Pre-Open Market Analysis

Friday reversed up strongly and now is a High 2 buy signal bar with Wednesday’s high. However, the selloff was so strong that the bull trend will probably not resume for at least a month. The Big Up in January and the Big Down in February creates Big Confusion. The odds favor a trading range on the daily chart. Yet, this 10% correction will lead to a new high within a few months.

Friday is a tradable bottom for a 1 – 2 week rally up to above Wednesday’s high. This would be about a 50% bounce. The bears will sell it for a leg down in the developing trading range. There is at least a 50% chance that last week will be the low of the bull flag on the monthly chart.

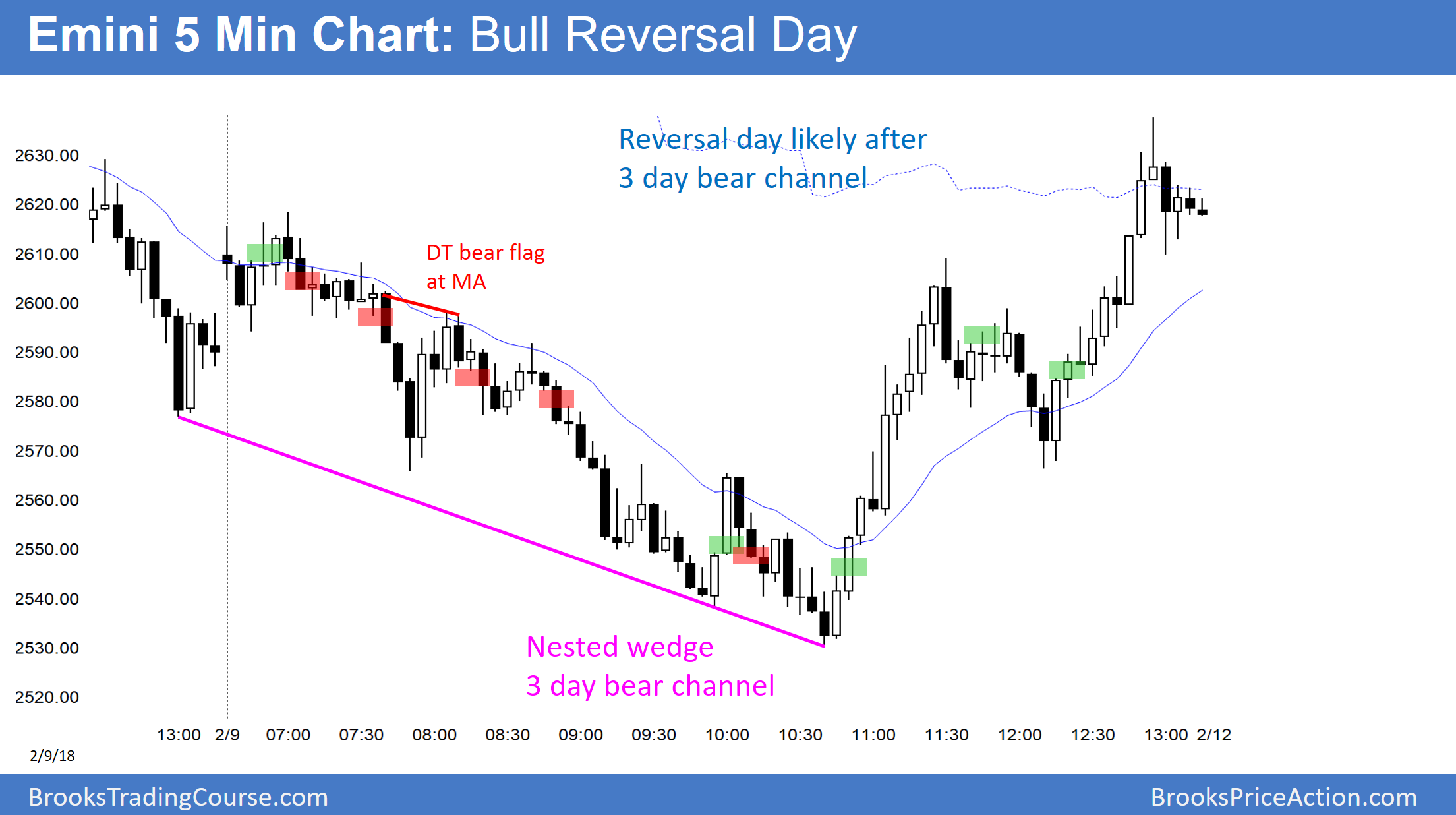

Overnight Emini Globex trading

The Emini is up 29 points in the Globex session. It therefore might gap up today. While it could have one more push down to a wedge bottom on the 60-minute chart, the two strong reversals last week make a rally likely for the next week or two. There is an increased chance of bull trend days this week.

Since a trading range is likely over the next month, the rally will likely be a bull leg in a trading range. However, even if the Emini goes sideways for a month, the odds are that it will be at a new high within a few months. It could get there within a month. Because a bull leg in a trading range is more likely than an immediate resumption of the bull trend, there will be something wrong with the rally. For example, it could have big bull bars, but not consecutive big bull bars. Alternatively, it could have several small bars, and some will be dojis or have bear bodies.

There is always a bear case. Yet, there is only a 20% chance that this selloff is the start of a bear trend on the monthly chart. A trading range is more likely. The bears need consecutive big bear days falling below last week’s low to improve their odds.

Friday’s Setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.