Pre-Open Market Analysis

As I wrote before yesterday’s open, yesterday was a bad sell-signal bar on the daily chart. Although the Emini triggered the sell, it reversed up. The Emini is waiting for the final hour on Friday.

Friday is the last day of the week and this week is the entry bar in a good sell setup on the weekly chart. The bears want the week to close near its low. At a minimum, they want the candlestick to have a bear body and close below last week’s low.

Friday is also the last day of the month, and the Emini is near the open of the month. Traders want to see if the month will have a bull body. If it does not, then April will probably test the March low. That means a 100 point selloff over the next month.

Furthermore, 80% of years have at least a 2-month move up and a 2-month move down. Therefore, the selloff could last a couple of months before the bulls will buy again.

The past several days have oscillated around the open of the week, the open of the month, and last week’s low. These are clearly important prices. Therefore, the odds are that this trading range will continue again today. However, there is an increased chance of either a rally to the high of the week or a selloff to the low of the week starting today or tomorrow.

Overnight Emini Globex Trading

The Emini is up 1 point in the Globex session. It therefore will probably open within yesterday’s 3-hour trading range. In addition, it increases the chance of trading range trading again today. However, most days over the past 2 weeks have had at least one swing up and one swing down.

There might be significant Brexit news tonight. That could result in a big gap up or down tomorrow and a big trend up or down tomorrow. The move would be especially important because it would affect both the weekly and monthly charts.

Yesterday’s Setups

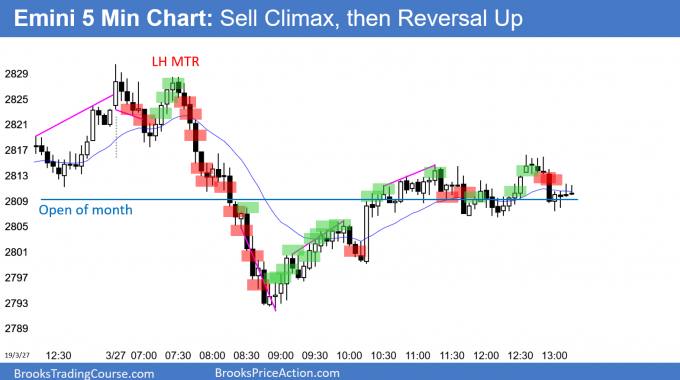

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.