The bears got 2 big bear days this week. The Emini turned down from just below the top of the wedge on the daily chart.

This week traded above last week’s high and then below its low. It is an outside down week on the weekly chart.

The bears want this week to close below last week’s low. It would then be a stronger outside down candlestick on the weekly chart. Also, it would be a 2nd reversal down from the 20 week EMA. A 2nd attempt to sell off has a higher probability of success.

This is probably the start of a move down to 2600. However, if the bulls get a reversal up today or tomorrow, traders will wonder if the selloff is a bear trap. The bulls then would again try to break above the wedge top and test the 200 day moving average around 3,000.

It is important to note that yesterday repeatedly tried to break below the low of 2 weeks ago, yet it kept reversing up. It would have been better for the bears is instead the Emini collapsed below that support and closed far below it.

Will today be a 3rd consecutive strong bear day? Probably not because it is in a 2 1/2 year trading range. Trading ranges tend to disappoint traders. Also, there was short-covering into yesterday’s close. Today should have at least a couple hours of sideways to up trading.

But the bears will sell the 1st 1 – 2 day bounce. Traders expect lower prices over the next 2 – 3 weeks.

Overnight Emini Globex trading

The Emini is down 32 points in the Globex session. The bears want today to close far below the May 4 low of 2788.50. That is the neckline of the 2 week double top. A big bear breakout will make it likely that the Emini will continue down to 2600 in May or June.

The bulls always want the opposite. Traders know that the bears have not had 3 consecutive strong bear days since February. They will watch for a reversal up today. It can come at any time.

If the bears do get a 3rd consecutive bear day, then the move will probably continue down to 2600. There will be bounces along the way, especially since the current selloff is already extreme. Traders will sell the 1st 1 – 3 day bounce.

Since traders want to know if the bears can get a 3rd strong bear day, the bulls might wait for a few hours to see how strong the bears can be. If they conclude that the bears are not strong enough, they will try to create a midday reversal. If they get a strong reversal, the 3 day selloff could become just a pullback in the rally up to 3000 and the 200 day MA.

Yesterday’s Setups

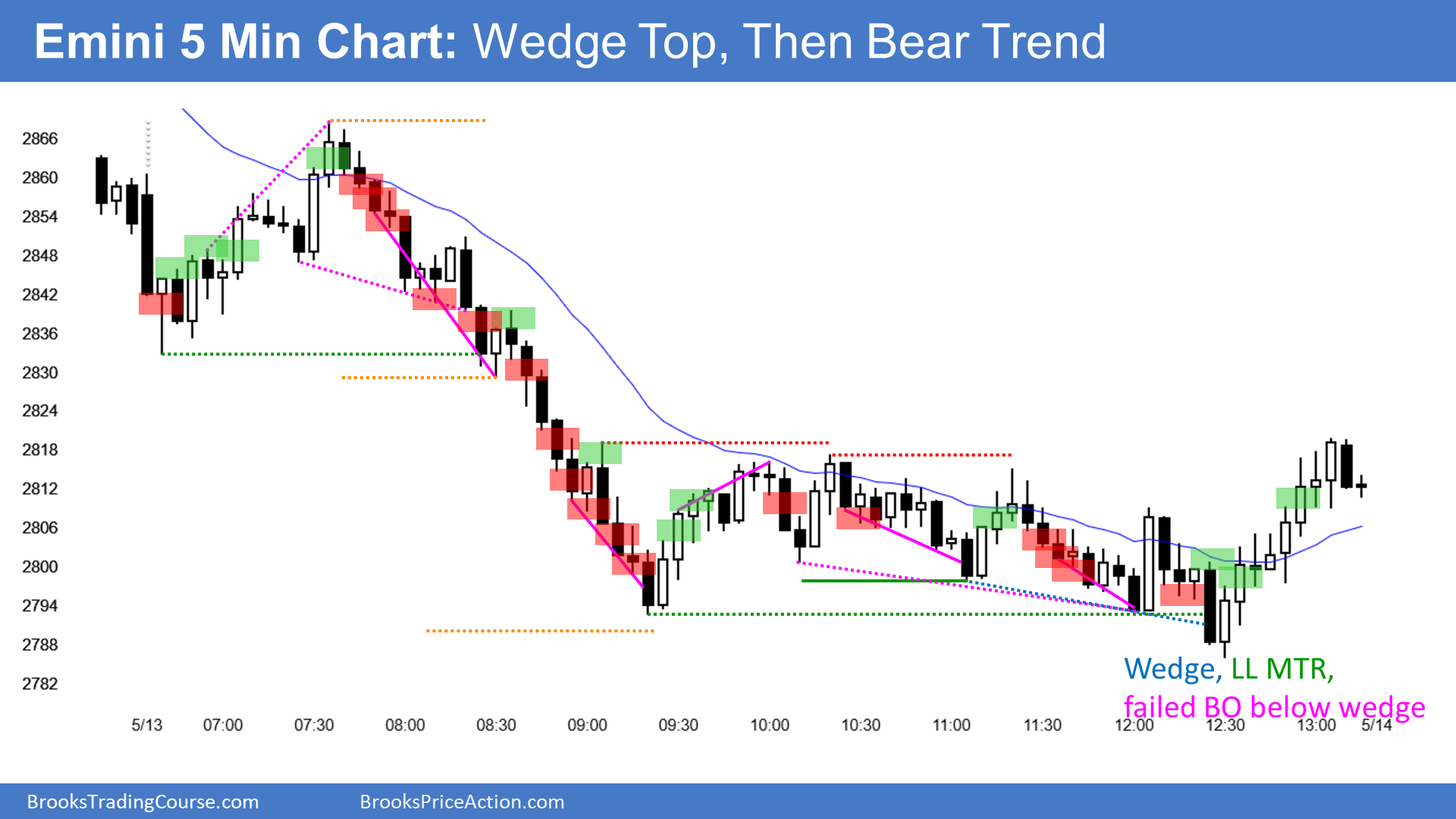

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.