Pre-Open Market Analysis

On the weekly chart, the bears finally got their 1st bear bar after a streak of 9 consecutive bull bars. In the 20 year history of the Emini, there have been many streaks of 8 or more bull bars. Once there was a bear bar, the Emini then went sideways to down for a few weeks. That is likely here, even if the Emini goes a little above last week’s high.

Nine consecutive bull bars is a sign of strong bulls. Consequently, the odds are against a big selloff. Many bulls will take some profits and then wait to see how far down the selloff goes. Once it stalls, they will buy again. The selloff will probably only last a few weeks and not be deep.

Less likely, there will be an Endless Pullback that lasts 2 – 3 months. That is a bull flag that just keeps adding bars in a gentle bear channel. It is a common type of pullback after a Small Pullback Bull Trend like the bulls have had for 2 months.

Since the Emini will likely begin to go sideways for a few weeks, there will be more trading range trading on the 5 minute chart. Furthermore, if the Emini rallies or sells off for a day or two, traders will look for a reversal.

Overnight Emini Globex Trading

The Emini is up 10 points in the Globex session. It will probably gap up on the weekly chart, like it did last week. However, last week’s gap up closed. Since small gaps typically close quickly, today’s gap up will probably close today or tomorrow.

The bulls are trying to break strongly above the October high. While they will probably succeed at some point this year, there will probably be a pullback 1st. Since that target is only about 10 points higher, the pullback will likely begin within a week.

Ten consecutive weeks is extremely unusual. Many bulls will probably begin to take profits this week or next. That will result in a 2 – 3 week pullback of at least 50 – 100 points.

However, until the bears can get 2 – 3 consecutive big bear bars on the 5 minute chart and 2 – 3 consecutive bear days closing on their lows on the daily chart, traders will correctly continue to bet on higher prices.

While the strong bull trend is continuing, almost every day has had at least one swing up and one swing down. In addition, there have not been many big trend days up or down on the 5 minute chart. Day traders will continue to bet that this price action will continue.

Friday’s Setups

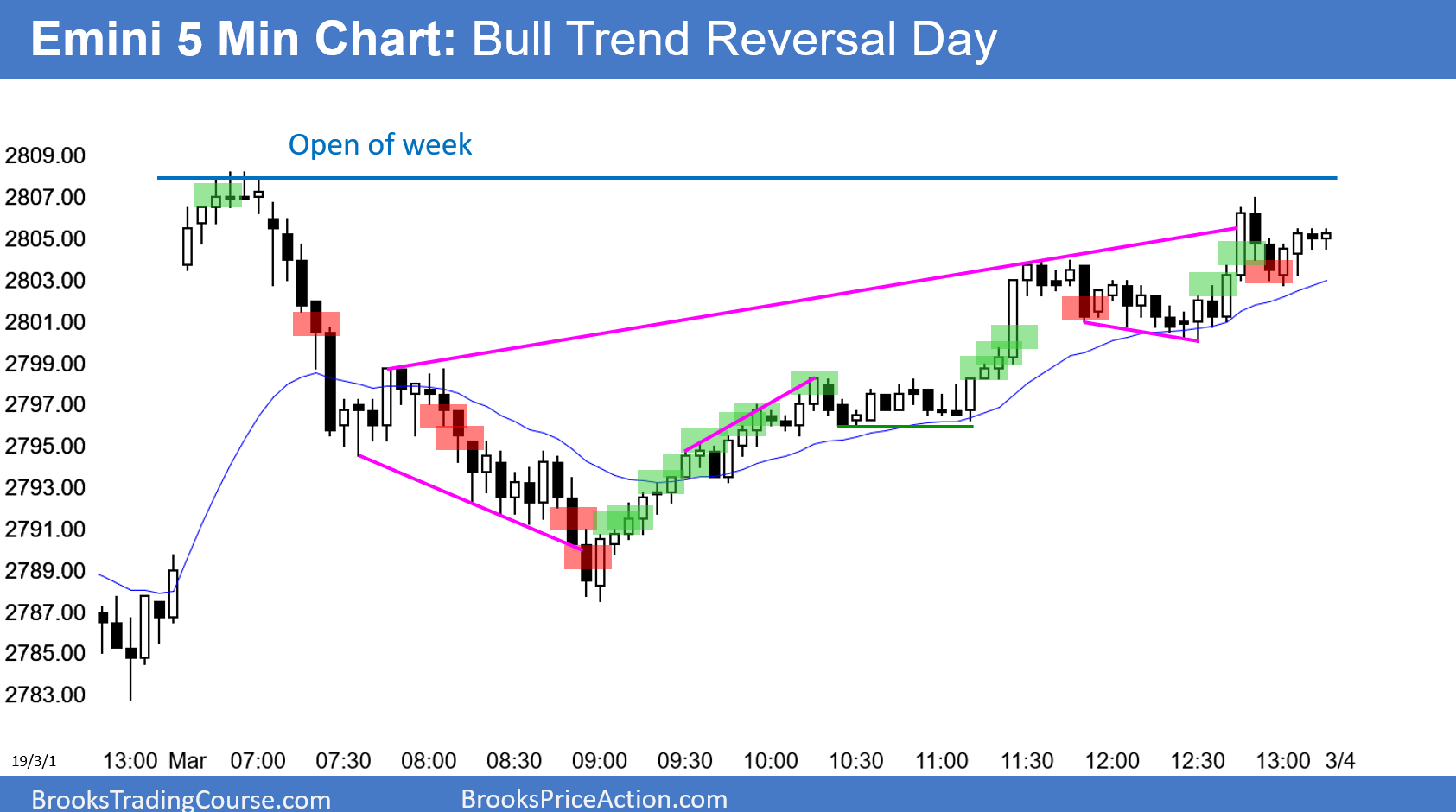

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.