Pre-Open market analysis

The Emini formed an inside day yesterday. It is therefore both a buy signal bar and a sell signal bar. The bulls want a test of 2900 and then a continuation up to a new all-time high. Yesterday had a bull body and the Emini is in a bull trend. It is therefore a better buy setup than sell setup.

Since this 3 month rally is climactic, the bears want a reversal down. However, until there is a big bear trend bar on the daily chart, the bulls will continue to buy every 20 point selloff.

Today is Friday so today will determine how the weekly chart will look. The momentum up has been strong for 3 months and there is no clear top yet. Therefore, the bulls will try to get the week to close near its high. If they are successful, it will increase the chance of a new all-time high within a couple months.

The bears always want the opposite. If they can get a big selloff today, the week could close near its low. It might then be a good sell signal bar for next week. The selloff might come in the final hour. At the moment, the odds favor the bulls and higher prices.

Overnight Emini Globex trading

The Emini is up 7 points in the Globex session. It is close enough to the 2900 Big Round Number to get there today. Because that is a magnet and the momentum up has been strong, there is an increased chance of a swing up today.

However, yesterday was in a bull channel for the 2nd half of the day. A bull channel is a bear flag. There is a 75% chance of a break below yesterday’s bull trend line today. That does not require a bear trend. If the Emini simply goes sideways for a couple of hours, it will break below the bull channel. The bull trend would then have evolved into a trading range.

Most days over the past week have had at least one swing up and one down. Consequently, that is likely again today.

What is most important today is the appearance of the weekly candlestick once today closes. Therefore, there is an increased chance of a surprisingly big swing up or down in the final hour.

Yesterday’s setups

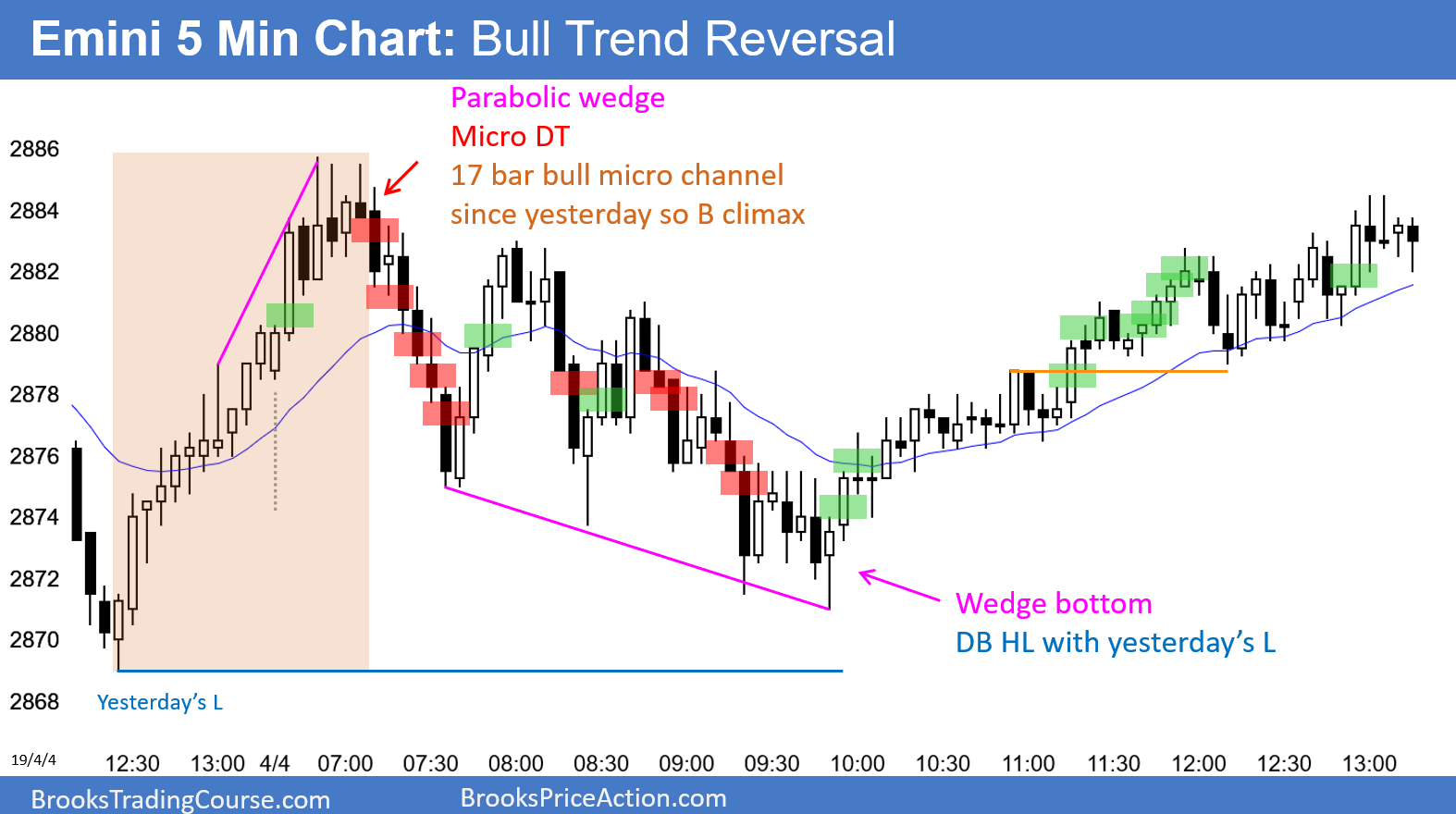

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.