Investing.com’s stocks of the week

Pre-Open Market Analysis

Yesterday was another bull day in a 6 bar tight trading range. The Emini S&P 500 is still going up and it might accelerate. Until midday yesterday, this week was likely to sell off to below the open of the week. That changed. Instead, the week will probably close near its high. Traders expect higher prices next week.

The top of the bull channel on the weekly chart is around 3120. Strong trends tend to overshoot before pulling back. Buy climaxes can go a long way before there is profit taking.

Overnight Emini Globex Trading

The Emini is up 10 points in the Globex session. It will therefore probably gap up today. A big gap up has an increased chance of leading to a trend day. When the gap is up, if there is a trend, up is more likely.However, when the Emini gaps far above the 5 minute EMA, many bulls are hesitant to buy far above that average price. This usually results in some trading range price action over the 1st hour or two. The bulls often wait for a double bottom or wedge bottom near the EMA before betting on a bull trend.If there is an opening trading range, the bears will want to see either a double top or a wedge top. They will sell it and hope for a bear trend.A trading range open is a sign of balance. If there then is a trend up or down, it usually is not as strong as a trend that begins from the 1st bar. There is always a 20% chance of either a bull or bear trend from the open on any day. When there is a big gap up, there is an increased chance that a trend will be strong.Yesterday’s Setups

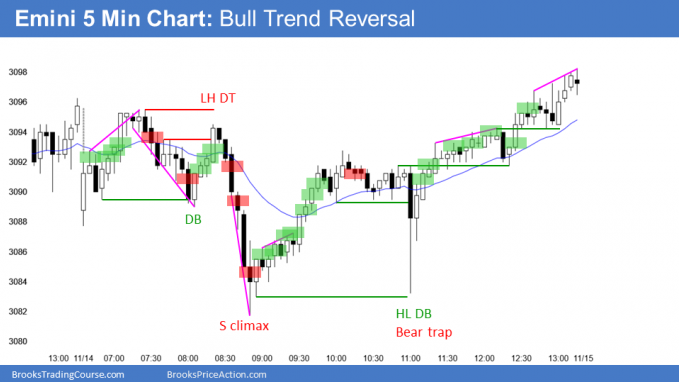

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.