Pre-Open market analysis

When yesterday traded below Tuesday’s low, it triggered a sell signal on the daily chart. Yet, the bulls created a reversal up. Yesterday was therefore a weak sell entry bar.

The bears need a strong follow-through bear bar today. Yet, after a weak entry bar, the odds are against it. Alternatively, if they form a 3rd consecutive bear bar closing below its low, traders will begin to suspect that there will be a swing down for several days.

Since the channel down was tight on the 60 minute chart, the 1st reversal up will probably be minor. Therefore, the bulls will need at least a small double bottom.

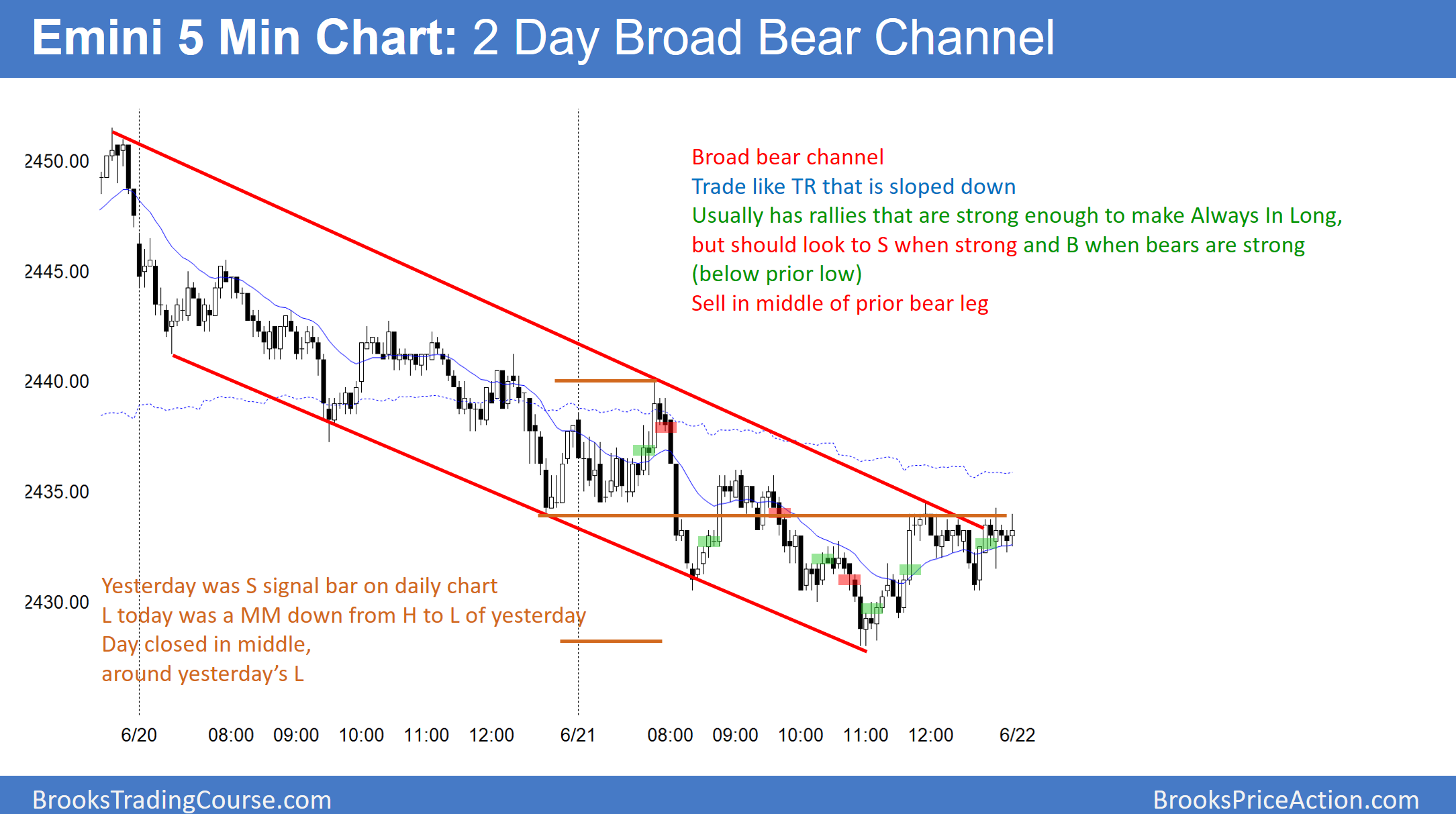

The Emini sold off in a broad bull channel for 2 days on the 5 minute chart. If there is a rally and then a test down, the odds are that it form a major trend reversal buy signal today.

Overnight Emini Globex trading

The Emini is down 2 points in the Globex session. While the odds favor a bull break above the 2 day bear channel today, there is still a 40% chance of a bear breakout and a selloff to the June 9 low at the bottom of the 3 week trading range. If the bears could then break strongly below that support, the Emini would probably begin its 100 point selloff to the weekly moving average.

Today’s Senate healthcare plan could be a catalyst for a breakout up or down. Yet, most days over the past month have had mostly sideways trading, despite many news items. Consequently, the odds favor mostly trading range trading.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday.