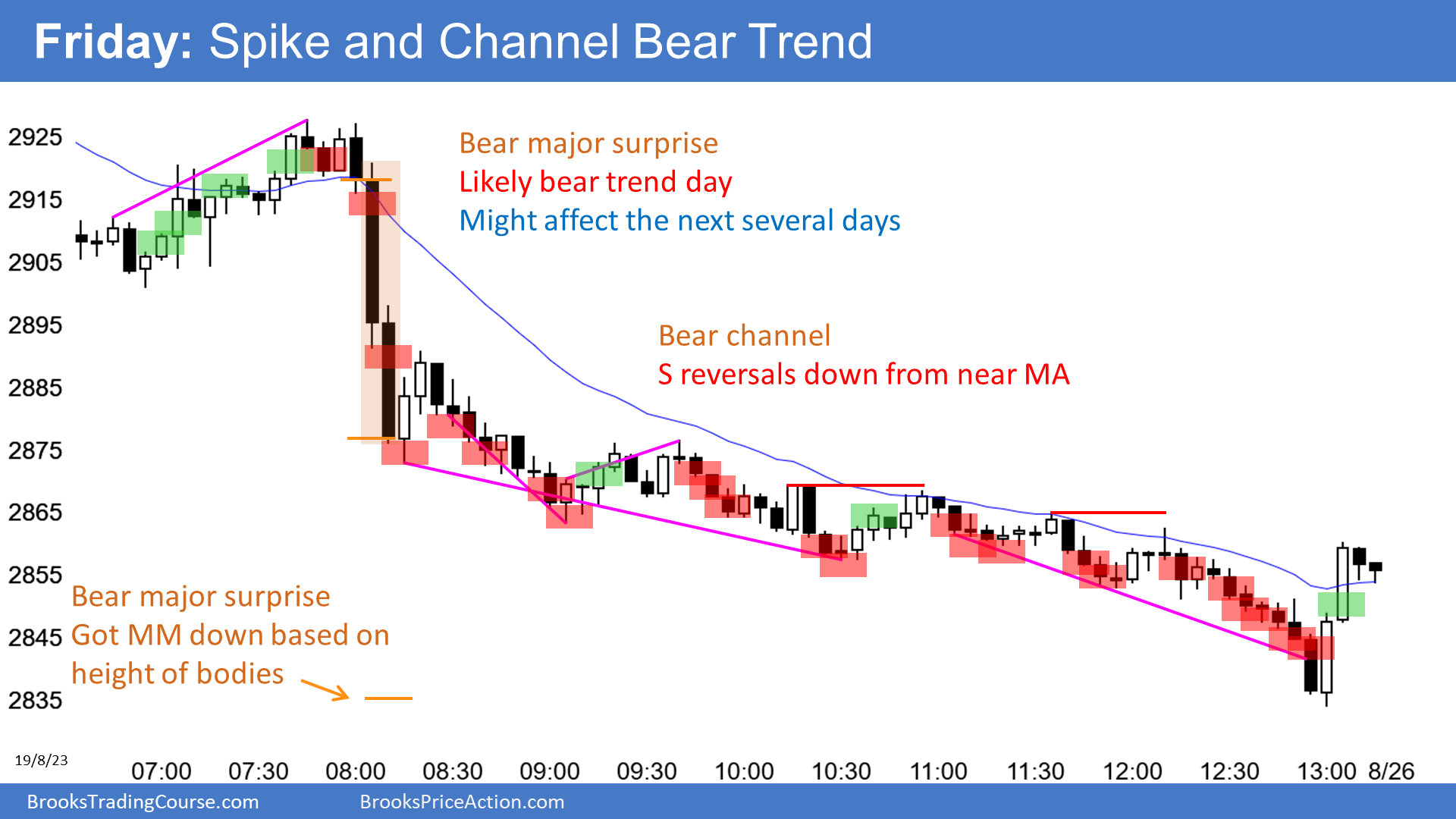

Friday was a Spike and Channel bear trend. There is usually a bull breakout above the bear channel and then a test of the start of the channel. It began with the pullback to around 2890 after Friday’s huge selloff. Finally, the bear channel typically evolves into a trading range.

Friday’s late reversal up and the overnight rally are probably the start of the transition. This increases the chance of a sideways’s to up day today.

Friday’s setups

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.