Emini And Forex Trading Update

Pre-Open Market Analysis

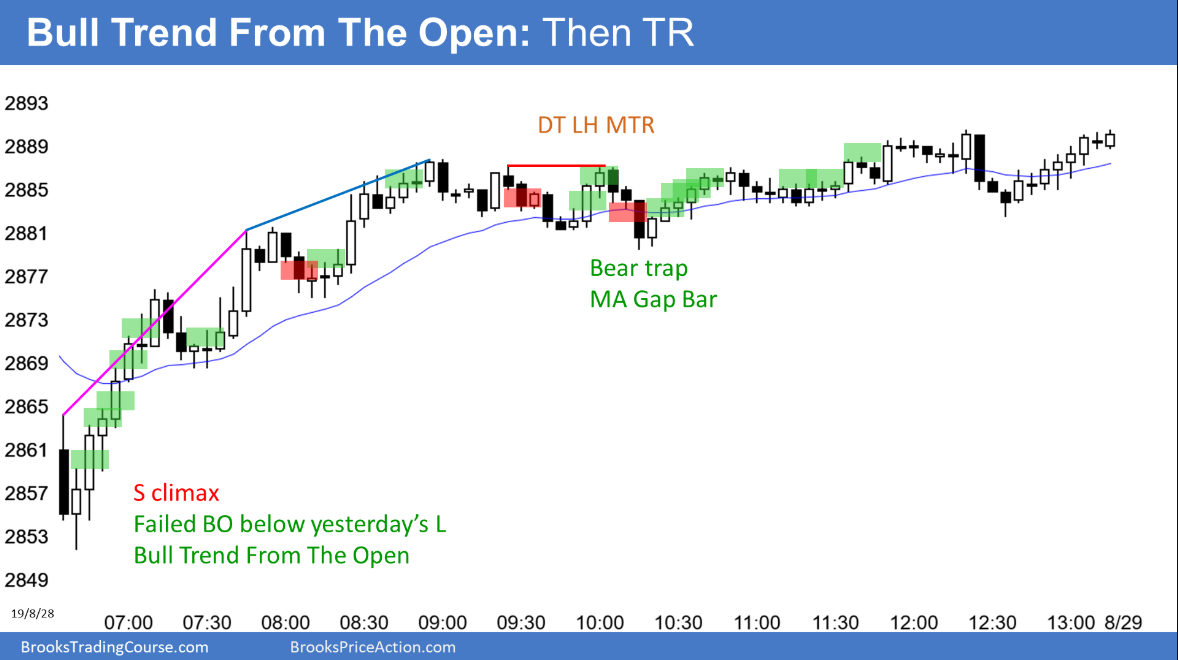

The Emini triggered a minor sell signal yesterday by trading below Tuesday’s low. But, I said that it was a weak sell setup since it was a big bear bar in the bottom third of a 4-week trading range. Traders bought below Tuesday’s sell signal bar and yesterday was a bull trend day.For the bulls, yesterday is now a buy signal bar for today. It formed a micro double bottom with Monday’s low, which increases the chance of at least a small rally.It is important to note that there are only 2 trading days left in August and that July triggered a reliable buy signal on the monthly chart. Today and tomorrow might rally to undo much of August’s selloff.Will the overnight China news lead to a resumption of the June/July bull trend? It might, but traders will assume that the institutions have already factored in everything involving a possible trade deal, including the timing. Therefore, the overnight news might not have a lasting effect.

Overnight Emini Globex Trading

The Emini is up 26 points in the Globex session. Today will probably gap up above yesterday’s high and the 2900 Big Round Number.

A big gap increases the chance of a trend day. If there is going to be a trend day, a bull trend day is slightly more likely than a bear trend day when the gap is up.

Because there are only 2 days left in August, monthly support and resistance could be magnets for the next 2 trading days. At a minimum, the bulls want the month to close above its 2917.38 midpoint. Traders would see that as a sign that the bulls owned the month, despite the strong selloffs.

The bulls would prefer that the monthly candlestick has a bull body. That would require tomorrow closing above the 2981.25 open of the month. However, that might be out of reach by tomorrow’s close.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.